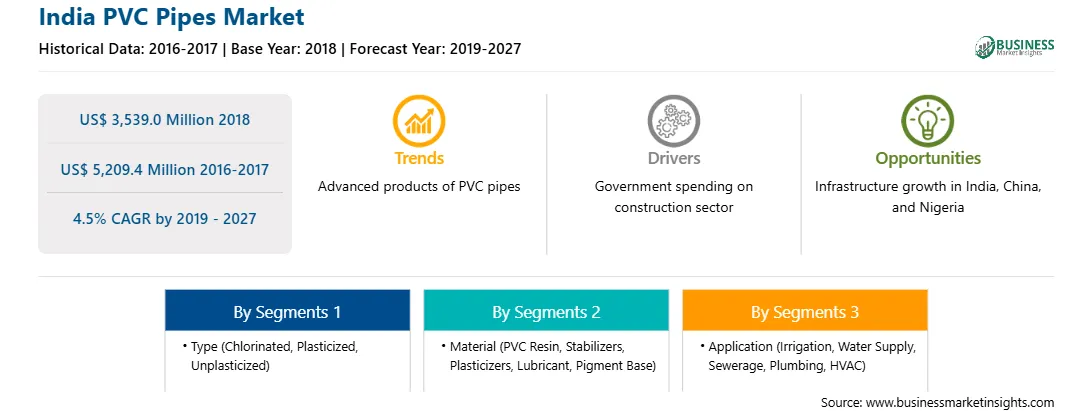

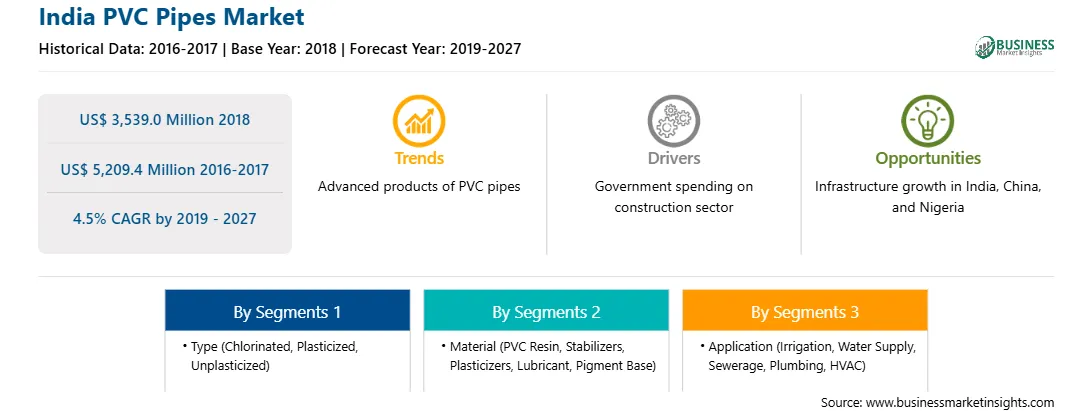

India PVC pipes market was valued at US$ 3,539.0 Mn in 2018 and is projected to be worth US$ 5,209.4 Mn by 2027; it is expected to grow at a CAGR of 4.5% during the forecast period 2019 - 2027.

PVC pipes are pipes that are produced by extrusion of raw material from polyvinyl chloride and are known for their high tensile strength, ductility, endurance toward extreme temperature conditions, and resistance over corrosion.

PVC pipes find their application in various commercial and industrial sectors including chemical industry, electronics, semiconductors, food and beverage, marine, mining, agricultural, steel processing, and wastewater treatment plants. These pipes are majorly used in the underground supply of potable water, in sewer and drainage systems, for irrigation, medical devices, and others. They are being commercially used in infrastructures including banks, health care facilities, airports, marine systems, resorts, office buildings, amongst others. PVC pipes are also used in various pressure systems in building service lines, site utility systems, reclaimed and gray water systems, turf irrigation, and among others.

