GCC Last Mile Delivery Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 150 | Report Code: BMIRE00031258 | Category: Automotive and Transportation

No. of Pages: 150 | Report Code: BMIRE00031258 | Category: Automotive and Transportation

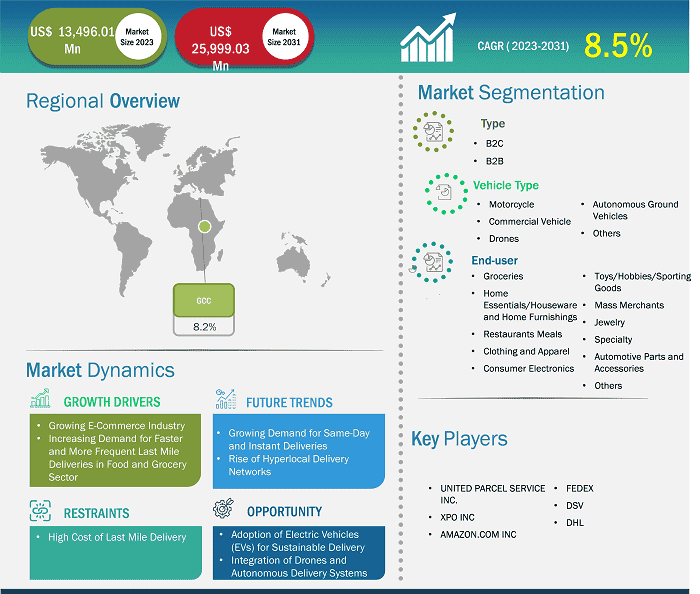

The GCC last mile delivery market size is expected to reach US$ 13,496.01 million by 2031 from US$ 25,999.03 million in 2023. The market is estimated to record a CAGR of 8.5% from 2023 to 2031.

The UAE's last-mile delivery market is driven by e-commerce growth, technological innovations, rapid urbanization, and evolving consumer preferences. Stakeholders in this market must remain agile and forward-thinking to capitalize on the evolving dynamics and meet the expectations of the modern consumer. The last-mile delivery market in the UAE is expected to continue growing owing to the increasing adoption of AI, machine learning, and automation, which will help businesses optimize their operations and improve customer satisfaction. Companies that can effectively integrate sustainability and technological innovations into their delivery models will have a competitive edge in the coming years.

As the UAE continues to focus on becoming a global logistics hub, investment in infrastructure, both physical (e.g., warehouses and transportation networks) and digital (e.g., real-time tracking systems), will continue to shape the market landscape. The UAE's ability to maintain its role as a regional and global logistics leader depends on the country's effectiveness in addressing challenges such as traffic congestion, regulatory complexities, and environmental sustainability. With a strategic focus on digital transformation, sustainability, and customer-centric delivery solutions, the UAE is positioning itself as a leader in the Middle East's logistics ecosystem.

Key segments that contributed to the derivation of the last-mile delivery market analysis are type and application.

Bahrain has experienced significant growth in its logistics and e-commerce sectors in recent years. As Bahrain's digital economy grows, fueled by the rise of e-commerce and technological innovations, the demand for efficient, fast, and reliable last-mile delivery services is increasing. Bahrain's strategic location as a gateway to the Gulf region, combined with its business-friendly policies and strong digital infrastructure, has made it a hub for both local and international e-commerce players. With a population of ~1.7 million and a high internet penetration rate, the demand for e-commerce and associated logistics services has surged in recent years.

The last-mile delivery market in Bahrain is becoming increasingly competitive as various players, including traditional logistics providers, third-party logistics (3PL) companies, tech startups, and established e-commerce giants, are witnessing the growing demand for rapid and cost-effective delivery services. The rise of e-commerce platforms has led to the emergence of delivery as a Service (DaaS), where third-party logistics providers offer comprehensive solutions for last-mile deliveries. A few of these services are warehousing, inventory management, order fulfillment, and delivery, which help businesses outsource their entire delivery process while focusing on core competencies.

Saudi Arabia, the largest and most populous country in the Middle East, is emerging as a significant player in the logistics and e-commerce sectors. With a rapidly growing economy, a young and tech-savvy population, and a government committed to economic diversification, the last-mile delivery market in Saudi Arabia is undergoing substantial transformation. The rise of e-commerce, the shift in consumer behavior, and technological advancements are propelling the growth of last-mile delivery services in the country.

