GCC Ice Cream Market to 2027 - Regional Analysis and Forecasts By Type (Impulse Ice Cream, Take-Home Ice Cream, and Artisanal Ice Cream); Distribution Channel (Supermarket/Hypermarket, Convenience Store, Specialist Store, and Others) and Country

The GCC ice cream market is accounted to US$ 543.0 Mn in 2018 and is expected to grow at a CAGR of 6.7% during the forecast period 2019 – 2027, to account to US$ 969.1 Mn by 2027.

Most countries in GCC, such as Saudi Arabia, UAE, Kuwait, and Bahrain, have traditionally been oil economies, but in recent years they have started to promote themselves tourist hubs in the Gulf. Therefore, the demand for ice cream has also surged due to increasing tourism in some of the countries such as the UAE and Saudi Arabia. GCC countries enjoy hot sunny days during the most part of the year. Summer is an undisputed season for the consumption of ice cream and related products. The hot climate and sweltering afternoons in the GCC make for a perfect atmosphere to relish frozen desserts and ice creams. This further boosts the ice cream market in GCC.

Get more information on this report : GCC Ice Cream Market, Revenue and Forecast, 2018

Market Insights

Long summers and hot climate conditions are projected to boost the GCC ice cream market over the forecast period

The climate in GCC countries such as Saudi Arabia, UAE, Qatar, and Bahrain, among others, is very hot. The UAE has a desert climate, characterized by pleasantly mild winters and very hot, sunny summers. Summers in the UAE are very hot, and the temperature ranges from 38 °C to 42 °C. Likewise, Saudi Arabia is an extremely dry country, and rainfall is minimal. In summers, the country witnesses blistering heat and humid temperatures thus, making it uncomfortable to get around. The climate of Qatar can be described as a subtropical dry, hot desert climate with low annual rainfall, very high temperatures in summer. The harsh climatic condition results in high demand for cold food and beverages. Therefore, ice-cream remains the favorite frozen dessert in GCC countries such as Saudi Arabia, UAE, Qatar, and Bahrain. A large number of ice-cream manufacturers operating in the GCC ice cream market are focusing on introducing new ice-cream variants in the GCC market. Additionally, the growth of the tourism sector and restaurant businesses in the UAE, Qatar, and Bahrain is also expected to support the growth of the ice-cream market.

Growing demand for gluten- and lactose-free ice-creams provides an opportunity for the ice cream market growth

Lactose is one of the main constituent sugars in dairy milk. Lactose intolerance a condition found in many humans; it is characterized by the inability to digest sugar (lactose) in dairy products fully. It is usually caused by a deficiency of the lactase enzyme due to the inability of the body to synthesize it. The growing rate of lactose intolerances around the world has created a demand for gluten- and lactose-free products, including ice-creams. The rapidly expanding trend of veganism has further driven the market for vegan, lactose- and gluten-free ice-cream varieties made from ingredients that are devoid of animal products, based on other milk substitutes, such as almond milk and coconut milk. People of Arab ethnicity are more prone to lactose and gluten intolerances. The growing incidences of lactose intolerance in the GCC is expected to generate high demand for gluten- and lactose-free ice cream products during the forecast period. These factors lead to surge in demand for gluten- and lactose-free ice cream market.

Type Insights

The GCC ice cream market by type has been categorized in impulse ice cream, take-home ice cream, and artisanal ice cream. The demand for impulse ice cream is rising as they can be readily consumed without the need for portioning or preparation. Impulse Ice Cream includes ice cream products such as ice cream cones, ice cream sandwiches, chocolate-coated ice creams, and single-serve ice cream tubs. Impulse ice cream products such as ice cream cones and ice cream sandwiches are sold in individual packages while the traditional ice cream ball in the wafer is sold without a package. Impulse ice creams segment dominates the ice cream market owing to its high popularity among individuals of all age groups. Impulse ice creams offer the convenience of eating ice cream whenever and wherever one wants.

