Germany PropTech Market Forecast to 2028 - COVID-19 Impact and Country Analysis By Offerings (Solution and Services), Component (Security and Surveillance, Asset Management, Sales and Advertisement, and Others), and Building Type (Residential and Non-residential)

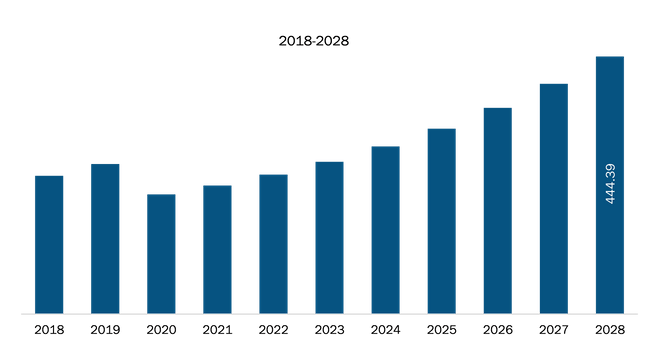

The Germany PropTech market is expected to reach US$ 444.39 million by 2028 from US$ 206.30 million in 2020. The market is estimated to grow at a CAGR of 10.4% from 2021 to 2028.

Property technology (PropTech) is an innovative approach adopted by different end users to search, rent, buy, or manage properties. PropTech products for property management applications use IoT tools such as cameras, sensors, and wireless components for controlling the heating, ventilation, and air conditioning (HVAC) systems; lighting systems; utility lines; and access points. Owing to the growing cost of energy and concerns regarding the environment, facility operators are actively seeking for solutions such as energy management and IoT tools that help them curtail the cost of building utilities by enabling a remote control for utilities. Further, monitoring facilities with the use of sensors and cameras, and energy management systems can automatically optimize the lighting and air-conditioning consumption as well as costs. Moreover, such tools eliminate the need of manual workers for performing such maintenance tasks, further cutting down the operating costs. Thus, the increasing energy costs and growing environmental concerns boost the PropTech market growth.

Germany comprises more than 500 companies operating in the PropTech market with an investment of more than US $ 340 million. One of the crucial factors influencing the strong growth rate of the market in Germany is that the strong inclination toward the adoption of new technologies to improve the overall standard of living. The adoption of smart home system in Germany has risen from 2 million in 2016 to 6.6 million in 2020 and is expected to reach 9.3 million by 2022. Such rising adoptions are subsequently fueling the growth of the PropTech market in Germany. Moreover, the government has a strong inclination for improving the urban infrastructure.

Germany is a home to the most active backers of PropTech start-ups. As remote working is continuing and employees are no longer needed to go to office, they are moving outside urban areas and finding some suburban place for more greenery and space, and cheaper rents. Working remotely has made nomadic living trendy. It can also be seen that start-ups in this market are strengthening. For instance, Flatio announced that it is merged with NomadX. Both platforms experienced strong signs of growth and development between COVID 19 pandemic. Interest in co-living spaces is increasing. People who usually prefer to stay on their own are deciding to live in co-living spaces to overcome social isolation and loneliness.

Germany PropTech Market Revenue and Forecast to 2028 (US$ Million)

Get more information on this report :

Germany PropTech Market Segmentation

Germany PropTech Market – by Offerings

- Solution

- Services

Germany PropTech Market – by Component

- Security and Surveillance

- Asset Management

- Sales and Advertisement

- Others

Germany PropTech Market – by Building Type

- Residential

- Non-residential

Germany PropTech Market - Companies Mentioned

- ALPHAPENTA

- BETTERHOMES AG

- BOTTIMMO AG

- HAUSGOLD

- Homeday GmbH

- immoverkauf24 GmbH

- Maklaro.de

- McMakler GmbH

- PriceHubble

- realbest Germany GmbH

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Germany PropTech Market Landscape

4.1 Market Overview

4.1.1 Germany – PEST Analysis

4.2 Ecosystem Analysis

4.3 Expert Opinion

5. Germany PropTech Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Rising Awareness About Need of Energy Conservation

