Many European countries have been the key supporters of the development of financial institutions and financial markets. The worth of FinTech businesses in Europe is twice as that of any other technology business on the continent. The region leads the rest of the globe in terms of energy and internet availability, provides ideal circumstances for digital wealth management vendors to thrive. Its technological infrastructure is likely to offer 5G network coverage to 75% of its population by 2025. Thus, Europe provides favorable corporate conditions that encourage innovation and technological developments; many European countries, including Switzerland and the Netherlands, dominated the 2020 Global Innovation Index. Further, Europe accounts for 17%, i.e., USD 2.26 trillion, of the cumulative valuation of FinTech companies in the world. FinTech is the top venture capital investment category that receives 20% of all venture money, which is greater than that in Asian countries and the US. Card payments have continued to dominate the means of cashless transactions resulting in digital payments, with advanced economies in Europe cumulatively accounting for a high percentage of non-cash payment transactions.

In Europe, Switzerland was the hardest-hit country by the COVID-19 outbreak, followed by the UK and others. A majority of European countries are expected to suffer an economic hit due to a lack of revenue from various industries, as these countries recorded the highest number of COVID-19 cases and deaths in the past year. Due to business lockdowns, travel bans, and supply chain disruptions, the region faced an economic slowdown in 2020 and most likely even in 2021. European countries represent a major market for wealthtech solution owing to the financially stability of the region. As Europe is mega hub for the startups, there is a significant demand for effective wealth management solutions. However, the supply chain disruptions and demand decline from various end-user industries of wealthtech solution market have led to a decline in revenues of market players operating in Europe.

Strategic insights for the Europe WealthTech Solution provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

