Heavy Construction Equipment Market Report (2021–2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 150 | Report Code: BMIRE00031135 | Category: Manufacturing and Construction

No. of Pages: 150 | Report Code: BMIRE00031135 | Category: Manufacturing and Construction

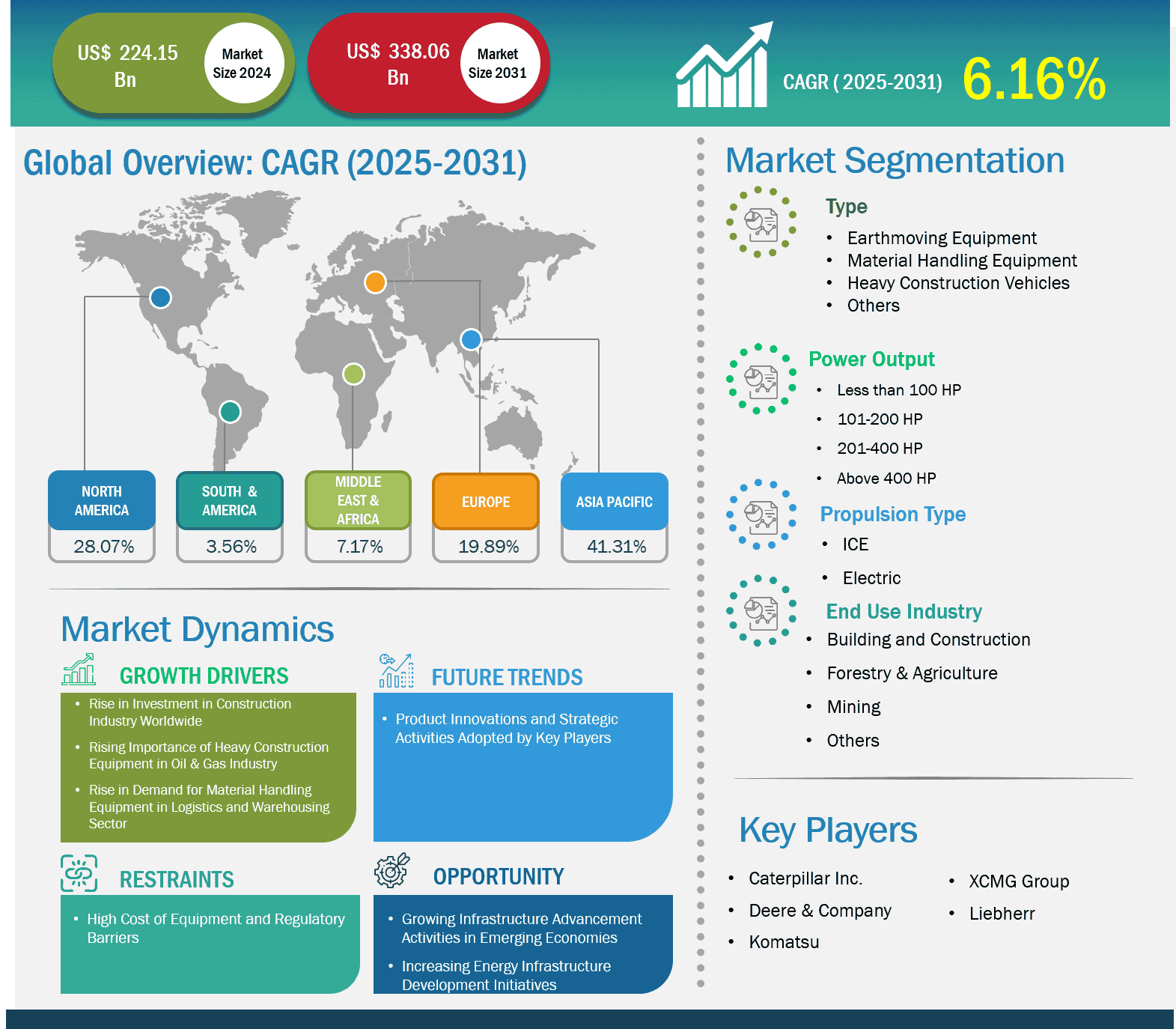

The Heavy Construction Equipment Market size is expected to reach US$ 338.06 billion by 2031 from US$ 224.15 billion in 2024. The market is estimated to record a CAGR of 6.05% from 2023 to 2031.

