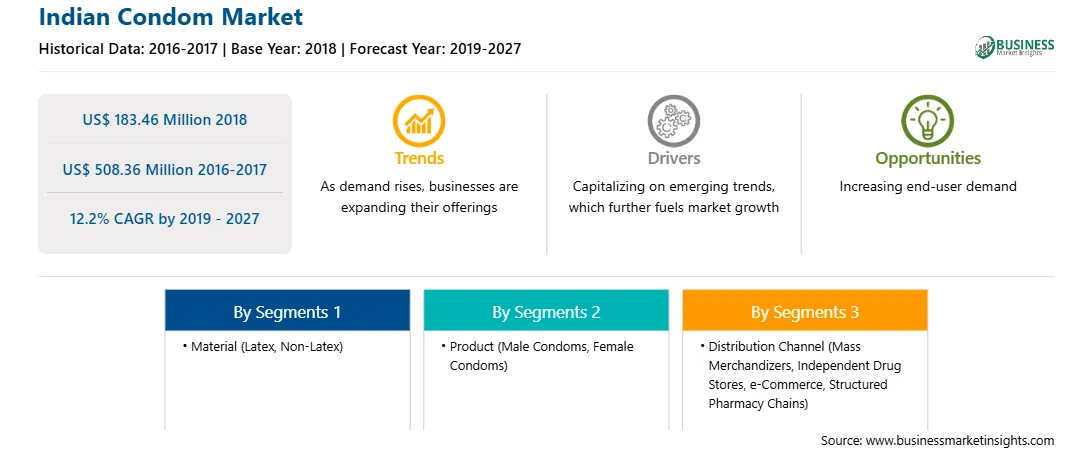

The Indian Condom market is expected to reach US$ 508.36 Mn in 2027 from US$ 183.46 Mn in 2018. The market is estimated to grow with a CAGR of 12.2% from 2019-2027.

The growth of the market is driven by the factors such as rising number of awareness programs, increasing use of locally manufactured condoms in the remote parts of this region, presence of a robust distribution network and high density of adult and middle aged population are likely to grow the Indian condom market in the forecast period. Whereas, the rising number of sterilization procedures in the India is likely to impact the growth of the Indian condom market during the forecast period.

Pricing and promotion of consumer goods have a significant impact on sales of the products in India. Optimum distribution strategies involve bulk discounts, free delivery, and online purchasing options, which are among the factors that have significant long and short-run effects. India has witnessed substantial growth in e-commerce in the recent years. In 2017, the Indian Brand Equity Foundation (IBEF) reported that India is the fastest-growing e-commerce sector with a compound annual growth rate of 51%, which is highest worldwide. 4G internet launch, smartphone penetration, and increasing consumer wealth have encouraged the condom market players to advertise and promote their products on multiple digital platforms. This has helped the customers to have an increasing choice of products at the lowest rates. Moreover, the advertisements and online promotional platforms have helped the condom sales to reach efficiently in tier-2 and tier-3 cities.

Condom advertisements are aired amid late-night programs on television channels that help gain greater the attention of young viewers. Moreover, alternative practices such as hoardings, billboards, leaflets, celebrity endorsements, and collaborations with NGOs, along with other reforms, to promote safe sexual practices are being implemented to convey correct information and benefits of condom usage to the common populace. Digital platforms are serving the means of a marketing channel for the condom companies after the ban on aggressive condom advertisements in the country. Visitors of these platforms also receive pop-up ad commercials during audios/videos or blog browsing. Thus, the aggressive marketing strategies incorporated by players are expected to propel the growth of the condom market in India.

North Zone is expected to lead the market in the India owing to the reasons such as highest number of population in the country, and various government initiatives have been taken to control the population growth. Therefore, considering the above mentioned factors, the growth of the market in the north zone is likely to contribute the largest share in the India during the forecast period.

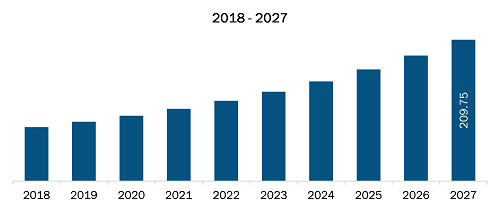

North Zone Condom Market Revenue and Forecasts to 2027 (US$ Mn)

Strategic insights for the Indian Condom provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 183.46 Million |

| Market Size by 2027 | US$ 508.36 Million |

| Global CAGR (2019 - 2027) | 12.2% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | India

|

| Market leaders and key company profiles |

The geographic scope of the Indian Condom refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

INDIAN CONDOM– MARKET SEGMENTATION

Indian Condom Market – By

Material

Indian Condom Market – By

Product

Indian Condom Market – By Distribution Channel

Indian Condom Market – By

Region

Companies Mentioned

The List of Companies in Indian Condom Market

The Indian Condom Market is valued at US$ 183.46 Million in 2018, it is projected to reach US$ 508.36 Million by 2027.

As per our report Indian Condom Market, the market size is valued at US$ 183.46 Million in 2018, projecting it to reach US$ 508.36 Million by 2027. This translates to a CAGR of approximately 12.2% during the forecast period.

The Indian Condom Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Indian Condom Market report:

The Indian Condom Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Indian Condom Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Indian Condom Market value chain can benefit from the information contained in a comprehensive market report.