E-commerce platforms have made adult diapers more accessible to a broader consumer base. People can conveniently browse and purchase adult diapers online, eliminating the need to visit physical stores. Also, online platforms provide detailed product descriptions, specifications, and customer reviews. This information helps potential buyers decide which adult diapers to purchase. By accessing reviews and ratings, customers can also gauge the quality and effectiveness of different products, leading to increased consumer confidence and overall market growth.

Additionally, adult diapers are a sensitive product for many individuals, and e-commerce provides a discreet and private means of purchasing them, the anonymity offered by online shopping allows people to overcome the potential embarrassment associated with buying adult diapers in person. This factor has encouraged more people to seek out and purchase these products online, leading to market growth. Moreover, many e-commerce platforms offer subscription services for adult diapers, allowing customers to set up recurring deliveries at specified intervals. This feature ensures a constant supply of adult diapers without the hassle of manual reordering. Subscription services have gained popularity among regular users of adult diapers, contributing to market growth.

Furthermore, e-commerce platforms offer a wide range of adult diaper options, catering to different sizes, absorbency levels, and other specific requirements. This extensive product selection allows individuals to find the most suitable adult diapers that meet their unique needs. In comparison, physical stores may have limited shelf space and not have a comprehensive range of options. Also, e-commerce offers convenience through 24/7 availability and the ability to place orders from the comfort of one's home. This is especially beneficial for individuals with mobility challenges, older adults, or caregivers who may find it challenging to visit physical stores regularly. Home delivery services provided by e-commerce platforms further enhance convenience, creating lucrative opportunities for Middle East & Africa Adult Diaper Market

According to the Ministry of Health (Saudi Arabia), approximately 290,000 non-critical surgeries were conducted across several regions of Saudi Arabia. The Ministry of Health (Saudi Arabia) revealed that the average number of patients added to the waiting list regarding pediatrics, and orthopedics in hospitals was approximately 18,000 per month in 2022. According to a report published by the International Trade Administration in 2022, the government of Kuwait commenced the upgradation of healthcare infrastructure under National Development Plan with an investment of US$ 104 billion. Kuwait has a well-developed primary care network of 100 polyclinics and 28 government-operated general and specialized hospitals. Adult diapers are widely used by patients experiencing temporary loss of bladder control due to surgical procedures and medical interventions. A report published by United Nations Population Fund in 2021 revealed that the disability rate rose with age as 41.5% men and 46.7% women aged above 60 years have limited functional ability. The governments of many Middle Eastern countries have planned strategies delivering primary, secondary, and tertiary healthcare for aged population. Thus, development of healthcare infrastructure, and primary healthcare network in the Middle East & Africa is expected to boost the demand for adult diaper during the forecast period.

Strategic insights for the Middle East & Africa Adult Diaper provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Adult Diaper refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Adult Diaper Strategic Insights

Middle East & Africa Adult Diaper Report Scope

Report Attribute

Details

Market size in 2023

US$ 1,143.04 Million

Market Size by 2030

US$ 1,909.57 Million

Global CAGR (2022 - 2030)

6.6%

Historical Data

2021-2022

Forecast period

2024-2030

Segments Covered

By Product Type

By Category

By End-User

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Adult Diaper Regional Insights

Middle East & Africa Adult Diaper Market Segmentation

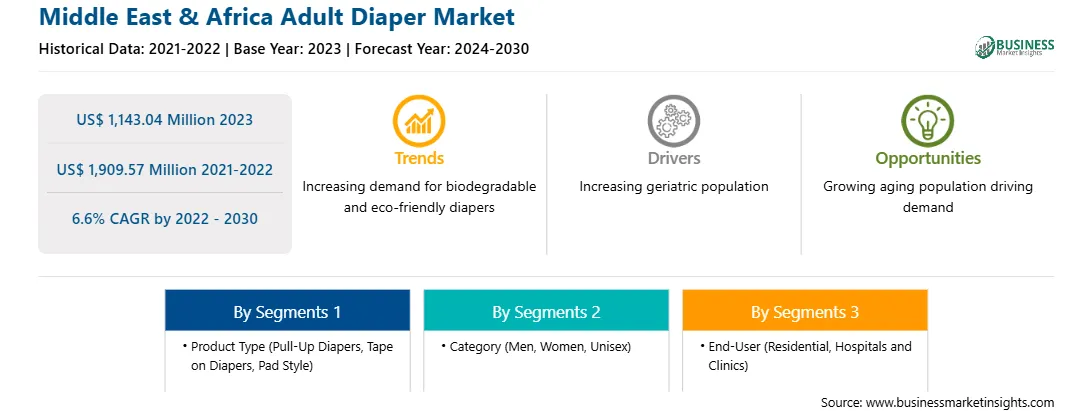

The Middle East & Africa adult diaper market is segmented into product type, category, end user, and country.

Based on route of product type, the Middle East & Africa adult diaper market is segmented into pull-up diapers, tape on diapers, pad style, and others. The pull-up diapers segment held a largest share of the Middle East & Africa adult diaper market in 2022.

Based on category, the Middle East & Africa adult diaper market is segmented into men, women, and unisex. The unisex segment held the largest share of the Middle East & Africa adult diaper market in 2022.

Based on end user, the Middle East & Africa adult diaper market is segmented into residential, hospitals and clinics, and others. The residential segment held the largest share of the Middle East & Africa adult diaper market in 2022.

Based on country, the Middle East & Africa adult diaper market is segmented into the South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Rest of Middle East & Africa dominated the Middle East & Africa adult diaper market in 2022.

Nippon Paper Industries Co Ltd, Ontex BV, Kmbe rly-Clark Corp, Essity AB, Paul Hartmann AG, and Abena AS are some of the leading companies operating in the Middle East & Africa adult diaper market.

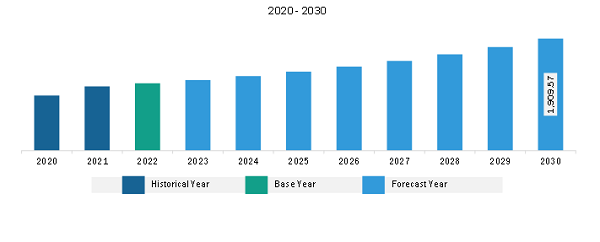

The Middle East & Africa Adult Diaper Market is valued at US$ 1,143.04 Million in 2023, it is projected to reach US$ 1,909.57 Million by 2030.

As per our report Middle East & Africa Adult Diaper Market, the market size is valued at US$ 1,143.04 Million in 2023, projecting it to reach US$ 1,909.57 Million by 2030. This translates to a CAGR of approximately 6.6% during the forecast period.

The Middle East & Africa Adult Diaper Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Adult Diaper Market report:

The Middle East & Africa Adult Diaper Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Adult Diaper Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Adult Diaper Market value chain can benefit from the information contained in a comprehensive market report.