Heavy construction equipment refers to large machinery and vehicles used in construction projects to carry out tasks such as excavation, lifting, material handling, and demolition. These machines are essential for large-scale construction and civil engineering projects, providing efficiency and productivity on job sites. The increasing government funding projects in transportation, renewable energy, and public infrastructure sectors across developing countries such as India, Mexico, and Brazil drive the demand for heavy construction equipment. According to the World Bank, per year, more than US$ 3.7 trillion is invested in infrastructure development to meet the growing demand of growing global populations. The rise in global investments in the clean energy sector is also a major driving factor for the heavy construction equipment market. According to the International Energy Agency, more than US$ 3 trillion invested in 2024 for clean energy related infrastructure developments across the globe.

Key segments that contributed to the derivation of the Heavy Construction Equipment market analysis are type and application.

Rise in Investment in Construction Industry Worldwide

The construction industry is growing rapidly in various countries across the globe, with a rise in government investments and an increase in demand for various construction projects. Countries such as the US, China, Mexico, Brazil, and India have the most significant construction businesses in the world. According to the Associated General Contractors of America (AGC), the US construction industry is growing with an investment of ~US$ 1.4 trillion per year. A surge in construction activities in the country, along with the increasing population and the proliferating commercial sector, drives the heavy construction equipment market growth. The global demand for the long-term construction sector is growing rapidly owing to the increasing government investment in infrastructure development. For instance, ~US$ 1.2 trillion in funding was passed by the Bipartisan Infrastructure Law in the US, and US$ 828.8 billion was passed by the EU infrastructure development fund in Europe.

In Asia Pacific, the rising population is putting a strain on current infrastructure, highlighting the need for the development of new rail networks, residential structures, and roadways. The construction industry in Asia Pacific was valued at US$ 4.36 trillion in 2022, which represents 45% of the overall global construction industry. The investment is mostly in countries such as India, Japan, Australia, Singapore, Malaysia, and China. The governments and regulatory bodies in countries in this region are focusing on additional infrastructure investments which is proliferating the demand for heavy construction equipment.

Growing Infrastructure Advancement Activities in Emerging Economies

Argentina, Brazil, China, India, Indonesia, Mexico, Poland, South Africa, South Korea, Turkey, Egypt, Iran, Nigeria, Pakistan, Russia, Saudi Arabia, Taiwan, and Thailand are the notable emerging economies implementing major construction and infrastructure activities. In Argentina, the Riachuelo water system, Salado River waterworks, stage IV, National Route 7 Lujan-Junín stretch, National Route 9, and San Miguel de Tucumán-Santiago del Estero stretch are a few of the major infrastructure projects. The governments of China and India are also taking various initiatives to strengthen their construction and infrastructure industries. Various active projects in China include the Hong Kong-Zhuhai-Macau Bridge, Shanghai Tower, Beijing Subway Metro Network, the Giant Wind Turbines, and the Super LNG Tanker. In Europe, Evora Public Central Hospital, Edge East Side Tower, Baltic Offshore Pipeline, Flamanville 3, and Crossrail are among the ongoing construction projects contributing to the demand for heavy construction equipment. Such infrastructure and construction initiatives taken by the governments of various emerging economies worldwide are likely to provide lucrative growth opportunities to the heavy construction equipment market.

Based on type, the global heavy construction equipment market is bifurcated into earthmoving equipment, material handling equipment, heavy construction vehicles, others. The earthmoving equipment segment registered a larger market share in 2024 and is expected to dominate during the forecast period. Earthmoving equipment include excavators, bulldozers, backhoe loaders, and wheel loaders. The increasing investment in infrastructure development projects worldwide is a major driving factor for this segmental growth. Germany's Federal Transport Infrastructure Plan 2030 includes an investment of US$ 280.68 billion between 2016 and 2030 on transportation-related infrastructure. Also, the German government committed US$ 59.34 billion for the green infrastructure projects in 2024. Such an increase in the investment for infrastructure development is a major driving factor for the earth moving equipment market. Several major players in the market are launching advanced electric earthmoving equipment. For instance, in September 2024, Volvo Construction Equipment launched the next electric L120 Electric wheel loader machine in Indonesia. The new electric wheel loader machine was launched at the Mining Indonesia event and will be made available for purchase in 2025.

