The Middle East & Africa industrial wood adhesives market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. Construction industry has been witnessing a boost in the number of new residential and commercial building constructions. The rapid development of metropolitan cities is augmenting the demand for commercial construction projects. Commercial buildings include stores, offices, hotels, resorts, schools, gymnasiums, libraries, museums, hospitals, clinics, and others. The design and construction of commercial buildings impact environmental quality and worker productivity. It is considered that attractive and pleasant working places increase the productivity of the employees. Hence, office spaces are highly using wooden materials to impart an aesthetic appearance. Moreover, the expansion of the tourism sector across Middle East & Africa is further contributing to commercial construction activities. Foodservices and lodging are estimated as the top two spending categories by domestic and international travelers. Therefore, the hotels and resorts construction is witnessing tremendous growth across the Middle East & Africa. To gain customer attraction and provide aesthetic beauty, hotels are constructed with wooden floorings, windows, doors, and furniture. Wood has low thermal conductivity; hence even in a cold climate, it will always be warm inside a wooden building. Thus, the rising construction activities, as well as increased utilization of wooden products in the buildings, is augmenting the growth of the Middle East & Africa industrial wood adhesives market.

In case of COVID-19, in Middle East & Africa, especially South America, witnessed an unprecedented rise in number of coronavirus cases, which led to the discontinuation of industrial wood adhesives manufacturing activities. Downfall in other chemical and materials manufacturing sectors has subsequently impacted the demand for industrial wood adhesives during the early months of 2020. Moreover, decline in the overall construction and building materials manufacturing activities has led to discontinuation of industrial wood adhesives manufacturing projects, thereby reducing the demand for industrial wood adhesives. Similar trend was witnessed in other Middle East & Africa countries, i.e., UAE and Saudi Arabia. However, the countries are likely to overcome thus drop in demand with the economic activities regaining their pace, especially in the beginning of the 2021.

Strategic insights for the Middle East & Africa Industrial Wood Adhesives provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

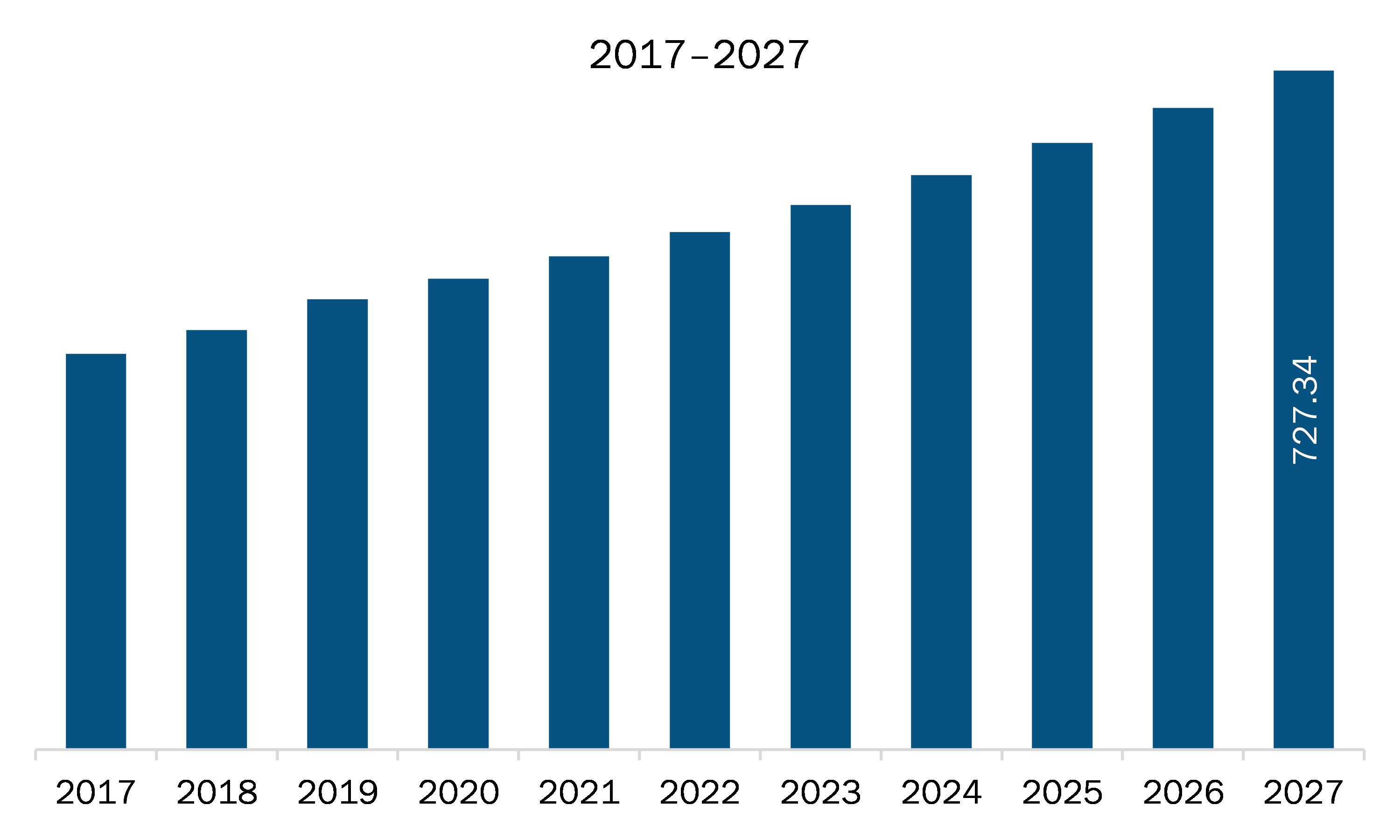

| Market size in 2020 | US$ 564.85 Million |

| Market Size by 2027 | US$ 727.34 Million |

| Global CAGR (2020 - 2027) | 3.7% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2027 |

| Segments Covered |

By Resin Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Industrial Wood Adhesives refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The industrial wood adhesives market in Middle East & Africa is expected to grow from US$ 564.85 million in 2020 to US$ 727.34 million by 2027; it is estimated to grow at a CAGR of 3.7% from 2020 to 2027. There has been a tremendous development in the research and innovation of bio-based adhesives in the engineered wood product industry. Synthetic wood adhesives are majorly derived from depleting petrochemical resources and caused increasing environmental concerns. Bio-based wood adhesives have gained immense momentum in recent years as the customers became aware of the consequences related to the use of petrochemical-derived products. Various biomass resources such as lignin, plant proteins, starch, tannin, bark, and vegetable oils are used as renewable feedstock to synthesize bio-based adhesives. Starch is considered a promising feedstock for the development of bio-adhesives attributed to its accessibility, good adhesion, low cost, easy process, and good film formation properties. Plant protein is another natural resource used to manufacture environmentally friendly wood adhesives. However, it is required to modify the structure of proteins to enhance the water resistance and bonding strength of protein-based adhesives. The National Center for Biotechnology Information estimates that increasing amounts of bio-based adhesives will be employed in the construction of wood composites to decrease the negative environmental impact of current wood adhesives and also to satisfy the societal need of developing sustainable materials and economy. Even though, due to the relatively poor water resistance and bonding strength of the bio-based adhesives, the complete substitution of petroleum-based wood adhesives with bio-based adhesives will be unlikely in the near future. However, technological advancements and R&D aimed at enhancing properties of naturally sourced wood adhesives are intended to create ample growth opportunities for bio-based wood adhesives in the coming years.

Based on resin type, the synthetic segment accounted for the largest share of the Middle East & Africa industrial wood adhesives market in 2019. Based on technology, the solvent-based segment held a larger market share of the Middle East & Africa industrial wood adhesives market in 2019. The solvent-based technology is considered to be the root base for any trend line in the development of adhesives. This technology is the oldest in the widest range of chemistries. A solvent-based adhesive is a glue or any adhesion product that is present in the form of a liquid. The solvent-based industrial wood adhesives have been valued through the years as they provide good adhesive properties such as durability along with fast drying conditions. The solvent-based adhesives are produced by blending the adhesive material with a suitable solvent for the creation of adhesive polymer solution. Industrial woods have high amount of resistance which makes it easier to stick them. A solvent-based adhesive is highly suitable to be used for wood due to its strong adhesive qualities. The industrial wood adhesives produced by the employment of this technology, contain an adhesive inside a spreadable or more malleable substance which makes it easier to apply. The solvent-based adhesive covers places where rigid glues would not be able to cover and be effective.

A few major primary and secondary sources referred to for preparing this report on the Middle East & Africa industrial wood adhesives market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include H H.B. Fuller Company; Henkel AG & Company KGaA; Ashland; Arkema Group; Sika AG; Pidilite Industries Ltd.; Dow Inc.; 3M, and Akzo Nobel N.V.

The Middle East & Africa Industrial Wood Adhesives Market is valued at US$ 564.85 Million in 2020, it is projected to reach US$ 727.34 Million by 2027.

As per our report Middle East & Africa Industrial Wood Adhesives Market, the market size is valued at US$ 564.85 Million in 2020, projecting it to reach US$ 727.34 Million by 2027. This translates to a CAGR of approximately 3.7% during the forecast period.

The Middle East & Africa Industrial Wood Adhesives Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Industrial Wood Adhesives Market report:

The Middle East & Africa Industrial Wood Adhesives Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Industrial Wood Adhesives Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Industrial Wood Adhesives Market value chain can benefit from the information contained in a comprehensive market report.