India Aerospace & Defense Power Technologies Market

No. of Pages: 217 | Report Code: TIPRE00025063 | Category: Aerospace and Defense

No. of Pages: 217 | Report Code: TIPRE00025063 | Category: Aerospace and Defense

Market Introduction

India is expected to be a prominent manufacturer defense and aerospace products in the future, which would drive the adoption of power technologies such as connectors, devices, wires and cables, relays, and rugged fiber optics (RFO) in the coming years. The market has been thoroughly analyzed, encompassing commercial and military aerospace, military vehicles, and other military technologies as well as the space industry. The demand for various power technologies assessed in the report is all-time high among the aerospace and defense product manufacturers.

The demand for connectors, communication devices, power actuators, FADEC (full authority digital engine control), jammers, relays, wires & cables, and fiber optics in the defense sector is high, as they make the operations of military vehicles, naval vessels, military aircraft, UAVs (unmanned aerial vehicle), and C4ISR, and robotics technically sound. In addition to the growing focus on continuously enhancing products related to these systems, a strong government support for manufacturing the products locally is another factor offering lucrative growth opportunities for the aerospace & defense power technologies market players. For instance, the Make in India and the Atma Nirbhar Bharat are the two prominent strategies that focus on the manufacturing of defense-related products in India. These strategies are enabling the product and component manufacturers to improve revenues, which is further boosting the aerospace & defense power technologies market growth.

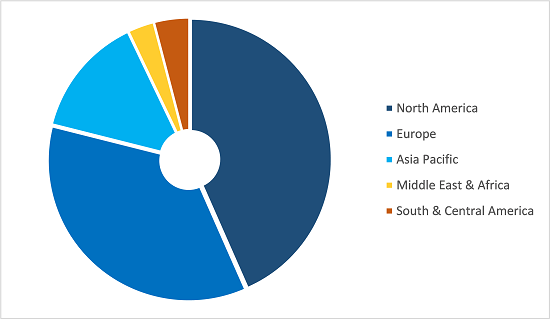

Strategic insights for the India Aerospace & Defense Power Technologies provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the India Aerospace & Defense Power Technologies refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

India Aerospace & Defense Power Technologies Strategic Insights

India Aerospace & Defense Power Technologies Report Scope

Report Attribute

Details

Market size in 2021

US$ 635.80 Million

Market Size by 2028

US$ 1,284.19 Million

Global CAGR (2021 - 2028)

10.6%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Component

By Application

Regions and Countries Covered

India

Market leaders and key company profiles

India Aerospace & Defense Power Technologies Regional Insights

Market Overview and Dynamics

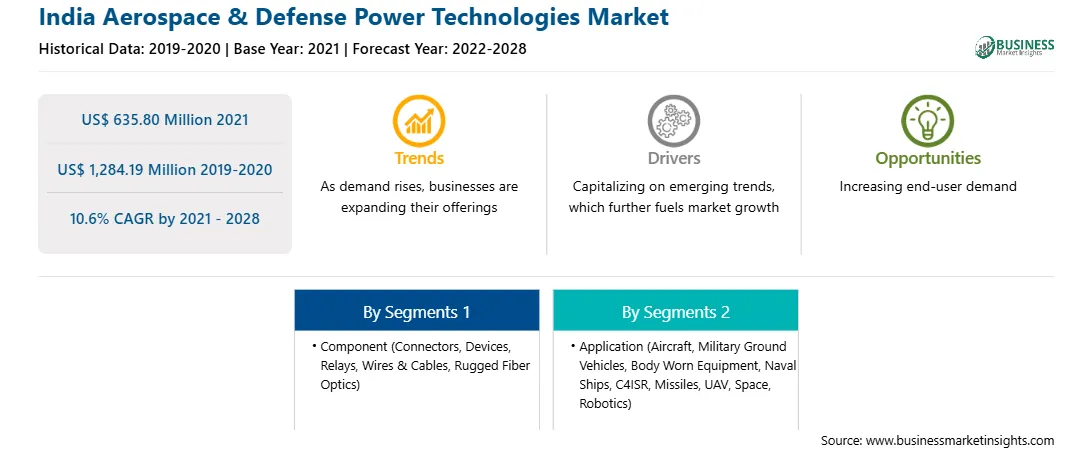

The India aerospace & defense power technologies market is projected to reach US$ 1,284.19 million by 2028 from US$ 635.80 million in 2021; it is estimated to grow at a CAGR of 10.6% from 2021 to 2028.