The growing application base, along with rapid urbanization and industrialization, is contributing to the growth of the India PVC pipes market. In addition, The Government of India focuses on the development of the economy by increasing its spending and focusing its efforts on the growth of several sectors. The government is proposing several schemes and plans such as Pradhan Mantri Awas Yojana, Pradhan Mantri Krishi Sinchai Yojana toward the development of infrastructural facilities. Such plans are also expected to support the growth of the India PVC pipes market.

Strategic insights for the India PVC Pipes provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the India PVC Pipes refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.India PVC Pipes Market Revenue and Forecast, 2018

India PVC Pipes Strategic Insights

India PVC Pipes Report Scope

Report Attribute

Details

Market size in 2018

US$ 3,539.0 Million

Market Size by 2027

US$ 5,209.4 Million

Global CAGR (2019 - 2027)

4.5%

Historical Data

2016-2017

Forecast period

2019-2027

Segments Covered

By Type

By Material

By Application

Regions and Countries Covered

India

Market leaders and key company profiles

India PVC Pipes Regional Insights

Market Insights

Growth of the agricultural sector in India provides an opportunity for the India PVC pipes market

About 58% of India's population depend on agriculture considering it as a primary source of income. Agriculture, forestry, and fishing in combination account for Rs.18.53 trillion (US$ 271.00 billion) in FY18. Further, the agriculture sector in India is poised to generate better momentum in the forthcoming years owing to increased government investments in agricultural facilities such as irrigation systems, warehousing, and cold storage. Further, the growth in domestic income, along with rising demand for food, is going to pose a burden on the country's agricultural sector, which further would propel the India PVC pipes market growth. Also, the adoption of various key trends in the agriculture industry, such as the rise in exports, increase in private participation in agriculture, and the use of information technology are further expected to stimulate the growth of the agricultural sector. The demand for better irrigation facilities and better form of infrastructural set-up has raised the use of PVC pipes for various agricultural applications. This fact has impacted the India PVC pipes market positively. PVC pipes have high tensile strength, ductility, endurance toward extreme temperature conditions, and resistance over corrosion which makes them ideal for agricultural applications. Further, the PVC pipe is quite economical and versatile as these can be used in numerous structures driving the growth of the India PVC pipes market.

Rising acceptance of CPVC pipes is expected to drive the growth of India PVC pipes market

CPVC (Chlorinated polyvinyl chloride) is a kind of thermoplastic formed by chlorination of the polyvinyl chloride resin. It is chemically composed of two carbon atoms bonded together with two hydrogen atoms and two chlorine atoms single-bonded to the carbon. These pipes are available in nominal pipe size and copper tube size. They are known for several features such as lightweight, ease in transportation, availability in different sizes, long-term reliability, and durability. Moreover, these pipes are quite resistant to corrosion and have an extended service lifespan. CPVC possesses the capability to handle extreme temperatures up to 200° Fahrenheit, which exhibits comparatively greater flexibility than PVC. The increase in the demand for such pipes in various sectors such as irrigation, sanitation, and building construction is driving the growth of the India PVC pipes market. Further, the increasing government expenditure and investment towards housing and sanitation, building and construction, irrigation, and environmental protection activities through schemes such as housing for all and making 100 smart cities are intended to open immense opportunities for India PVC pipes market players to maintain sustainable growth in future.

Raw Material Insights

Based on the raw material, the India PVC pipes market is segmented into PVC resin, stabilizers, plasticizers, lubricant, pigment base, and others. Among these stabilizers is expected to grow at the highest CAGR of 5.0% during the forecast period. PVC molecules are sensitive to UV light and heat, which leads to the disruption of their stability. The heating of PVC results in the breakage of polymeric chains and the liberation of hydrochloric acid gas. This hydrochloric acid catalyzes the degradation process, which results in large quantities of corrosive hydrochloric acid (HCl) and other toxic gases. Stabilizers are used to prevent such degradation of PVC. Most stabilizers contain metals, mostly in the form of salts, which react with hydrochloric acid and inhibit further degradation. Stabilizers can also be offered in the combination of two or more metals, and such combined variants provided protection against UV radiation. Calcium-Zinc-based (Ca-Zn) stabilizers are prevalently used in many flexible and rigid PVC applications. Ca-Zn stabilizers provide good mechanical and electrical properties, a high degree of clarity, and excellent organoleptic properties to the final products. Stabilizers aid PVC pipes to withstand heat and UV light in outdoor applications. The growing importance of PVC pipes having good processibility and PVC compatibility has led to the demand for stabilizers in the India PVC pipes market.

