Europe Wind Turbine Composites Market

No. of Pages: 114 | Report Code: BMIRE00030219 | Category: Chemicals and Materials

No. of Pages: 114 | Report Code: BMIRE00030219 | Category: Chemicals and Materials

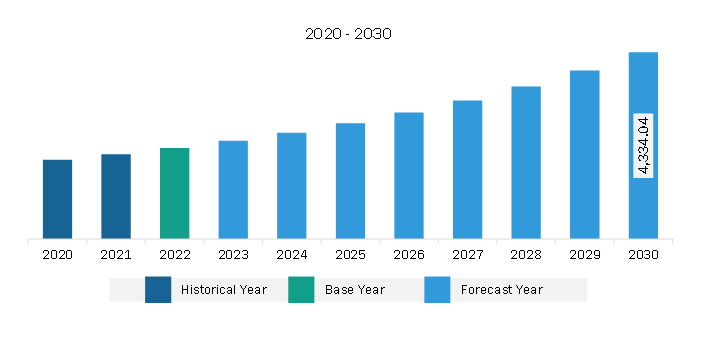

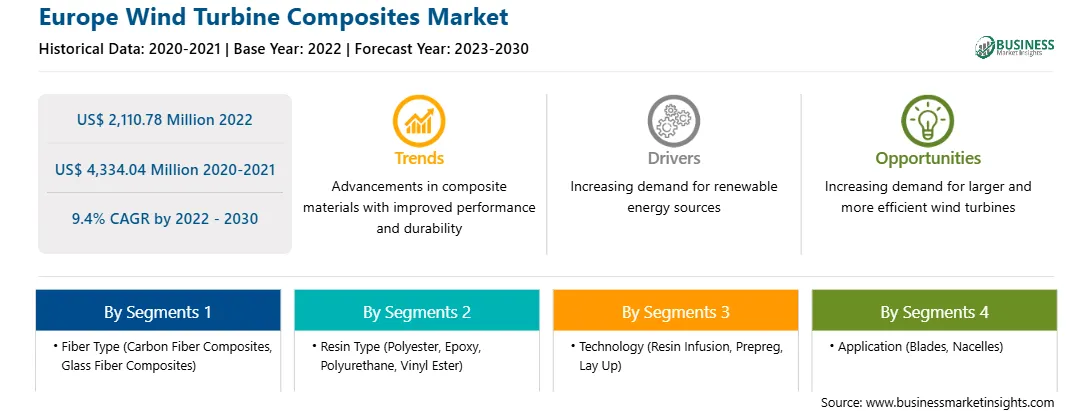

The Europe wind turbine composites market was valued at US$ 2,110.78 million in 2022 and is expected to reach US$ 4,334.04 million by 2030; it is estimated to grow at a CAGR of 9.4% from 2022 to 2030.

Wind power is considered a clean and renewable energy source that provides electricity without burning fuel or polluting the air. Wind energy helps reduce reliance on fossil fuels. Hence, there is an increasing interest in wind energy among various countries, which has resulted in rapid growth in their installed wind capacity. In 2020, new installations in the onshore wind farms reached 86.9 GW, while the offshore wind farms reached 6.1 GW, making 2020 the highest and the second-highest year in history for new wind installations for onshore and offshore, respectively. Europe witnessed record onshore wind installations in 2022, which helped boost the region’s share in new wind power capacity addition from 19% in 2021 to 25% in 2022. In Europe, in 2022, new wind installations amounted to 19.1 GW (16.7 GW onshore and 2.5 GW offshore). Furthermore, 87% of the new wind installations in Europe in 2022 were onshore wind. Germany, Sweden, and Finland were significant contributors to the construction of onshore wind farms. Approximately half the offshore installations were in the UK. Also, France installed its first large offshore wind farm. Wind turbine composites are the materials that are utilized in the production of equipment such as blades and nacelles. These materials include fiber and matrix, which provide resilience and high tensile strength. Glass fiber-reinforced plastics (GRP) have been the most commonly used composite material in the wind turbine industry. The growing demand for wind turbine composites can be attributed to the installation of new wind turbines in offshore and onshore projects due to increasing governmental focus on renewable energy forms. The increasing capacity of wind farms and a surge in the number of wind farm projects across the globe are boosting the need for wind turbines, fueling the demand for wind turbine composites.

