India & South-East Asia Air Cargo Security and Screening Systems Market

No. of Pages: 131 | Report Code: TIPRE00025467 | Category: Aerospace and Defense

No. of Pages: 131 | Report Code: TIPRE00025467 | Category: Aerospace and Defense

The air cargo security and screening systems are used for detecting explosives, narcotics, and metal & contraband. Airport authorities across India & South-East Asian countries have implemented advanced security systems to detect cargo explosives and trace narcotics in large and small pallets of cargo. In the recent past, the growing risk of attacks through explosives has led to increasing adoption of technologies such as x-rays systems, ETD (explosives trace detectors), and EDS (explosives detection system) by airport authorities for reducing the chances of such attacks. Moreover, the rising usage of air cargo facilities for the transportation of goods is leading to the increasing use of such technologies for screening cargo at airports for a quicker screening process. Thus, the adoption of bomb-detecting technologies and screening devices has increased considerably across the region in the recent past.

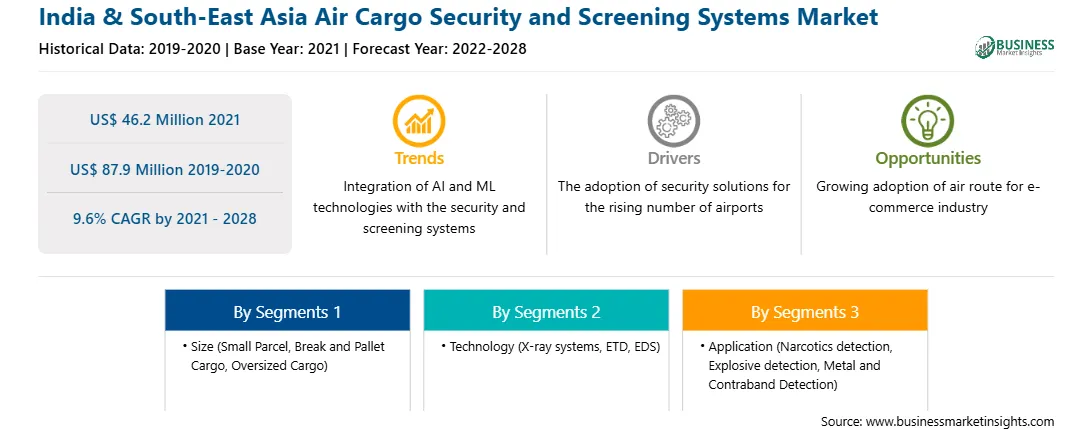

The India & South-East Asia air cargo security and screening systems market is expected to grow from US$ 46.2 million in 2021 to US$ 87.9 million by 2028; it is estimated to grow at a CAGR of 9.6% from 2021 to 2028.

The transportation of temperature-sensitive products, such as chemicals, drugs, and medicines, creates a massive demand for air cargo. For instance, almost 68% of all biotech products are considered to be temperature sensitive. In addition, in August 2019, Marken (presence in India) announced clinical home healthcare services that consist of clinical drug storage, biologic sample collection, direct-to-patient delivery, central pharmacy, and home care/nursing services. Pharmaceutical companies are highly dependent on-air transportation due to factors such as time sensitivity and temperature-controlled transportation. The rapid growth of the pharmaceutical industry boosts the demand for transportation services for temperature-sensitive cargo. Also, the demand for these transportation services is increasing as new pharmaceutical and biotechnology products enter the market each day. Therefore, airlines using advanced cool chain solutions will be well-positioned to take full advantage of this growing demand. Airlines witness increasing demand for shipping services that cater to the needs of the pharmaceutical industry.

Therefore, air cargo is required for supplying temperature-sensitive products to different places or countries. Along with the growing need for transportation, hidden explosive objects and narcotics have also been supplied. Therefore, a systematic screening system is needed at the airport. Also, with the ongoing COVID-19 pandemic, automatic advanced air cargo security and screening systems demand will increase contributing to the market growth.

