Fuel card market operates in a highly-competitive marketplace. As leading companies in Mexico fuel card market continues to broaden their addressable market, by expanding their current product portfolio, diversifying their client base, and developing new applications and markets, all the prominent players faces an increasing level of competition, both from regional as well the leading global technology and industrial companies in the world. Mexico fuel card market is fragmented at higher level with major eight to ten players comprising 30% of the Mexico fuel card market share, whereas at the regional level it is highly fragmented with several local players. Rise in fleet sizes around the world is pushing the market for fuel card as it helps a fleet owner to streamline the process of tracking driver behavior and fuel consumption per vehicle.

Fuel cards enable enhanced tracking of fleet expenses and efficiency of the fleet by tracking real-time mileage and fuel usage by vehicles in a fleet. Fleet operators use fuel cards for costs such as truck maintenance, truck repairs, fuel, truck cleaning, and replacement vehicle rental, among others. Data captured by a fuel card include odometer reading, fuel grades, fuel product, and quantity of fuel, vehicle ID, driver ID and tax information along with transaction details such as time, location, spend amount and date support rich repowering for fleet managers. These features of fuel card are significantly driving the Mexico fuel card market.

Impact of COVID-19 on Mexico Fuel Card Market

COVID-19 is one of the most impactful disruptions till today. It has adversely impacted the transportation and logistics sector. Corona virus has forced transportation and logistics companies to delay resuming work. Overall, vehicle movement nationwide was suspended for almost a month due to the outbreak, but there is still a chance that lost output can be made up for later. These factors are hindering the Mexico fuel card market.

Strategic insights for the Mexico Fuel Card provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

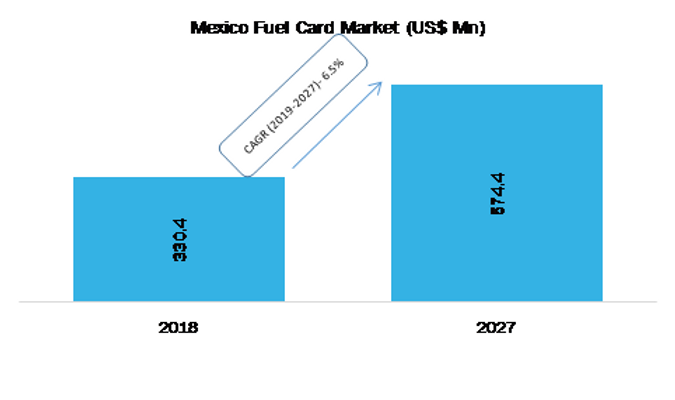

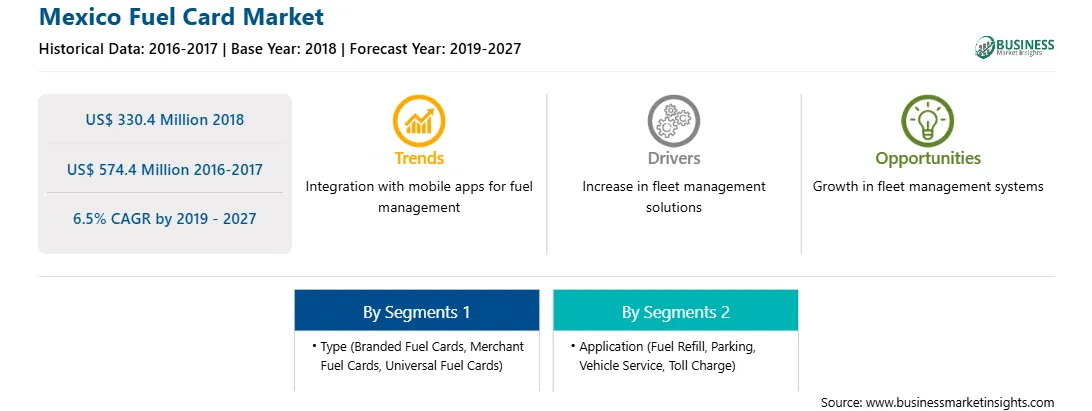

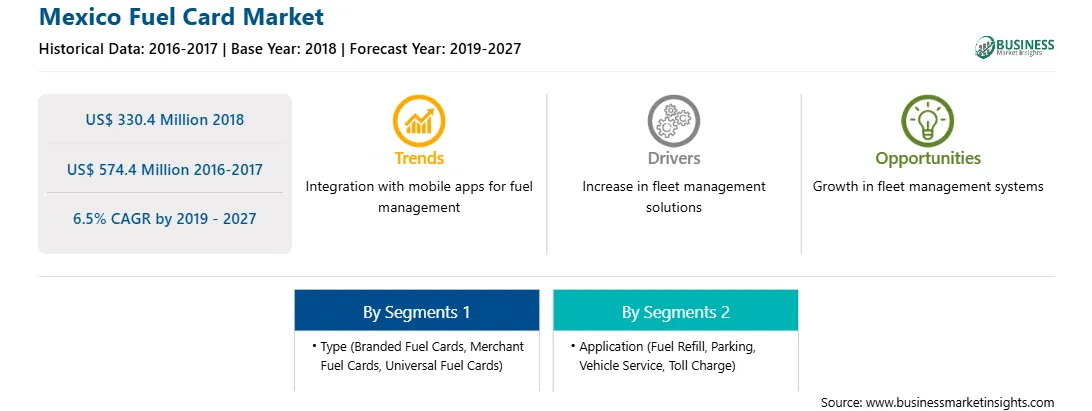

| Market size in 2018 | US$ 330.4 Million |

| Market Size by 2027 | US$ 574.4 Million |

| Global CAGR (2019 - 2027) | 6.5% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Mexico

|

| Market leaders and key company profiles |

The geographic scope of the Mexico Fuel Card refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Mexico Fuel Card Market Insights