Application Insights

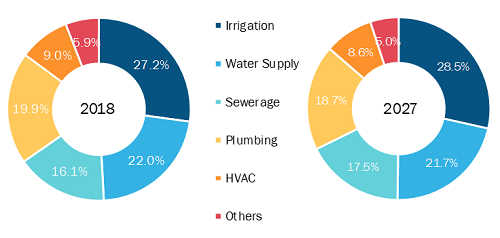

The India PVC pipes market by application has been segmented into irrigation, water supply, sewerage, plumbing, HVAC, and others. The irrigation segment led the India PVC pipes market with a market share of 27.2% in 2018. Further, it is expected to garner a 28.5% share by 2027. The PVC pipe is widely used in the agriculture sector for irrigating farms and fields as they are tough, durable, and economical, as well as have a long life. They are commonly used between the valves on the main water line and sprinkler head. They aid in transporting or conveying water from main lines to sprinkler or drip irrigators. Rigid PVC pipes are also suitable for underground installation, where they are protected from steep temperature variations and hazards posed by farming operations, farm animals, and traffic. As PVC pipes are designed to be pressure-resistant, they are leak-proof and help in conserving water making them ideal for use in agriculture and farming processes. The growing network of irrigation canals, as well as the development of new water reservoirs and dams, in India, is anticipated to support the growth of the PVC pipes in India during the forecast period. However, owing to its rigidity, PVC pipes are known to crack and shatter in freezing temperatures. This tendency to crack at low temperatures is expected to limit the application of PVC pipes in the irrigation sector to some extent.

Strategic insights for the India PVC Pipes provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the India PVC Pipes refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.India PVC Pipes Market by Application

India PVC Pipes Strategic Insights

India PVC Pipes Report Scope

Report Attribute

Details

Market size in 2018

US$ 3,539.0 Million

Market Size by 2027

US$ 5,209.4 Million

Global CAGR (2019 - 2027)

4.5%

Historical Data

2016-2017

Forecast period

2019-2027

Segments Covered

By Type

By Material

By Application

Regions and Countries Covered

India

Market leaders and key company profiles

India PVC Pipes Regional Insights

Strategic Insights

India PVC pipes market is consolidated due to the presence of several major players such as Ashirvad, Astral Poly Technik Limited, Captain Pipes Ltd, Dutron, Finolex Industries Ltd, Kankai Pipes & Fittings Private Limited. These companies have been implementing various strategies that have helped their growth and, in turn, have brought about various changes in the India PVC pipes market. These India PVC pipes market players have been continuously focusing on strategies such as product developments, plant expansions, and mergers and acquisitions to expand their footprint and hold a significant share in India PVC pipes market. Few of the recent developments in the India PVC pipes market are listed below:

2018:

Astral Poly Technik Ltd. announced its acquisition of Rex Polyextrusion Pvt. Ltd. with a 51% share buyout.

The Lubrizol Corporation and Finolex Industries Limited have signed FlowGuard Processor agreement for the manufacturing and sale of FinOlex FlowGuard Plus CPVC pipes and fittings in India.

2017:

INDIA PVC PIPES MARKET SEGMENTATION

India PVC Pipes Market - By

Type

India PVC Pipes Market - By Material

India PVC Pipes Market - By Application

Company Profiles

The List of Companies - India PVC Pipes Market

The India PVC Pipes Market is valued at US$ 3,539.0 Million in 2018, it is projected to reach US$ 5,209.4 Million by 2027.

As per our report India PVC Pipes Market, the market size is valued at US$ 3,539.0 Million in 2018, projecting it to reach US$ 5,209.4 Million by 2027. This translates to a CAGR of approximately 4.5% during the forecast period.

The India PVC Pipes Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the India PVC Pipes Market report:

The India PVC Pipes Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The India PVC Pipes Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the India PVC Pipes Market value chain can benefit from the information contained in a comprehensive market report.