The demand for air cargo was unaffected by the lockdowns in India, and the operating conditions remain supportive for air cargo. The air cargo and freighter operators have reported brisk business owing to the increased transportation of COVID-19 related essentials by air. For instance, SpiceExpress (an air cargo subsidiary of SpiceJet) is encouraging performance as its fleet is increasingly being deployed to transport essential items and medical goods to deal with the COVID-19 pandemic. The cargo delivered to various parts of the country includes COVID-19 related medical equipment, reagents, enzymes, masks, testing kits & PPE, gloves & other accessories. Further, the ministry of civil aviation in India has undertaken continuous efforts at the policy level and ground level to add substantially to the country’s fight against COVID-19. For instance, Air India and IAF (Indian Air Force) collaborated for supplying medical equipment across Ladakh, Imphal, Dimapur, Gangtok, Bagdogra, Guwahati, Chennai, and Port Blair. A dedicated medical air cargo-related website Lifeline Udan has been launched and is functional. Therefore, with the growing demand for air cargo for supplying medical equipment, the requirement for security and screening systems has also increased. Thus, the air cargo business in India has reflected positive market growth.

Based on size, the India & South-East Asia air cargo security and screening systems market is bifurcated into small parcel, break and pallet cargo, and oversized cargo. In 2020, the break and pallet cargo segment led the market, accounting for a larger share in the market. On the basis of technology, the India & South-East Asia air cargo security and screening systems market is segmented into x-ray systems, ETD, EDS, and others. In 2020, the x-ray systems segment accounted for the largest market share. Based on application, the India & South-East Asia air cargo security and screening systems market is bifurcated into narcotics detection, explosive detection, metal and contraband detection, and others. In 2020, the explosives segment led the market, accounting for a larger share in the market.

The top companies operating in the India & South-East Asia air cargo security and screening systems market are Astrophysics Inc.; Dhonaadhi Hitec Innovations; Krystalvision Image Systems Pvt. Ltd.; Nuctech Company Limited; Rapiscan Systems, Inc.; Safran; VOTI Detection Inc.; Safeway Inspection System Limited; Smiths Detection Group Ltd. (Smiths Group plc); and FocusTest Inc. Various other companies operating in the market are coming up with new technologies and offerings, which is helping the India & South-East Asia air cargo security and screening systems market to expand in terms of revenue.

· To understand the India & South-East Asia air cargo security and screening systems market landscape and identify market segments that are most likely to guarantee a strong return

· To stay ahead of the race by comprehending the ever-changing competitive landscape for the India & South-East Asia air cargo security and screening systems market

· To efficiently plan M&A and partnership deals in the India & South-East Asia air cargo security and screening systems market by identifying market segments with the most promising probable sales

· To make knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segments of the India & South-East Asia air cargo security and screening systems market

· To obtain revenue forecast for market by various segments from 2020 to 2028 in India & South-East Asia

India & South-East Asia Air Cargo Security and Screening Systems Market Segmentation

India & South-East Asia Air Cargo Security and Screening Systems Market – by Size

· Small Parcel

· Break and Pallet Cargo

· Oversized Cargo

India & South-East Asia Air Cargo Security and Screening Systems Market – by Technology

· X-ray systems

· ETD

· EDS

· Others

India & South-East Asia Air Cargo Security and Screening Systems Market – by Application

· Narcotics detection

· Explosive detection

· Metal and Contraband Detection

· Others

India & South-East Asia Air Cargo Security and Screening Systems Market - Companies MentionedAstrophysics Inc.

Strategic insights for the India & South-East Asia Air Cargo Security and Screening Systems provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 46.2 Million |

| Market Size by 2028 | US$ 87.9 Million |

| Global CAGR (2021 - 2028) | 9.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Size

|

| Regions and Countries Covered | India & South-East Asia

|

| Market leaders and key company profiles |

The geographic scope of the India & South-East Asia Air Cargo Security and Screening Systems refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The India & South-East Asia Air Cargo Security and Screening Systems Market is valued at US$ 46.2 Million in 2021, it is projected to reach US$ 87.9 Million by 2028.

As per our report India & South-East Asia Air Cargo Security and Screening Systems Market, the market size is valued at US$ 46.2 Million in 2021, projecting it to reach US$ 87.9 Million by 2028. This translates to a CAGR of approximately 9.6% during the forecast period.

The India & South-East Asia Air Cargo Security and Screening Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the India & South-East Asia Air Cargo Security and Screening Systems Market report:

The India & South-East Asia Air Cargo Security and Screening Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The India & South-East Asia Air Cargo Security and Screening Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the India & South-East Asia Air Cargo Security and Screening Systems Market value chain can benefit from the information contained in a comprehensive market report.