Distribution Channel Insights

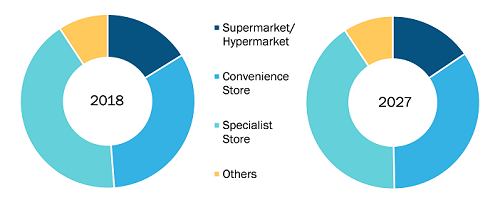

On the basis of the distribution channels, the GCC ice cream market is bifurcated into supermarket/hypermarket, convenience store, specialist store, and others. Under the distribution channel segment, the specialist store is the leading distribution segment in the GCC ice cream market. Specialist stores are shops that cater to a single retail market. Some instances of specialist stores include ice cream shops, pharmacies, book stores camera stores and stationeries. They specialize in sales of just one type of product of the range. Specialist stores have to compete with other types of stores such as grocery stores, department stores, supermarkets, general stores, and variety stores. Since specialty stores are category specialists, they use their buying power to negotiate lower prices, excellent terms and assured timely supply. The growing number of specialist stores selling a wide range of ice cream products is expected to drive the ice cream market in the forecast period.

Get more information on this report : GCC Ice Cream Market by Distribution Channel

Strategic Insights

Mergers & acquisition, strategy and business planning, and new product development were observed as the most adopted strategies in the GCC ice cream market. Few of the recent developments in the GCC ice cream market are listed below:

2019: Mars Incorporated has recently acquired its Dubai subsidiary fully following the new GCC law on foreign ownership.

2019: Mars Wrigley Confectionery expanded the range of its single-serve ice creams by adding of the snicker's dark chocolate and Twix triple chocolate ice cream bars in its range.

2019: The Dubai Multi Commodities Centre (" DMCC "), the licensing authority for the Jumeirah Lakes Towers ("JLT") Free Zone, has witnessed and welcomed Dunkin’ Brands Group, Inc. parent and its two most recognizable brands, Dunkin’ Donuts and Baskin-Robbins

GCC ICE CREAM MARKET SEGMENTATION

By Type

- Impulse Ice Cream

- Take-Home Ice Cream

- Artisanal Ice Cream

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Store

- Specialist Store

- Others

By Country

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Rest of GCC

Company Profiles

- Desert Chill Ice Cream LLC

- Dunkin Brands, Inc.

- General Mills, Inc.

- Maras Turka

- Mini Melts Inc.

- Nestle S.A.

- IFFCO

- Mars, Incorporated

- Graviss Group (Pure Ice Cram Co. LLC)

- Unilever

- Saudi Dairy & Foodstuff Co Ltd

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Ice cream Market, by Product Type