The Europe wind turbine composites market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe (Sweden, Finland, etc.). Various countries in the region are harnessing technological capabilities to achieve their sustainability goals. As seen in the following figure, in 2022, new wind installations in Europe totaled 19.1 GW (16.7 GW onshore and 2.5 GW offshore), recording an increase of 4% compared with 2021. Germany, Sweden, and Finland built the most onshore wind projects in 2022. The UK accounted for almost half the offshore installations. Further, Sweden is making significant investments in the wind energy sector. According to news released in December 2022, the Nordic Investment Bank (NIB) and Kölvallen Vind AB signed a EUR 50.15 million (US$ 54.82 million) loan agreement to construct a 277 MW wind farm in Sweden. According to WindEurope, Europe invested EUR 41 billion (US$ 45.07 billion) in new wind farms in 2021, which included the financing of 25 GW of new capacity. Moreover, the region invested EUR 17 billion (US$ 18.69 billion) in new wind farms in 2022, down from US$ 48.47 million in 2021 and the lowest investment figure since 2009. The European wind industry suffers from higher input costs and supply chain disruptions. Moreover, the Russia–Ukraine war amplified challenges associated with raw material cost volatility and international shipping. As a result, the cost of producing a wind turbine in Europe has increased by up to 40% in the last two years. Thus, investments in the wind energy sector dropped in 2022 across Europe, which hampered the wind turbine composites market in the region.

Strategic insights for the Europe Wind Turbine Composites provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,110.78 Million |

| Market Size by 2030 | US$ 4,334.04 Million |

| Global CAGR (2022 - 2030) | 9.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Fiber Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Wind Turbine Composites refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe wind turbine composites market is segmented based on fiber type

Based on fiber type, the Europe wind turbine composites market is segmented into carbon fiber composites, glass fiber composites, and others. The glass fiber composites segment held a larger share in 2022.

In terms of resin type, the Europe wind turbine composites market is segmented into polyester, epoxy, polyurethane, vinyl ester, and others. The epoxy segment held the largest share in 2022.

Based on technology, the Europe wind turbine composites market is segmented into resin infusion, prepreg, lay up, and others. The resin infusion segment held the largest share in 2022.

By application, the Europe wind turbine composites market is bifurcated into blades and nacelles. The blades segment held a larger share in 2022.

Based on country, the Europe wind turbine composites market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The Rest of Europe dominated the Europe wind turbine composites market in 2022.

Avient Corp, Toray Industries Inc, SGL Carbon SE, Owens Corning, Gurit Holding AG, Covestro AG, Hexion Inc, EPSILON Composite SA, Exel Composites Oyj, and Hexcel Corp are some of the leading companies operating in the Europe wind turbine composites market.

1. Avient Corp

2. Toray Industries Inc

3. SGL Carbon SE - Global

4. Owens Corning

5. Gurit Holding AG

6. Covestro AG

7. Hexion Inc

8. EPSILON Composite SA

9. Exel Composites Oyj

10. Hexcel Corp

The Europe Wind Turbine Composites Market is valued at US$ 2,110.78 Million in 2022, it is projected to reach US$ 4,334.04 Million by 2030.

As per our report Europe Wind Turbine Composites Market, the market size is valued at US$ 2,110.78 Million in 2022, projecting it to reach US$ 4,334.04 Million by 2030. This translates to a CAGR of approximately 9.4% during the forecast period.

The Europe Wind Turbine Composites Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Wind Turbine Composites Market report:

The Europe Wind Turbine Composites Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Wind Turbine Composites Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Wind Turbine Composites Market value chain can benefit from the information contained in a comprehensive market report.