The Indian military bases have been targets for various enemies over the years, owing to which the defense authorities emphasize on reinforcing the defense operations with advanced systems procured from various local/indigenous and international manufacturers. Jamming systems enable safer and smoother maneuver of military operations, along with safeguarding the military bases. The year-on-year growth in defense budgets and expenditure is encouraging jamming system manufacturers such as Thales Group, Zen Technologies, and Gurutvaa Systems to cater effectively to the Indian forces. In the recent years, drone attacks on the Indian defense bases have risen considerably. In mid-2021, an air force base in Jammu encountered a drone attack. Such attacks are compelling the government to roll out contracts for various drone jamming technologies. Moreover, according to a senior defense official, following the incident, the defense authorities are procuring jammers in large numbers and expanding the range of the existing jammers to protect large military bases in forward areas from drone attacks. The Indian Air Force (IAF) awarded a contract, worth ~US$ 20.17 million (INR 150 crore), to Zen Technologies for an anti-drone system. Similarly, another Indian company, Gurutvaa Systems will be supplying drone jammer guns, worth US$ 1.08 million (INR 8 crore), to the IAF. An increase in the adoption of jamming systems is likely to create lucrative opportunities for various aerospace & defense power technologies market players in the coming years.

Impact of COVID-19 Pandemic on India Aerospace & Defense Power Technologies Market

The COVID-19 pandemic has severely impacted India due to wide disease spread; The country is one of the highly populated countries in the world, which led to massive spread of the virus. The rapid outbreak of the COVID-19 pandemic has led to strict lockdowns across the country since the March 2020. The result of lockdown had a severe impact on the aerospace & defense manufacturing sector as well as commercial aviation sector.

Manufacturing restrictions imposed by the Indian government to combat the spread of the virus has negatively impacted the growth of the aerospace & defense power technologies market. The Indian government have also taken several initiatives to revive the industry from the adverse impact such as the government and the RBI have announced financial support measures to ease the financial load across the industry to ensure availability of working capital. The production and MRO projects undertaken by the Indian aerospace and defense industry coupled with the high government initiatives is expected to increase ethe demand for various components such as connectors, devices, relays and wiring and cables for the aerospace and defense industry thereby expected to propel the growth of the market.

Key Market Segments

Based on component, the India aerospace & defense power technologies market is segmented into connectors, devices, relays, wire & cable, and rugged fiber optics (RFO). The devices segment held a larger market share in 2020. On the basis of application, the India aerospace & defense power technologies market is segmented into aircraft, military ground vehicles, body-worn equipment (Soldiers), naval ships, C4ISR, missiles, UAV, space, and robotics. The military ground vehicles segment a larger market share in 2020.

Major Sources and Companies Listed

The major companies operating in the India aerospace & defense power technologies market are TE Connectivity, Thales Group, Eaton Group, Amphenol Interconnect India Pvt Ltd., C&K, AXON' MECHATRONICS S.A.S., Hitech India Private Limited, Positronic, VMX Connectors Private Limited, Sanghvi Aerospace Pvt. Ltd., Miracle Electronics Devices Pvt Ltd., PREMIER AUTO CABLES, FIRST SWITCHTECH, ITT Inc., Teledyne Defense Electronics, Jayant Group, ALPHA DESIGN TECHNOLOGIES PVT LTD, Mistral Solutions Pvt. Ltd., Phantom Technologies LTD, and Radiall. Various other companies operating in the market are also coming up with new technologies and innovative offerings, thereby contributing to the market growth.

Reasons to Buy Report

India Aerospace & Defense Power Technologies Market Segmentation

By Component

By

Application

India Aerospace & Defense Power Technologies Market - Companies Mentioned

The List of Companies - India Aerospace & Defense Power Technologies

The India Aerospace & Defense Power Technologies Market is valued at US$ 635.80 Million in 2021, it is projected to reach US$ 1,284.19 Million by 2028.

As per our report India Aerospace & Defense Power Technologies Market, the market size is valued at US$ 635.80 Million in 2021, projecting it to reach US$ 1,284.19 Million by 2028. This translates to a CAGR of approximately 10.6% during the forecast period.

The India Aerospace & Defense Power Technologies Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the India Aerospace & Defense Power Technologies Market report:

The India Aerospace & Defense Power Technologies Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The India Aerospace & Defense Power Technologies Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the India Aerospace & Defense Power Technologies Market value chain can benefit from the information contained in a comprehensive market report.