The aircraft turbine fuel system market in the MEA is sub segmented into South Africa, Saudi Arabia, the UAE, and the Rest of MEA. The rest of MEA includes Egypt, Turkey, Iran, Israel, Algeria, Nigeria, and Iraq. According to SIPRI, Saudi Arabia is the largest military spender in MEA, and it invested US$ 57.5 billion in this sector in 2020. Turkey, Israel, Iran, and Algeria are among the prominent military spenders in the region, after Saudi Arabia. Over the recent years, the civil aviation sectors in countries such as Saudi Arabia, Qatar, the UAE, and Kuwait have matured. According to the Federal Aviation Administration in the Middle East, the aviation industry is experiencing an annual rate of 10%. Similarly, the African countries are experiencing growth in the aviation industry after rising air passenger count due to advances in liberalization of air service agreements. The IATA projects are expecting growth in annual passengers by almost 5.9% over the next 20 years, which accounts for more than 300 million additional air passengers. Moreover, the steady growth in passenger traffic and fluctuations in traffic volumes at individual airports are expected to increase the demand for passenger aircraft. Therefore, the aircraft industry is growing sustainably, and government initiatives in trade, tourism, and other transport sectors in different regions are also boosting the development and employment in these sectors. A few of the leading aircraft manufacturers in the region are Israel Aerospace Industries, Elbit Systems Ltd., and Turkish Aerospace Industries. To cater the demands from their respective customers, these manufacturers strive to pace up their manufacturing facilities and production lines. This factor is boosting the procurement of the aircraft turbine fuel system market in MEA. Further, the rise in aircraft fleet would reflect a surge in MRO activities, which is anticipated to bolster the aircraft turbine fuel system market's growth during the forecast period.

The MEA aircraft turbine fuel system market is majorly affected by supply chain disruptions caused by the COVID-19 pandemic. The shutdown of borders of countries have disturbed the aerospace & defense industry’s supply chains. These has led to lowered demand for advanced aerospace technologies such as aircraft turbine fuel system systems. This has resulted in a loss of business among the aircraft turbine fuel system market players, offering their products the customers in the MEA. The spread of COVID-19 has led the manufacturers to suspend their operations or operate with a minimal workforce temporarily. This has weakened the demand for turbine fuel systems, thereby hindering the aircraft turbine fuel system market in the region.

Strategic insights for the Middle East and Africa Aircraft Turbine Fuel System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

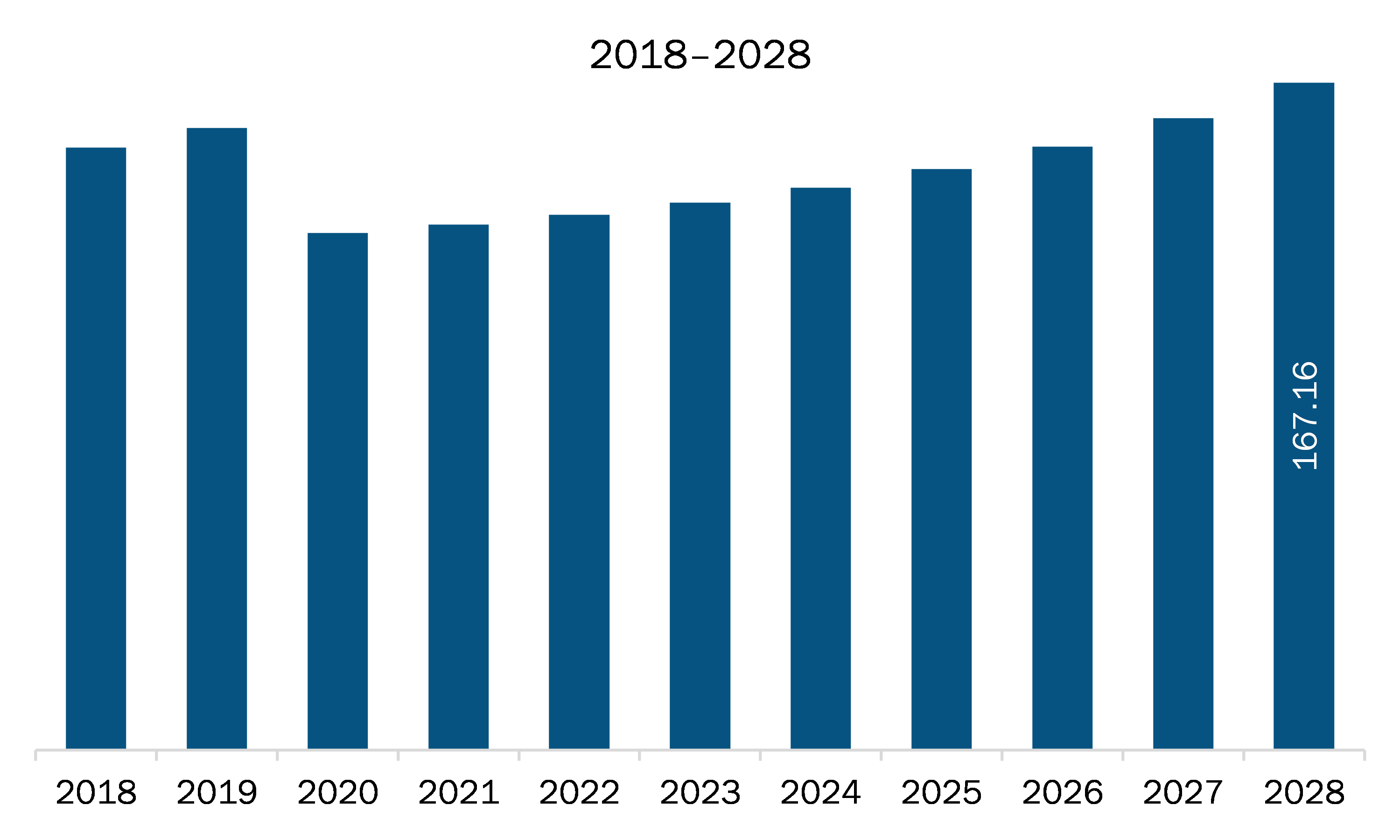

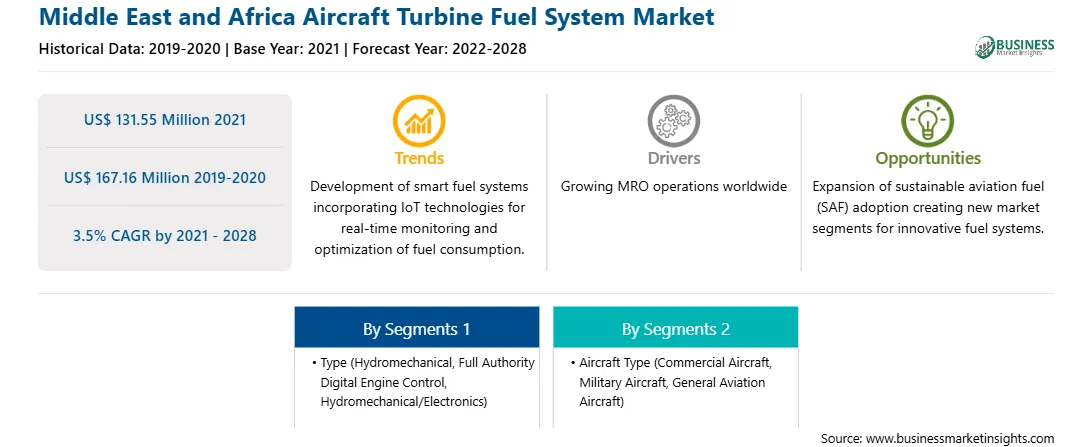

| Market size in 2021 | US$ 131.55 Million |

| Market Size by 2028 | US$ 167.16 Million |

| Global CAGR (2021 - 2028) | 3.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Aircraft Turbine Fuel System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The aircraft turbine fuel system market in MEA is expected to grow from US$ 131.55 million in 2021 to US$ 167.16 million by 2028; it is estimated to grow at a CAGR of 3.5% from 2021 to 2028. The MEA aircraft turbine fuel system market is experiencing significant growth owing to increasing year on year government budgets for national security. Governments across the world are significantly investing on procurement of advanced state-of-the-art commercial as well as military aircraft fleet. To cater the dynamic challenges of defense industry, market players are investing on the development of robust and innovative systems. Additionally, growing commercial aviation industry owing to rise in disposable income among middle class population coupled with the growing MRO operation across the world is bolstering the growth of the aircraft production rate. This is reflecting rise in demand for aircraft turbine fuel system market.

The MEA aircraft turbine fuel system market is segmented into type and aircraft type. Based on type, the aircraft turbine fuel system market is segmented into hydromechanical, full authority digital engine control (FADEC), and hydromechanical/electronics. The full authority digital engine control (FADEC) segment held the largest share in 2020 based on type. Based on aircraft type, the MEA aircraft turbine fuel system market is segmented as commercial aircraft, military aircraft, and general aviation aircraft. The commercial aircraft segment held the largest share in 2020.

A few major primary and secondary sources referred to for preparing this report on the aircraft turbine fuel system market in MEA are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Collins Aerospace; Eaton Corporation plc; Honeywell International Inc.; Parker-Hannifin Corporation; Safran; and Woodward, Inc.

The Middle East and Africa Aircraft Turbine Fuel System Market is valued at US$ 131.55 Million in 2021, it is projected to reach US$ 167.16 Million by 2028.

As per our report Middle East and Africa Aircraft Turbine Fuel System Market, the market size is valued at US$ 131.55 Million in 2021, projecting it to reach US$ 167.16 Million by 2028. This translates to a CAGR of approximately 3.5% during the forecast period.

The Middle East and Africa Aircraft Turbine Fuel System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Aircraft Turbine Fuel System Market report:

The Middle East and Africa Aircraft Turbine Fuel System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Aircraft Turbine Fuel System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Aircraft Turbine Fuel System Market value chain can benefit from the information contained in a comprehensive market report.