The MENA car rental services market accounted to US$ 1.7 Bn in 2018 and is expected to grow at a CAGR of 5.5% during the forecast period 2019 – 2027, to account to US$ 2.8 Bn by 2027.

Geographically, the MENA car rental services market is segmented into North Africa, Saudi Arabia, UAE, and the Rest of MENA. UAE led the MENA car rental services market in 2018 with a significant market share, as, Dubai is one of the most rapidly emerging business centers across the globe, as well as the attractive infrastructure of the city, is attracting huge tourists to visit the city. Thus, the demand for car rental services in the country is growing at a faster pace. Some of the prominent car rental service provider in the UAE market are Hertz, Europcar, SIXT, Thrifty, and Avis Hala. UAE is followed by Saudi Arabia and the growth is mainly driven by the country’s tourism industry. Moreover, the strong economic support has facilitated the consistent development in the car rental services resulting in significant sources of business for intelligent transportation-related services such as rate comparing tools, 24*7 customer service, and many more. The North African car rental service market is a combination of both leisure and the European customer base of leading car rental brands, which offers enhance the demand for short-term inbound rentals services. The Rest of the MENA market includes countries such as Tunisia, Mauritania, Oman, Qatar, Palestine, Morocco, Egypt, and Libya among others. The growth rate in the countries present in the rest of MENA for the car rental service market is growing at a sluggish rate.

Market Insights

The high cost of car ownership as compared to car rental

The car rental industry has been experiencing noteworthy changes pertaining to technological advances along with the significant changes in customer behavior and preference. Technological advancements allow car rental service providers to introduce innovative products and services to meet the continuously evolving customer needs. The consumer behavior toward the use of cars has been shifting over the past few years through car rental and car-sharing services. This transformation has accompanied the supply as well as the expansion of several services conventionally offered by companies that focus all their activities on the mobility market, including car rental companies.

Integration of technology-driven solutions to offer better customer services

Several car rental companies are focusing on offering advanced technology-driven solutions to their customers with intent to offer improved customer service as well as to distinguish their services from those offered by their competitors. In October 2019, Enterprise Holdings introduced Entegral, an integrated software solution capable of simplifying the post-accident process; this product enabled service providers to get customers on their way, back into their cars.

Rental Location Insights

The non-airport segment led the MENA car rental services market, by rental location, with a share of 62.42% in 2018; it is anticipated to continue its dominance during the forecast period, growing at a CAGR of 5.7% of the MENA car rental services market during the forecast period. The non-airport rental location provides various types of advantages such as it offers customers a suitable and geographically wide-ranging network of car rental locations, and it contributes to higher vehicle use as a result of the longer average rental periods related to non-airport business.

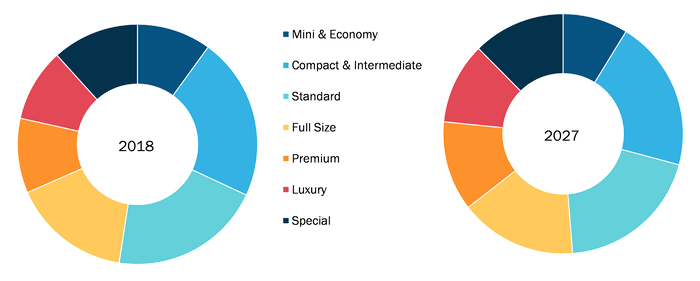

Car Category Insights

The car rental services market by car category was led by a compact & intermediate segment which held a market share of 21.95% in 2018. . A compact car offers much more interior space for passengers, along with trunk space. Small compact cars are an appropriate choice for extra storage space as well as ease of travel. Moreover, the intermediate car category can accommodate four adults and one child, along with space for two checked size baggage and one cabin size baggage.

Customer Type Insights

B2B segment led the MENA car rental services market with a market share of 51.14% in 2018. As B2B Companies across the region provide unique opportunities with the innovative technology in car rental services for executives and corporate travelers. Several companies have gained substantial share in the car rental services market by gaining large corporate contracts that could considerably impact the margins of the rental players.

Strategic insights for the MENA Car Rental Services provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 1.7 Billion |

| Market Size by 2027 | US$ 2.8 Billion |

| Global CAGR (2019 - 2027) | 5.5% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Rental Location

|

| Regions and Countries Covered | MENA

|

| Market leaders and key company profiles |

The geographic scope of the MENA Car Rental Services refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Strategic Insights

Some of the market Initiatives were observed to be the most adopted strategy in the MENA car rental services market. Few of the recent market initiatives are listed below:

MENA CAR RENTAL SERVICES MARKET SEGMENTATION

MENA Car Rental Services Market - By Rental Location

MENA Car Rental Services Market - By Cab Category

MENA Car Rental Services Market - By Customer Type

MENA Car Rental Services Market - By Country

MENA Car Rental Services Market - Company Profiles

The List of Companies - MENA Car Rental Services Market

The MENA Car Rental Services Market is valued at US$ 1.7 Billion in 2018, it is projected to reach US$ 2.8 Billion by 2027.

As per our report MENA Car Rental Services Market, the market size is valued at US$ 1.7 Billion in 2018, projecting it to reach US$ 2.8 Billion by 2027. This translates to a CAGR of approximately 5.5% during the forecast period.

The MENA Car Rental Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the MENA Car Rental Services Market report:

The MENA Car Rental Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The MENA Car Rental Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the MENA Car Rental Services Market value chain can benefit from the information contained in a comprehensive market report.