1.3.2 Ice cream Market, by Distribution Channel

1.3.3 Ice cream Market, by Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. GCC Ice Cream Market Landscape

4.1 Market Overview

4.2 Pest Analysis

4.2.1 GCC Ice Cream Market: PEST Analysis

4.3 Expert Opinions

5. GCC Ice Cream Market – Key Market Dynamics

5.1 Key Market Drivers

5.1.1 Long Summers and Hot Climate Conditions

5.1.2 Rising Number Of Cold Storage Facilities And Supermarkets

5.2 Key Market Restraints

5.2.1 Growing Consumer Inclination Toward Healthier Food Options

5.3 Key Market Opportunities:

5.3.1 Growing Demand For Gluten- And Lactose-Free Ice-creams

5.4 Key Future Trends:

5.4.1 Rising Consumer Preference Toward Organic Ice-cream Products

5.5 Impact Analysis

6. Ice Creams – GCC Market Analysis

6.1 GCC Ice Cream Market Overview

6.2 GCC Ice Cream Market Forecast And Analysis

6.3 Market Positioning – Top 5 Players

7. GCC Ice Cream Market Analysis – By Product Type

7.1 Overview

7.2 GCC Ice Cream Market Breakdown, By Product Type, 2018 & 2027

7.3 Impulse Ice Cream

7.3.1 Overview

7.3.2 Impulse Ice Cream Market, Revenue Forecasts to 2027 (US$ Mn)

7.4 Take-Home Ice Cream

7.4.1 Overview

7.4.2 Take-Home Ice Cream Market, Revenue Forecasts to 2027 (US$ Mn)

7.5 Artisanal Ice Cream

7.5.1 Overview

7.5.2 Artisanal Ice Cream Market, Revenue Forecast to 2027 (US$ Mn)

8. GCC Ice Cream Market Analysis – By Distribution Channel

8.1 Overview

8.2 GCC Ice Cream Market Breakdown, By Distribution Channel, 2018 & 2027

8.3 Supermarket or Hypermarket

8.3.1 GCC Supermarket or Hypermarket Market Revenue Forecast to 2027 (US$ Mn)

8.4 Convenience Stores

8.4.1 GCC Convenience Stores Market Revenue Forecast to 2027 (US$ Mn)

8.5 Specialist Store

8.5.1 GCC Specialist Store Market Revenue Forecasts to 2027 (US$ Mn)

8.6 Others

8.6.1 GCC Others Market Revenue Forecasts to 2027 (US$ Mn)

9. GCC Ice cream Market – Country Analysis

9.1 Overview

9.1.1 GCC Ice Cream Market Breakdown, By Country

9.1.1.1 Saudi Arabia Ice Cream Market Revenue Forecasts to 2027 (US$ MN)

9.1.1.1.1 Saudi Arabia Ice Cream Market Breakdown, By Product Type

9.1.1.1.2 Saudi Arabia Ice Cream Market Breakdown, By Distribution Channel

9.1.1.2 UAE Ice Cream Market Revenue Forecasts to 2027 (US$ MN)

9.1.1.2.1 UAE Ice Cream Market Breakdown, By Product Type

9.1.1.2.2 UAE Ice Cream Market Breakdown, By Distribution Channel

9.1.1.3 Qatar Ice Cream Market Revenue Forecasts to 2027 (US$ MN)

9.1.1.3.1 Qatar Ice Cream Market Breakdown, By Product Type

9.1.1.3.2 Qatar Ice Cream Market Breakdown, By Distribution Channel

9.1.1.4 Bahrain Ice Cream Market Revenue Forecasts to 2027 (US$ MN)

9.1.1.4.1 Bahrain Ice Cream Market Breakdown, By Product Type

9.1.1.4.2 Bahrain Ice Cream Market Breakdown, By Distribution Channel

9.1.1.5 Rest of GCC Ice Cream Market Revenue Forecasts to 2027 (US$ MN)

9.1.1.5.1 Rest of GCC Ice Cream Market Breakdown, By Product Type

9.1.1.5.2 Rest of GCC Ice Cream Market Breakdown, By Distribution Channel

10. Industry Landscape

10.1 Merger & Acquisition

10.2 Product news

10.3 Strategy And Business Planning

11. Ice Cream Market: Key Company Profiles

11.1 Desert Chill Ice Cream LLC

11.1.1 Key Facts

11.1.2 Business Description

11.1.1 Products and Services

11.1.2 Financial Overview

11.1.3 SWOT Analysis

11.1.4 Key Developments

11.2 Dunkin Brands, Inc.

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 General Mills, Inc.

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.4 Maras Turka

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.5 Mini Melts Inc.

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 Nestle S.A.

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products And Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.7 IFFCO

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Products and Services

11.7.4 Financial Overview

11.7.5 SWOT Analysis

11.8 Mars, Incorporated

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Products and Services

11.8.4 Financial Overview

11.8.5 SWOT Analysis

11.8.6 Key Developments

11.9 Graviss Group (Pure Ice Cram Co. LLC)

11.9.1 Key Facts

11.9.2 Business Description

11.9.3 Products and Services

11.9.4 Financial Overview

11.9.5 SWOT Analysis

11.10 Unilever

11.10.1 Key Facts

11.10.2 Business Description

11.10.3 Products and Services

11.10.4 Financial Overview

11.10.5 SWOT Analysis

11.10.6 Key Developments

11.11 Saudi Dairy & Foodstuff Co Ltd

11.11.1 Key Facts

11.11.2 Business Description

11.11.3 Products and Services

11.11.4 Financial Overview

11.11.5 SWOT Analysis

11.11.6 Key Developments

12. Appendix

12.1 About The Insight Partners

12.2 Glossary Of Terms

LIST OF TABLES

Table 1. GCC Ice Cream Market Revenue And Forecasts To 2027 (US$ Mn)

