Market Introduction

A fixed-base operator (FBO) is an organization granted the right by an airport to operate at the airport premises and provide various aeronautical services such as hangaring, fueling, tie-down, aircraft rental, aircraft maintenance, and flight instructions. The fixed-base operators provide support services to the general aviation operators. Most fixed-base operators are doing their business at moderate to high-traffic airports. The key drivers for the fixed-base operator market size are development in global airport infrastructures and growth in the business aviation sector.

Owing to the COVID-19 outbreak, LATAM experienced a significant decline in production volumes from the aviation industry. There is a lack of aircraft parking and general aviation (GA) infrastructure throughout the LATAM region. However, with the formation of local flight departments in the region, the fixed-base operator market will strengthen and encourage improvement in infrastructure and general aviation services. Further, the region is experiencing a decline in travel and tourism-related activities, owing to the containment measures imposed by governments, ultimately hindering the adoption of fixed-base operators services. Also, the discontinuation of fixed-base operator projects in Argentina, Colombia, Peru, and Chile, among other Latin American countries, and disruption in the supply chain of the aviation industry in the region are affecting the market growth.

Strategic insights for the LATAM Fixed-Base Operator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the LATAM Fixed-Base Operator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

LATAM Fixed-Base Operator Strategic Insights

LATAM Fixed-Base Operator Report Scope

Report Attribute

Details

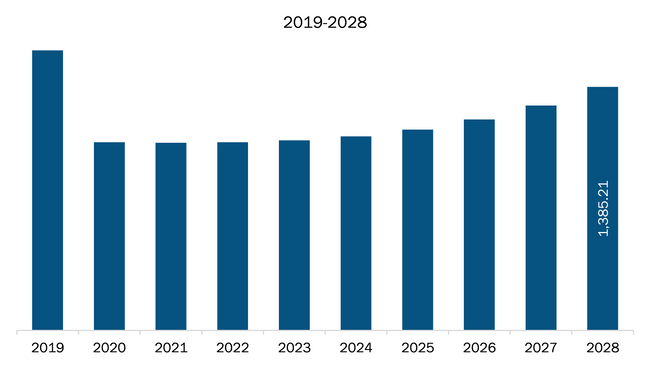

Market size in 2021

US$ 1,067.72 Million

Market Size by 2028

US$ 1,385.21 Million

Global CAGR (2021 - 2028)

3.8%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Service Offered

By Application

Regions and Countries Covered

LATAM

Market leaders and key company profiles

LATAM Fixed-Base Operator Regional Insights

Market Overview and Dynamics

The LATAM fixed-base operator market was valued at US$ 1,067.72 million in 2021 and is projected to reach US$ 1,385.21 million by 2028; it is estimated to register a CAGR of 3.8% from 2021 to 2028.

Mexico is one of the leading countries in the LATAM fixed-base operator market, and it accounts for more than 60% of the fixed-base operator market share. Owing to the low labor cost, many aerospace and aviation players are expected to increase their footprints in this region due to the United States–Mexico–Canada Agreement. Companies that have made expansions in Mexico include LinkedIn, Pinterest, Littler Mendelson P.C., Altimetrik Corp., Eventtia, and ZAG. These factors have increased the business aviation sector across the country. Additionally, the Mexican government is also making high investments in the development of the airport infrastructure across the country. The country focuses on meeting the emerging demand from business class travelers and offering them a better traveling experience with enhanced FBO services. The country houses several international FBO service providers at different locations, with Cancun International Airport being one of the leading airports with a higher number of FBOs. The number of FBOs is expected to grow over the upcoming years as the country is observing steady growth in business and leisure aviation sectors.

Key Market Segments

Based on services offered, the fueling segment dominated the LATAM fixed-base operator market. At airports, the FBOs provide ground handle and fueling services to the commercial airlines operating from the airport. The most important thing that the buyers are looking for is the smaller airfields with a quick response of the FBO, as the purchasing power varies and impacts the margins on each gallon of fuel sold. For instance, Signature Flight Support offers fueling services to corporate and commercial aircraft, by following rules set by airport authorities. The company is engaged in offering, Sustainable Aviation Fuel (SAF) to customers across all its operating airports. The demand for SAF is consistently growing among the aviation companies to reduce carbon footprint, and owing to this, Signature Aviation has strategized to offer SAF. This strategy is expected to boost Signature Aviation’s brand image, customer base, and revenues in the coming years.

The LATAM fixed-base operator market is divided into services offered, application, and geography. Based on services offered, the LATAM fixed-base operator market size is segmented into hangaring, fueling, flight instruction, aircraft maintenance, and aircraft rental. In terms of application, the LATAM fixed-base operator market is segmented into business aviation and leisure aviation. Geographically, the LATAM fixed-base operator market is segmented into Brazil, Argentina, Mexico, and the Rest of LATAM.

Major Sources and Companies Listed

A few major primary and secondary sources referred to while preparing this report on the LATAM fixed-base operator market are company websites, annual reports, financial reports, national government documents, and statistical databases. ICCS; World-Way Aviation; Signature Flight Support; Líder Aviação; South American Jets, LLC; Universal Weather and Aviation, Inc.; Loreto Aviation Services; Jetex; LOBOS HANDLING; and TALMA are among the major companies listed in the LATAM fixed-base operator market report.

Reasons to Buy Report

The LATAM Fixed-Base Operator Market is valued at US$ 1,067.72 Million in 2021, it is projected to reach US$ 1,385.21 Million by 2028.

As per our report LATAM Fixed-Base Operator Market, the market size is valued at US$ 1,067.72 Million in 2021, projecting it to reach US$ 1,385.21 Million by 2028. This translates to a CAGR of approximately 3.8% during the forecast period.

The LATAM Fixed-Base Operator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the LATAM Fixed-Base Operator Market report:

The LATAM Fixed-Base Operator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The LATAM Fixed-Base Operator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the LATAM Fixed-Base Operator Market value chain can benefit from the information contained in a comprehensive market report.