Based on propulsion type, the global heavy construction equipment market is segmented into ICE and electric. The ICE segment dominated the market for vehicle type in 2024. ICE includes vehicle powered by diesel and gasoline. Diesel heavy construction equipment are a category of machines powered by diesel engines, used extensively in the construction industry for tasks that require significant power and heavy lifting. These vehicles play a crucial role in building infrastructure, from roads and bridges to buildings and industrial facilities. Diesel-powered heavy construction equipment include excavators, backhoe loaders, dump trucks, wheel loaders, cranes, and others. Diesel engines are generally more fuel-efficient than gasoline engines, especially in heavy-duty applications, reducing operational costs. Diesel-powered equipment are widely available, and they have a proven infrastructure, making it easier for construction projects to maintain their fleets.

Heavy Construction Equipment Market Report Highlights

Report Attribute

Details

Market size in 2024

US$ 224.15 Billion

Market Size by 2031

US$ 338.06 Billion

Global CAGR (2025 - 2031)

6.05%

Historical Data

2022-2023

Forecast period

2025-2031

Segments Covered

By Heavy Construction Equipment Market

By Machinery Type

By Propulsion Type

By Power Output

Regions and Countries Covered

North America

Heavy Construction Equipment Market Report Coverage and Deliverables

The "Heavy Construction Equipment Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

Heavy Construction Equipment Market Country and Regional Insights

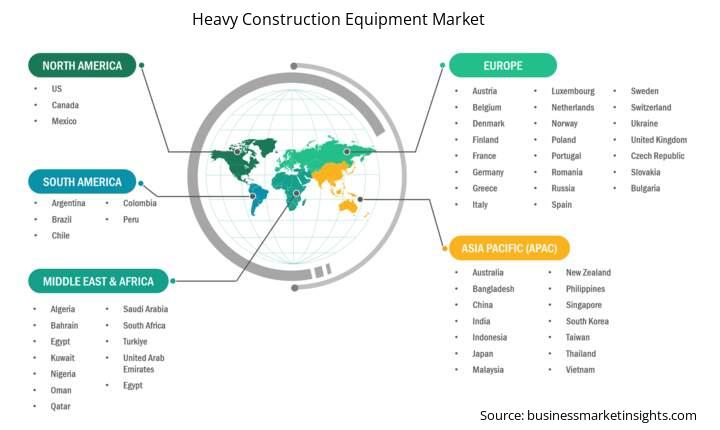

The geographic scope of the Heavy Construction Equipment market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The Heavy Construction Equipment market in Asia Pacific is expected to grow significantly during the forecast period.

The heavy construction equipment market in Asia Pacific is segmented into Australia, China, India, Japan, South Korea, Indonesia, Singapore, Malaysia, the Philippines, Vietnam, and the Rest of Asia Pacific. The construction sector in Asia Pacific recorded ~US$ 4.36 trillion of output in 2022, representing approximately 45% of the global construction sector. However, in January 2025, infrastructure investments related to transportation, renewable energy, and manufacturing reached US$ 21.9 billion in Singapore and Malaysia. Further, the government of New Zealand is emphasizing the development of infrastructure networks such as water and wastewater systems, road and rail networks, electricity transmission, and telecommunication infrastructure. Growing population and increasing urbanization are a few factors boosting the need to expand and upgrade important infrastructure facilities in the country. The government of New Zealand plans to offer ~US$ 47 billion for infrastructure development over the coming five years 2023-2027. The growing focus on infrastructure development is anticipated to propel the growth of construction activities, along with the application of heavy construction equipment, across the country in the coming years.

Heavy Construction Equipment Market Research Report Guidance

The Heavy Construction Equipment market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the Heavy Construction Equipment market are:

The Heavy Construction Equipment Market is valued at US$ 224.15 Billion in 2024, it is projected to reach US$ 338.06 Billion by 2031.

As per our report Heavy Construction Equipment Market, the market size is valued at US$ 224.15 Billion in 2024, projecting it to reach US$ 338.06 Billion by 2031. This translates to a CAGR of approximately 6.05% during the forecast period.

The Heavy Construction Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Heavy Construction Equipment Market report:

The Heavy Construction Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Heavy Construction Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Heavy Construction Equipment Market value chain can benefit from the information contained in a comprehensive market report.