Europe Well Completion Equipment and Services Market

No. of Pages: 137 | Report Code: TIPRE00026081 | Category: Manufacturing and Construction

No. of Pages: 137 | Report Code: TIPRE00026081 | Category: Manufacturing and Construction

The well completion market in Europe is further segmented into France, Germany, Russia, Italy, the UK, and the Rest of Europe. In comparison with the Nordic and Eastern European countries, western European countries are more developed and technologically advanced. The abundance of natural gas in regions such as the Black Sea, North Sea, Caspian Sea, Barents Sea, Mediterranean Sea, and Norwegian Sea and prominence of shale gas projects are expected to offer potential growth opportunities to the well completion market players in this region. The UK, Germany, France, and Norway hold major expansion opportunities for the market players due to continuously growing and improving oil & gas drilling activities in the Johan Sverdrup field in the North Sea. Moreover, emphasis on, both, conventional and unconventional resources, and reduction in the maintenance cost of wells due to rising crude oil and natural gas demand are likely to drive the European market growth during the forecast period. As a part of the European EUOGA project, 82 hydrocarbon-bearing shale formations, in 21 countries, were assessed for their unconventional resource potential.

The COVID-19 pandemic in Europe has had a diverse impact on various nations, since only a few nations have seen an increase in the number of cases, resulting in stringent, long-term lockdown periods or social isolation standards. Because of their excellent healthcare systems, Western European nations such as Germany, France, Russia, and the United Kingdom have witnessed a comparably slight decline in their growth activities. The governments of these nations have made significant expenditures in improving the efficiency and efficacy of disease detection and treatment. Following the relaxation of limitations across Europe, all of Europe's well completion vendors and component manufacturing are now open. To ensure full compliance with regulatory requirements, sanitary measures are reinforced within locations. As a result, the European well completion equipment and services market is expected to grow significantly in the next years.

Strategic insights for the Europe Well Completion Equipment and Services provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

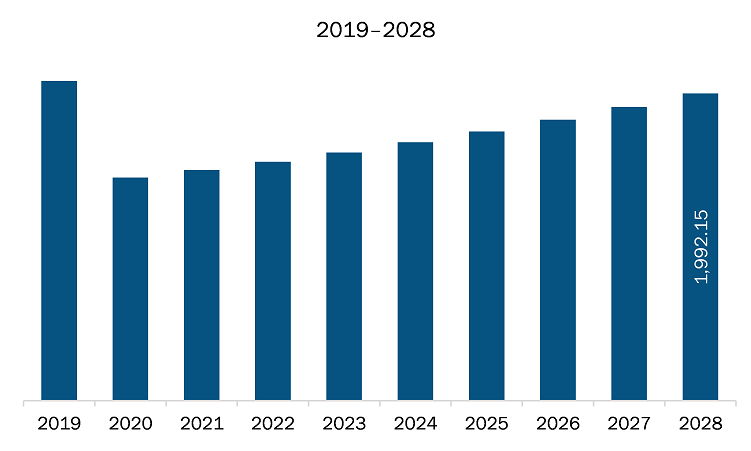

| Market size in 2021 | US$ 1,495.46 Million |

| Market Size by 2028 | US$ 1,992.15 Million |

| Global CAGR (2021 - 2028) | 4.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Offerings

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Well Completion Equipment and Services refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The well completion equipment and services market in Europe is expected to grow from US$ 1,495.46 million in 2021 to US$ 1,992.15 million by 2028; it is estimated to grow at a CAGR of 4.2% from 2021 to 2028. Collaboration of oil service vendors and arctic exploration; the future collaboration of oil & gas service providers can have a positive impact on the market. The collaboration and mergers between the companies can lead to the launch of ventures for new projects in the future. Moreover, the exploration projects can generate huge opportunities for market vendors during the forecast period. Due to the present global carbon footprints, several countries across the region has witnessed the melting of glaciers in the past few decades, which has generated the awareness to explore the deep side of the Arctic. This can also lead to the discovery of new materials and resources such as petroleum as the region has a wide scope of discovery of fuel. This is expected to generate huge opportunities for Europe market vendors during the forecast period. This is bolstering the growth of the well completion equipment and services market.

Based on the offerings, the well completion equipment and services market are segmented into equipment and services. In 2020, the services segment held the largest share Europe well completion equipment and services market. Based on equipment the market is divided into packers, sand control tools, multistage fracturing tools, liner hangers, smart wells, valves, control devices, and others. In 2020, the packers segment held the largest share Europe well completion equipment and services market. Based on location, the well completion equipment and services market, is segmented into onshore and offshore. The onshore segment accounts for largest market share in the 2020.

A few major primary and secondary sources referred to for preparing this report on the well completion equipment and services market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Baker Hughes Company; Halliburton Company; Nov Inc.; NCS Multistage, LLC; Royal Dutch Shell PLC; RPC Incorporated; Schlumberger Limited; Nine Energy Services; and Welltec among others.

The Europe Well Completion Equipment and Services Market is valued at US$ 1,495.46 Million in 2021, it is projected to reach US$ 1,992.15 Million by 2028.

As per our report Europe Well Completion Equipment and Services Market, the market size is valued at US$ 1,495.46 Million in 2021, projecting it to reach US$ 1,992.15 Million by 2028. This translates to a CAGR of approximately 4.2% during the forecast period.

The Europe Well Completion Equipment and Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Well Completion Equipment and Services Market report:

The Europe Well Completion Equipment and Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Well Completion Equipment and Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Well Completion Equipment and Services Market value chain can benefit from the information contained in a comprehensive market report.