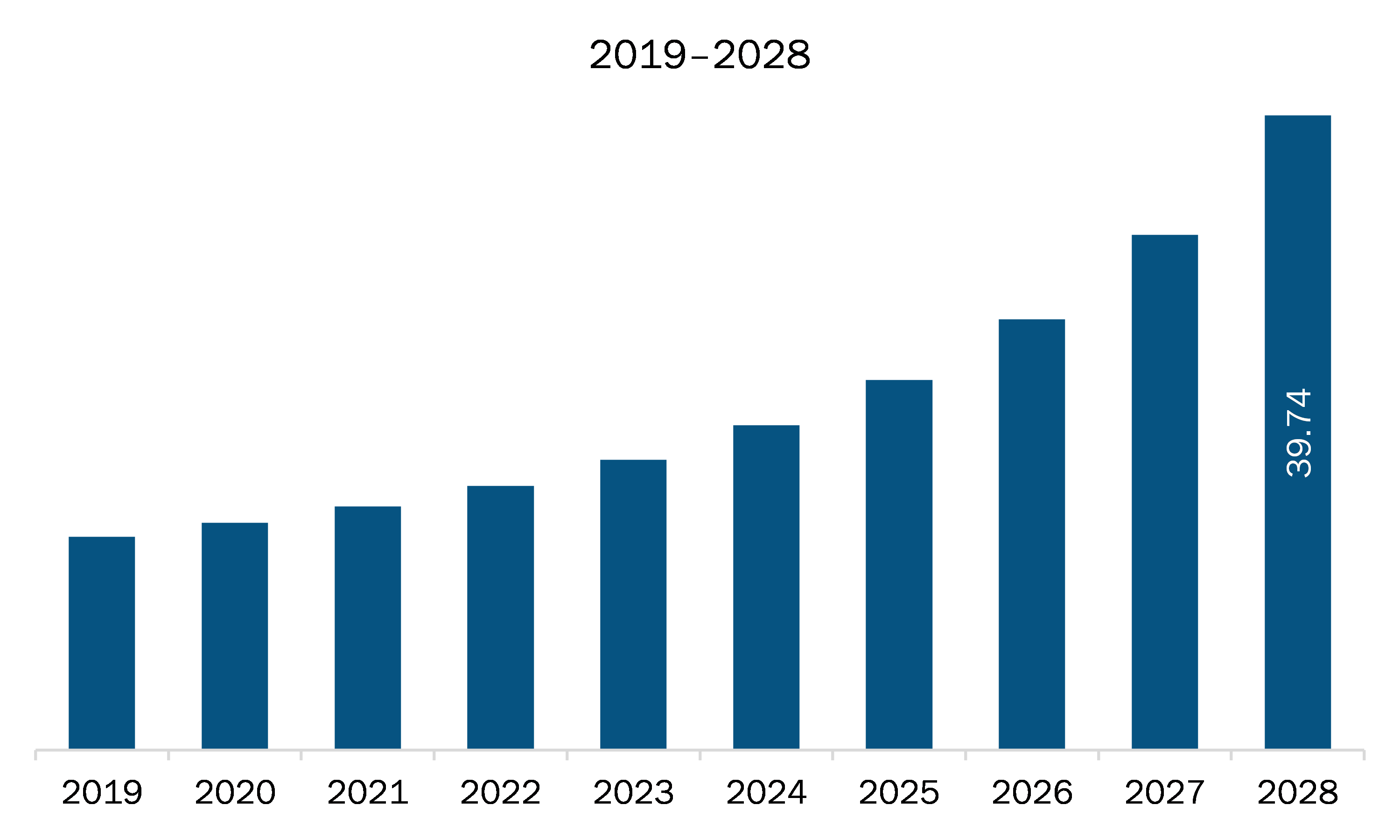

| Market size in 2021 | US$ 15.23 Billion |

| Market Size by 2028 | US$ 39.74 Billion |

| Global CAGR (2021 - 2028) | 14.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe WealthTech Solution refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The wealthtech solution market in Europe is expected to grow from US$ 15.23 billion in 2021 to US$ 39.74 billion by 2028; it is estimated to grow at a CAGR of 14.7% from 2021 to 2028. According to US Bank Locations website data, Europe had 5,963 banks in total in January 2020; and according to Bankinfobook website data, Thus, with the growing number of banks and their branches worldwide, the use of banking software has also increased. Further, the wealthtech solutions are majorly used for retail banking and private banking. The importance of investment advisory services, portfolio analysis and portfolio reporting, portfolio risk management, and wealth management solutions in retail banking is increasing continuously. The companies offering wealthtech solutions for retail banks include aixigo AG; InvestCloud, Inc.; Valuefy Solutions Private Limited; and InvestSuite. Thus, the growing number of banks worldwide is expected to fuel the wealthtech solution market growth in the coming years.

Europe wealthtech solution market is segmented into component, end user, organization size, deployment mode, and country. Based on component, the wealthtech solution market is bifurcated into solution and services. In 2020, the solution segment led the market, accounting for a larger market share. Based on end user, the wealthtech solution market is segmented into banks, wealth management firms, and others. In 2020, the wealth management firms segment accounted for the largest market share. Based on organization size, the wealthtech solution market is bifurcated into large enterprises and small and medium-sized enterprises. In 2020, the large enterprises segment accounted for a larger market share. By deployment mode, the wealthtech solution market is bifurcated into cloud-based and on-premises. In 2020, the cloud-based segment accounted for a larger market share. Based on country, the Europe wealthtech solution market is segmented into France, Germany, Austria, UK, and rest of Europe. In 2020, UK led the market, accounting for a larger market share.

A few major primary and secondary sources referred to for preparing this report on the wealthtech solution market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are 3rd-eyes analytics; aixigo AG; BlackRock, Inc.; FinMason, Inc.; InvestCloud, Inc.; InvestSuite; Synechron; Wealthfront Inc.; Valuefy; and WealthTechs Inc.

The Europe WealthTech Solution Market is valued at US$ 15.23 Billion in 2021, it is projected to reach US$ 39.74 Billion by 2028.

As per our report Europe WealthTech Solution Market, the market size is valued at US$ 15.23 Billion in 2021, projecting it to reach US$ 39.74 Billion by 2028. This translates to a CAGR of approximately 14.7% during the forecast period.

The Europe WealthTech Solution Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe WealthTech Solution Market report:

The Europe WealthTech Solution Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe WealthTech Solution Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe WealthTech Solution Market value chain can benefit from the information contained in a comprehensive market report.