The last-mile delivery market in Saudi Arabia has been significantly shaped by the country's ambitious economic plans, including Vision 2030. This initiative aims to diversify the economy away from oil dependence and establish the country as a global logistics hub. Saudi Arabia's Vision 2030 seeks to diversify the economy, modernize infrastructure, and boost the logistics sector. The well-developed road infrastructure, advanced telecommunications networks, and an expanding e-commerce ecosystem have made Saudi Arabia an attractive market for both domestic and international logistics companies.

The Saudi government has introduced several reforms to improve the ease of conducting business and support logistics-related sectors. This includes investments in transport infrastructure, such as ports, airports, and roads, as well as initiatives to promote digital transformation and sustainability. Additionally, the Saudi Postal Corporation (Saudi Post) is actively developing its logistics capabilities, facilitating improved last-mile delivery services across the country.

Saudi Arabia is experiencing rapid urbanization, with cities such as Riyadh, Jeddah, and Dammam becoming more densely populated. This urban growth increases the demand for last-mile delivery services, particularly in metropolitan areas where the population is concentrated, and delivery times need to be fast and efficient. Additionally, Saudi Arabia's young population, with a median age of ~31 years, is increasingly tech-savvy and prefers shopping online; this factor fuels the demand for efficient last-mile delivery services.

Based on Geography, the GCC last mile delivery market comprises UAE, Saudi Arabia, Qatar, Oman, Bahrain, and Kuwait. Among these, Saudi Arabia has the largest share in 2023, and this is owing to increased online shopping trends with the surge in consumer spending in the e-commerce industry.

One of the major driving factors for the growth of the last-mile delivery market in Qatar is the increasing consumer demand for faster, more convenient delivery options. Consumers prefer same-day or next-day delivery, especially for e-commerce transactions. As a result, logistics companies have been investing in technology and operations that enable them to meet these high expectations. Businesses are experimenting with various delivery models, such as "click-and-collect," where customers order online but pick up their items from a local store, or hybrid models combining traditional delivery with locker systems. However, traffic congestion and limited access in urban areas are one of the major challenges in the last mile delivery market in Qatar. Although the Qatar government has made considerable progress in improving its infrastructure, traffic congestion remains a challenge, particularly in the capital city, Doha. Traffic delays and roadblocks often disrupt delivery schedules, especially during peak hours or in densely populated areas. Moreover, the limited access to a few residential complexes, compounded by the rapid pace of urban development, can cause inefficiencies in delivery routes. Companies that can leverage technological advancements, enhance sustainability efforts, and adapt to changing consumer expectations will be well-positioned to succeed in this rapidly evolving market.

The last-mile delivery market in Kuwait has witnessed significant growth in recent years, primarily driven by such as urbanization, the rise of e-commerce, demand for faster delivery options, the increasing adoption of advanced technologies, and shifting consumer expectations. As a wealthy nation with a growing digital economy, Kuwait presents a unique landscape for logistics and delivery services, making it an attractive market for both local and international logistics providers.

Kuwait's urbanization rate is among the highest in the Gulf Cooperation Council (GCC) region, with the majority of the population residing in the capital city, Kuwait City, and its surrounding areas. The concentration of consumers in urban centers has made last-mile delivery more manageable, although logistical challenges still exist in the more densely populated parts of the city.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 25,999.03 Million |

| Market Size by 2031 | US$ 13,496.01 Million |

| Global CAGR (2025 - 2031) | 8.5% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | GCC

|

Some of the key players operating in the market include DHL Group, UPS, RAK Logistics, FedEx, Emirates Logistics, Shipa Delivery, Saudia Cargo, Aramex, and others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note:

All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The GCC Last Mile Delivery Market is valued at US$ 25,999.03 Million in 2024, it is projected to reach US$ 13,496.01 Million by 2031.

As per our report GCC Last Mile Delivery Market, the market size is valued at US$ 25,999.03 Million in 2024, projecting it to reach US$ 13,496.01 Million by 2031. This translates to a CAGR of approximately 8.5% during the forecast period.

The GCC Last Mile Delivery Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the GCC Last Mile Delivery Market report:

The GCC Last Mile Delivery Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The GCC Last Mile Delivery Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the GCC Last Mile Delivery Market value chain can benefit from the information contained in a comprehensive market report.