Efficient fleet administration is one of the key factor boosting Mexico fuel card market

Fuel cards enable enhanced tracking of fleet expenses and efficiency of the fleet by tracking real-time mileage and fuel usage by vehicles in a fleet. Fleet operators use fuel cards for costs such as truck maintenance, truck repairs, fuel, truck cleaning, and replacement vehicle rental, among others. Data captured by a fuel card include odometer reading, fuel grades, fuel product, and quantity of fuel, vehicle ID, driver ID and tax information along with transaction details such as time, location, spend amount and date support rich repowering for fleet managers. All of these enhanced data permits richer reporting, which can be used by fleet operators to identify problem zones such as fraudulent transaction by truck drivers or truck with lower fuel efficiency. Thus, fuel cards provide complete insight into vehicle operating cost and driver behavior that provides fleet managers with a complete oversight and trends required to analyze shortcomings in the fleet. Above mentioned metrics are expected to drive the adoption of fuel card by fleet operators and to contribute to the Mexico fuel card market growth.

Leveraging telematics with the adoption of fuel card is a key trend in Mexico fuel card market

Certain fuel card providers have started implanting the telematics interface as well as robust reporting abilities as a natural product offering to enhance fleet management efficiency. This comprises of GPS data integration along with purchase data with a purpose to track fleet or driver performance. It further helps in determining whether the vehicle is refueling at an appropriate location. Moreover, integrating fuel cards with telematics helps in receiving accurate Miles/Gallon reports for each vehicle. The recorded data enables the business or users to effortlessly identify any inadequacies or pinpoint drivers who may need further training. Truck driver’s behavior can be tracked using telematics. Metrics related to driving speed, the route taken, harsh braking and trip schedule can be used to keep track of driver efficiency, habits and any anomalies such as deviation from the planned route, unscheduled stoppage refueling at non-partner fuel stations and driving behavior among others.

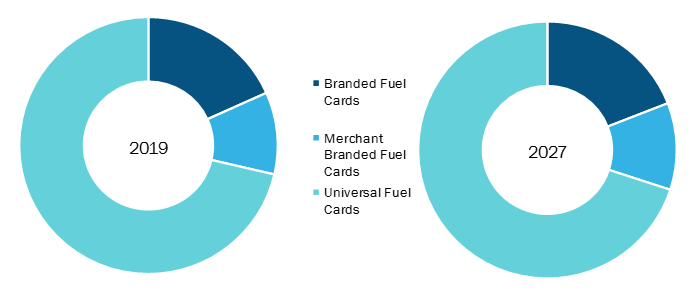

Mexico Fuel Card Market By Type

The Mexico fuel card market is segmented into three type by their function as branded fuel card, merchant fuel card, and universal fuel card. The Mexico fuel card market by type was led by universal fuel cards. Universal card are most convenient fuel card type, the providers of these cards usually partners with several fuel companies and offer great flexibility. Certain fuel card companies merely operate in some countries or regions. While others may only be accepted at particular fuel stations. Users with less options in their region may need to be cautious regarding limiting them to just a few fuel stations.

Strategic insights for the Mexico Fuel Card provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 330.4 Million |

| Market Size by 2027 | US$ 574.4 Million |

| Global CAGR (2019 - 2027) | 6.5% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Mexico

|

| Market leaders and key company profiles |

The geographic scope of the Mexico Fuel Card refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Strategic Insights

Merger & acquisition strategy is commonly adopted by companies to expand their footprint worldwide and meet the growing demand in Mexico fuel card market. Few of the recent developments in Mexico fuel card market are listed below;

2018:

Edenred, the world leader in transactional solutions for companies, employees and merchants, today announced the signing of an agreement to acquire 80% of the share capital of The Right Fuelcard Company (TRFC) group, the number four fuel card program manager in the United Kingdom.

2018:

Mastercard unveiled a new service to automatically integrate fuel and maintenance data from a connected car’s dashboard into the payment process. The service will streamline the process, providing fleet managers greater transparency and control.

The List of Companies - Mexico Fuel Card Market

The Mexico Fuel Card Market is valued at US$ 330.4 Million in 2018, it is projected to reach US$ 574.4 Million by 2027.

As per our report Mexico Fuel Card Market, the market size is valued at US$ 330.4 Million in 2018, projecting it to reach US$ 574.4 Million by 2027. This translates to a CAGR of approximately 6.5% during the forecast period.

The Mexico Fuel Card Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Mexico Fuel Card Market report:

The Mexico Fuel Card Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Mexico Fuel Card Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Mexico Fuel Card Market value chain can benefit from the information contained in a comprehensive market report.