5.1.2 Use of Augmented Reality and Virtual Reality in Marketing Activities

5.2 Market Restraints

5.2.1 High Prices and Disrupted Supply of Raw Materials

5.3 Market Opportunities

5.3.1 Use of Big Data in Real Estate Sector

5.4 Future Trends

5.4.1 Emergence of Smart Cities

5.5 Impact Analysis of Drivers and Restraints

6. PropTech – Germany Market Analysis

6.1 Germany PropTech Market Overview

6.2 Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

6.3 Market Positioning – Germany Market Players Ranking

7. Germany PropTech Market Analysis – By Offerings

7.1 Overview

7.2 Germany PropTech Market, By Offerings (2020 and 2028)

7.3 Solution

7.3.1 Overview

7.3.2 Solution: Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

7.4 Services

7.4.1 Overview

7.4.2 Services: Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

8. Germany PropTech Market Analysis – By Component

8.1 Overview

8.2 Germany PropTech Market, By Component (2020 and 2028)

8.3 Security and Surveillance

8.3.1 Overview

8.3.2 Security and Surveillance: Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

8.4 Asset Management

8.4.1 Overview

8.4.2 Asset Management: Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

8.5 Sales and Advertisement

8.5.1 Overview

8.5.2 Sales and Advertisement: Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

8.6 Others

8.6.1 Overview

8.6.2 Others: Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

9. Germany PropTech Market Analysis – By Building Type

9.1 Overview

9.2 Germany PropTech Market, By Building Type (2020 and 2028)

9.3 Residential

9.3.1 Overview

9.3.2 Residential: Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

9.4 Non-residential

9.4.1 Overview

9.4.2 Non-residential: Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

10. Germany PropTech Market- COVID-19 Impact Analysis

10.1 Overview

11. Industry Landscape

11.1 Market Initiative

11.2 New Development

12. Company Profiles

12.1 ALPHAPENTA

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 BETTERHOMES AG

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 BOTTIMMO AG

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 HAUSGOLD

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Homeday GmbH

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 immoverkauf24 GmbH

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Maklaro.de

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 McMakler GmbH

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 PriceHubble

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 realbest Germany GmbH

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Word Index

LIST OF TABLES

Table 1. Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

Table 2. List of Abbreviation

LIST OF FIGURES

Figure 1. Germany PropTech Market Segmentation

Figure 2. Germany PropTech Market Overview

Figure 3. Solutions Offerings to Dominate the Germany PropTech Market

Figure 4. Asset Management Component to Dominate the Germany PropTech Market

Figure 5. Residential Building Type to Dominate the Germany PropTech Market

Figure 6. Germany – PEST Analysis

Figure 7. Germany PropTech Market – Ecosystem Analysis

Figure 8. Expert Opinion

Figure 9. PropTech Market Impact Analysis of Drivers and Restraints

Figure 10. Germany: PropTech Market – Revenue and Forecast to 2028 (US$ Million)

Figure 11. Germany PropTech Market Revenue Share, by Offerings (2020 and 2028)

Figure 12. Solution: Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 13. Services: Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 14. Germany PropTech Market Revenue Share, by Component (2020 and 2028)

Figure 15. Security and Surveillance: Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 16. Asset Management: Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 17. Sales and Advertisement: Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 18. Others: Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 19. Germany PropTech Market Revenue Share, by Building Type (2020 and 2028)

Figure 20. Residential: Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 21. Non-residential: Germany PropTech Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 22. Impact of COVID-19 Pandemic on Germany PropTech Market

The List of Companies - Germany PropTech Market

- ALPHAPENTA

- BETTERHOMES AG

- BOTTIMMO AG

- HAUSGOLD

- Homeday GmbH

- immoverkauf24 GmbH

- Maklaro.de

- McMakler GmbH

- PriceHubble

- realbest Germany GmbH

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the Germany PropTech market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Germany PropTech market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Germany market trends and outlook coupled with the factors driving the market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution