India has a strong e-commerce industry, which has transformed the way business is done in India. India's e-commerce sector is propelled by increasing penetration of smartphones and Internet among the people. Growing e-commerce sector is positively influencing the growth of the e-commerce logistics market in India. With the growing e-commerce industry, the number of players entering the e-commerce sector is increasing. The e-commerce logistics market in India is anticipated to be dominated by captive players, specifically the internal logistics divisions of large e-retailers, since they are extending their services to other external online sellers as well. The Indian e-commerce logistics market players are focused on the adoption of innovative technologies to mitigate challenges, such as cost pressure, poor infrastructure, and high returns. In the coming years, new business models—including delivery via local retailers and omnichannel retailing—are projected to become noticeable in India's e-commerce logistics sector.

Strategic insights for the India E-commerce Logistics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the India E-commerce Logistics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

India E-commerce Logistics Strategic Insights

India E-commerce Logistics Report Scope

Report Attribute

Details

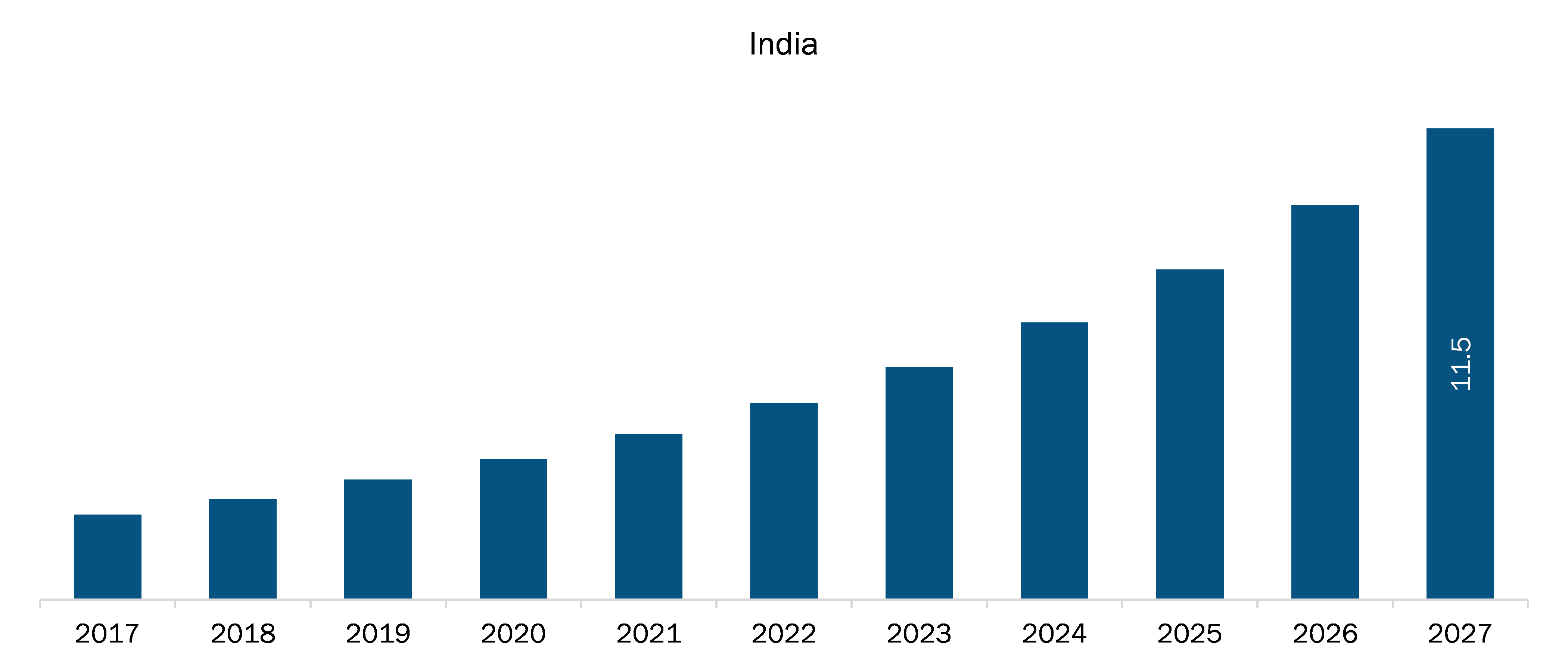

Market size in 2019

US$ 2.9 Billion

Market Size by 2027

US$ 11.5 Billion

Global CAGR (2020 - 2027)

18.8%

Historical Data

2017-2018

Forecast period

2020-2027

Segments Covered

By Service Type

By Operational Area

By End User

Regions and Countries Covered

India

Market leaders and key company profiles

India E-commerce Logistics Regional Insights

Market Overview and Dynamics

The online retailers are partnering with third-party logistics (3PL) providers to manage issues related to delivery, such as inventory, packaging, shipping, warehousing, and tracking. The partnership helps online retailers to focus on their key business areas and reduce their operational cost concerning the shipping. Also, 3PL helps them deliver their products faster. The emergence of several online-only stores, which cannot afford to have their own in-house services, is propelling the growth of India's e-commerce logistics market. Thus, growing focus of e-commerce players toward cost optimization and streamlining workflow is anticipated to influence the growth of the market

Key Market Segments

In terms of service type, the transportation segment accounted for the largest share of the India e-commerce logistics market in 2019. In terms of operational area, the domestic segment held larger market share of the India e-commerce logistics market in 2019. In terms of end user, the B2C segment held larger market share of the India e-commerce logistics market in 2019.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the India e-commerce logistics market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. A few of the players operating in the Asia-Pacific India e-commerce logistics market are Shiprocket; FedEx Corporation; Ecom Express Private Limited; Gati-Kintetsu Express Private Limited; Ekart Logistics; Mahindra Logistics Ltd; Amazon.com, Inc.; Aramex; Blue Dart Express Limited; and Delhivery Pvt Ltd, among others.

Reasons to buy report

India E-Commerce Logistics Segmentation

India E-Commerce Logistics Market – by Service Type

India E-Commerce Logistics Market – by Operation Area

India E-Commerce Logistics Market – by End User

The List of Companies - India E-Commerce Logistics Market

The India E-commerce Logistics Market is valued at US$ 2.9 Billion in 2019, it is projected to reach US$ 11.5 Billion by 2027.

As per our report India E-commerce Logistics Market, the market size is valued at US$ 2.9 Billion in 2019, projecting it to reach US$ 11.5 Billion by 2027. This translates to a CAGR of approximately 18.8% during the forecast period.

The India E-commerce Logistics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the India E-commerce Logistics Market report:

The India E-commerce Logistics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The India E-commerce Logistics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the India E-commerce Logistics Market value chain can benefit from the information contained in a comprehensive market report.