The technology in woodworking is constantly evolving. Interior door manufacturers are getting lean toward utilizing advanced technology to remain in the race of changing trends. The interior door manufacturers are taking help of CNC machines to process wood products such as MDF, plywood, and wood. Since, CNC machines provide higher productivity and efficiency, the scope of CNC is increasing. Additionally, CNC works smoothly on wood and is capable to create patterns in an easy manner, which is another factor driving the penetration rate of CNC within wooden interior doors. Below mentioned are some of the benefits fueling the CNC wood carving demand:

• Enhance quality and accuracy

• Maximize scalability and productivity

• Decrease labor cost, lower human errors and material waste to 30%.

Traditionally, the manual wooden door relies on human labors and results in low output and high price. Therefore, wooden door manufacturers are using wood carving machine to speed up production and product consistency.

Europe is segmented into Germany, France, Italy, the UK, Russia, Kazakhstan, Belarus, and Uzbekistan. The construction sector has been booming in Europe since 2014, mainly as far as new construction is concerned. The construction industry in Europe plays an important role in the economy, employing about 18 million people in the workforce and contributing to 9% of the total GDP of the European Union. The construction sector creates new residential, industrial, and commercial buildings for Europeans to work and live in, and builds infrastructure, maintains and repairs older structures and buildings. Europe is increasingly involved in initiating various major construction projects, which increases the adoption of wooden interior doors in the European Union. Below is the list of a few major construction projects initiated in Europe during Q1 2022.

• Krampnitz Housing Development (US$ 1,831 million): The project involves the construction of the Krampnitz housing complex to provide living space for 10,000 people.

• Ostendstraße 1–14 Commercial Buildings (US$ 1,293 million): This project aims to meet the growing requirement for office, retail, hotel, and commercial facilities for people in the region.

Such an increase in residential and nonresidential construction projects is further boosting the adoption of wooden interior doors in Europe.

The European Union accounts for approximately 5% of the world’s forests. This is increasing the production volume of roundwood and sawnwood, further boosting the use of wood in the development of doors for commercial and residential sectors. Moreover, Europe’s trade activities in wooden doors are increasing simultaneously. For instance,

• As per Volza’s European Union Export data in December 2022, Europe is the second largest exporter of wooden doors, with 24,180 shipments.

• According to OEC World, the top importers of wooden doors, frames, and thresholds in 2020 were the UK (US$ 291 Million), Germany (US$ 195 M), Norway (US$ 153 M), and Sweden (US$ 153 M).

Thus, huge growth in the construction industry and increase in export and imports across Europe are propelling the growth of the Europe wooden interior doors market.

Strategic insights for the Europe Wooden Interior Doors provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Wooden Interior Doors refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Wooden Interior Doors Strategic Insights

Europe Wooden Interior Doors Report Scope

Report Attribute

Details

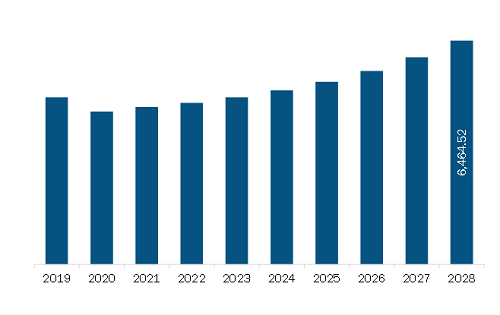

Market size in 2022

US$ 4,664.19 Million

Market Size by 2028

US$ 6,464.52 Million

Global CAGR (2022 - 2028)

5.6%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By Mechanism

By End User

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Wooden Interior Doors Regional Insights

Europe Wooden Interior Doors Market Segmentation

The Europe wooden interior doors market is segmented into type, mechanism, end-user, and country.

Based on type, the Europe wooden interior doors market is segmented into panel door, bypass door, bifold door, pocket door, and others. The panel door segment held the largest share of the Europe wooden interior doors market in 2022.

Based on mechanism, the Europe wooden interior doors market is segmented into swinging, sliding, folding, and others. The swinging segment held the largest share of the Europe wooden interior doors market in 2022.

Based on end-user, the Europe wooden interior doors market is segmented into residential and non-residential. The residential segment held the larger share of the Europe wooden interior doors market in 2022.

Based on country, the Europe wooden interior doors market is segmented into Germany, France, Italy, the UK, Russia, Kazakhstan, Belarus, Uzbekistan, and the Rest of Europe. The Rest of Europe dominated the share of the Europe wooden interior doors market in 2022.

Concept SGA Inc; JELD-WEN Holding Inc; Masonite International Corp; Puertas Salmar SA; and Puertas Sanrafael SA are the leading companies operating in the Europe wooden interior doors market.

The Europe Wooden Interior Doors Market is valued at US$ 4,664.19 Million in 2022, it is projected to reach US$ 6,464.52 Million by 2028.

As per our report Europe Wooden Interior Doors Market, the market size is valued at US$ 4,664.19 Million in 2022, projecting it to reach US$ 6,464.52 Million by 2028. This translates to a CAGR of approximately 5.6% during the forecast period.

The Europe Wooden Interior Doors Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Wooden Interior Doors Market report:

The Europe Wooden Interior Doors Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Wooden Interior Doors Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Wooden Interior Doors Market value chain can benefit from the information contained in a comprehensive market report.