Table 2. Saudi Arabia Ice Cream Market Revenue and Forecasts to 2027 – By Product Type (US$ Mn)

Table 3. Saudi Arabia Ice Cream Market Revenue and Forecasts to 2027 – By Distribution Channel (US$ Mn)

Table 4. UAE Ice Cream Market Revenue and Forecasts to 2027 – By Product Type (US$ Mn)

Table 5. UAE Ice Cream Market Revenue and Forecasts to 2027 – By Distribution Channel (US$ Mn)

Table 6. Qatar Ice Cream Market Revenue and Forecasts to 2027 – By Product Type (US$ Mn)

Table 7. Qatar Ice Cream Market Revenue and Forecasts to 2027 – By Distribution Channel (US$ Mn)

Table 8. Bahrain Ice Cream Market Revenue and Forecasts to 2027 – By Product Type (US$ Mn)

Table 9. Bahrain Ice Cream Market Revenue and Forecasts to 2027 – By Distribution Channel (US$ Mn)

Table 10. Rest of GCC Ice Cream Market Revenue and Forecasts to 2027 – By Product Type (US$ Mn)

Table 11. Rest of GCC Ice Cream Market Revenue and Forecasts to 2027 – By Distribution Channel (US$ Mn)

Table 12. Glossary Of Term: Ice Cream Market

LIST OF FIGURES

Figure 1. Ice cream Market Segmentation

Figure 2. Ice Cream Market Segmentation – By Country

Figure 3. Ice cream Market Overview

Figure 4. Impulse Ice Cream Held Largest Share of Ice Cream Market in 2018

Figure 5. Saudi Arabia Held Largest Share of Ice Cream Market in 2018

Figure 6. Ice cream Industry Landscape

Figure 7. GCC – PEST Analysis

Figure 8. Expert Opinion

Figure 9. Impact Analysis of Drivers And Restraints

Figure 10. Ice Cream Market Forecast And Analysis, (US$ Mn)

Figure 11. GCC Ice Cream Market Breakdown, By Product Type, in Terms of Value, 2018 & 2027 (%)

Figure 12. Impulse Ice Cream Market, Revenue Forecast To 2027 (US$ Mn)

Figure 13. Take-Home Ice Cream Market, Revenue Forecasts To 2027 (US$ Mn)

Figure 14. Artisanal Ice Cream Market, Revenue Forecast To 2027 (US$ Mn)

Figure 15. GCC Ice Cream Market Breakdown By Distribution Channel, Value, 2018 & 2027 (%)

Figure 16. GCC Supermarket or Hypermarket Sales Market Revenue Forecasts To 2027 (US$ Mn)

Figure 17. GCC Convenience Stores Market Revenue Forecasts To 2027 (US$ Mn)

Figure 18. GCC Specialist Store Market Revenue Forecasts To 2027 (US$ Mn)

Figure 19. GCC Others Market Revenue Forecasts To 2027 (US$ Mn)

Figure 20. GCC Ice Cream Market Breakdown, By Country, 2018 & 2027 (%)

Figure 21. Saudi Arabia Ice Cream Market Forecasts to 2027 (US$ MN)

Figure 22. UAE Ice Cream Market Forecasts to 2027 (US$ MN)

Figure 23. Qatar Ice Cream Market Forecasts to 2027 (US$ MN)

Figure 24. Bahrain Ice Cream Market Forecasts to 2027 (US$ MN)

Figure 25. Rest of GCC Ice Cream Market Forecasts to 2027 (US$ MN)

The List of Companies

- Desert Chill Ice Cream LLC

- Dunkin Brands, Inc.

- General Mills, Inc

- Maras Turka

- Mini Melts Inc.

- Nestle S.A.

- IFFCO

- Mars, Incorporated

- Graviss Group (Pure Ice Cream Co. LLC)

- Unilever

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the GCC ice cream market, thereby allowing players to develop effective long term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth GCC market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation and industry verticals.