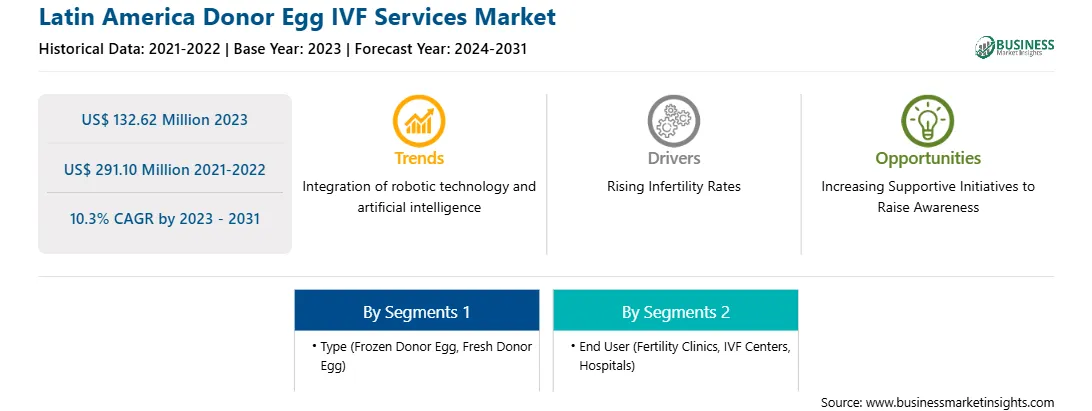

The Latin America donor egg IVF services market size is expected to grow from US$ 132.62 million in 2023 and is projected to reach US$ 291.10 million by 2031; it is expected to register a CAGR of 10.3% during 2023-2031.

Latin America has become a popular fertility treatment destination for international patients seeking affordable and high-quality IVF treatments. The relatively lower cost of fertility procedures in Latin America compared to North America and Europe makes the services more accessible, attracting both local and international patients seeking these treatment options. The fusion of technological excellence, cost-effectiveness, and compassionate care makes Latin America an ideal destination for fertility treatments. Countries such as Mexico attract patients from the US and other countries due to lower costs and successful treatment outcomes, which drive demand for donor egg services.

In the US, fertility treatments are most often not covered by insurance, making them price-intensive and inaccessible, with a fresh IVF cycle costing up to ~US$ 20,000 on average, according to the Out-of-Pocket Fertility Patient Expense: Data from a Multicenter Prospective Infertility Cohort. In order to access care, traveling to treatment destinations in Latin America is a more budget-friendly and convenient alternative to typical treatment costs, where clinics can offer IVF cycles at a quarter of the price with greater quality of care and better patient experience. IVF treatments in Latin America can be as much as 70% cheaper than in the US or Europe without compromising the quality of care.

Moreover, Mexico has established itself as a leading destination for medical tourism due to the relatively low treatment costs. Infertility Aide, an agency that links doctors with infertility patients globally, reports that the total average cost of IVF in Mexico, covering medications, monitoring, and fees for doctors and hospitals, is around US$ 8,000. Within Mexico's medical tourism sector, assisted reproduction is the 3rd top reason for medical travel. The country has favorable regulatory environments for the wide range of assisted reproductive technology treatments. There is no law in LATAM that restricts or prohibits IVF treatments, egg donation, gender selection, genetic screening, or sperm donation.

Brazil also has been a major center for medical tourism and is expanding the availability of medication, including fertility treatment. The country has a total of 150 facilities offering treatments for infertility. The costs associated with these treatments are highly affordable compared to those of the US and Western Europe. Therefore, affordability, quality care, influx of international patients seeking fertility treatments (including donor egg IVF), and the rising growth of fertility tourism are fueling the expansion of the donor egg IVF treatment services market in Latin America.

The Latin America donor egg IVF services market, by type, is bifurcated into frozen donor egg and fresh donor egg. The frozen donor egg segment held a larger share in the Latin America donor egg IVF services market share in 2023.

The Latin America donor egg IVF services market, by end user, is segmented into fertility clinics and IVF centers, hospitals, and others. The fertility clinics and IVF centers segment held the largest Latin America donor egg IVF services market share in 2023.

The Latin America donor egg IVF services market is driven by several key factors, such as increasing infertility rates among couples coupled with a growing acceptance of assisted reproductive technologies, which has led to heightened demand for these services. Additionally, the cost of IVF treatments in Latin America is generally lower than in developed countries, making it an ideal option for both local and international patients. The rise of fertility tourism further creates a robust environment for the expansion of donor egg IVF services, enhancing market growth as individuals from nations with restrictive reproductive laws seek affordable and accessible fertility solutions. Brazil held the largest share of the market in 2023. The declining birth rate is influencing the growth of infertility treatment across the country. For instance, according to the Brazil Birth Rate 1950–2024 published by Macrotrends, the nation’s birth rate in 2024 is 12.580 births per 1,000 people, a 1.76% decline from 2023, which was 12.806 births per 1,000 people. As more couples face challenges in conceiving, the demand for donor egg IVF services has surged. As per an article titled “Restricted access to assisted reproductive technology and fertility preservation,” published in September 2021, the number of IVF cycles conducted in the country improved between 2012 and 2019, the number of registered clinics in Brazil increased by 63%, and the number of frozen embryos increased threefold. The number of IVF clinics registered in the nation rose from 120 to 183 (Source: ANVISA, 2020). Additionally, fertilization rates in Brazil indicate that the country's assisted reproduction services are effective, achieving international standards. The country’s average fertilization success rate was 76%, which is within the quality standards recommended in the international literature, ranging from 65% to 75%, as per the data from the 12th report of the National System of Embryo Production (Source: SisEmbrio, 2019).

In addition, Brazil has a supportive legal framework for assisted reproductive technologies. The Brazilian regulations support anonymous egg donation, providing patients with a broad pool of potential donors while maintaining donor confidentiality. While paying donors is prohibited, many clinics in the country provide compensation for expenses, which encourages more women to participate as donors.

Moreover, in September 2023, the first AI-powered IVF operating system was introduced in Brazil at Perfetto, a multidisciplinary fertility clinic in Goiânia, by the reproductive technology business AIVF. A proprietary AI-powered operating system called EMA by AIVF was developed to assist IVF facilities in strengthening patient-clinician communications, optimizing workflows, and making better clinical decisions. The expansion of AIVF greatly meets Brazil's rising need for assisted reproductive technologies.

The National Institutes of Health (NIH), British Columbia Medical Journal, Wiley, and Fertility and Sterility are among the primary and secondary sources referred to while preparing the Latin America donor egg IVF services market report.

Strategic insights for the Latin America Donor Egg IVF Services provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 132.62 Million |

| Market Size by 2031 | US$ 291.10 Million |

| Global CAGR (2023 - 2031) | 10.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Latin America

|

| Market leaders and key company profiles |

The geographic scope of the Latin America Donor Egg IVF Services refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Latin America Donor Egg IVF Services Market is valued at US$ 132.62 Million in 2023, it is projected to reach US$ 291.10 Million by 2031.

As per our report Latin America Donor Egg IVF Services Market, the market size is valued at US$ 132.62 Million in 2023, projecting it to reach US$ 291.10 Million by 2031. This translates to a CAGR of approximately 10.3% during the forecast period.

The Latin America Donor Egg IVF Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Latin America Donor Egg IVF Services Market report:

The Latin America Donor Egg IVF Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Latin America Donor Egg IVF Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Latin America Donor Egg IVF Services Market value chain can benefit from the information contained in a comprehensive market report.