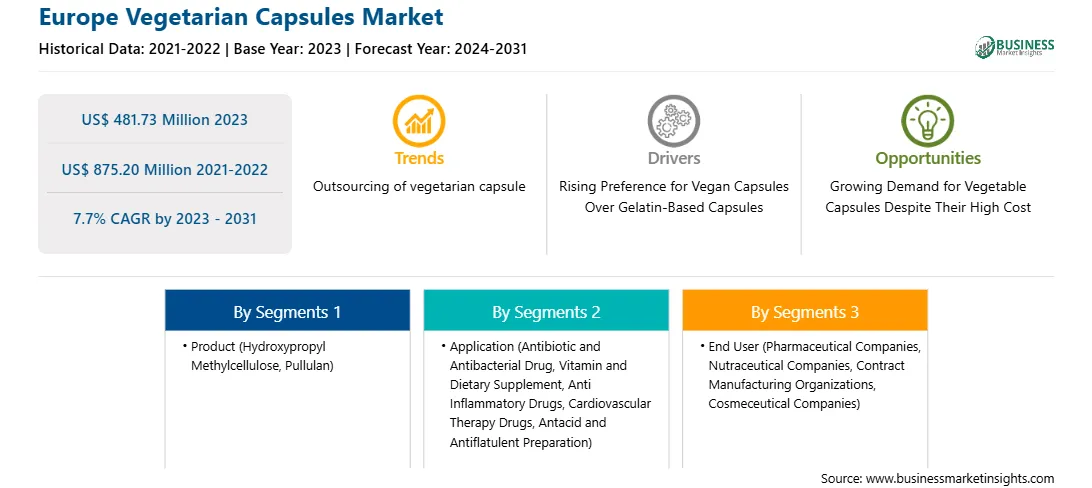

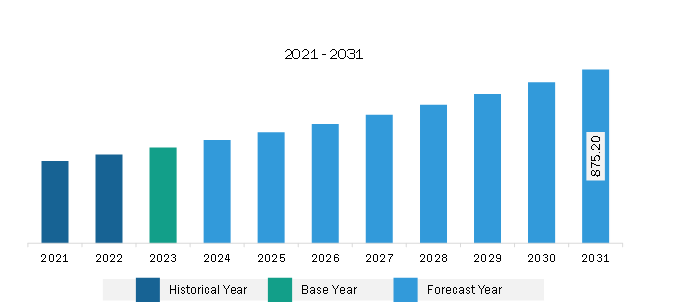

The Europe vegetarian capsules market was valued at US$ 481.73 million in 2023 and is expected to reach US$ 875.20 million by 2031; it is estimated to register a CAGR of 7.7% from 2023 to 2031.

Vegetarian capsule manufacturers have limited production facilities, no specialized equipment to process specialized raw materials, and a limited marketing strategy. However, contract manufacturers procure high capsules, match demand and supply, and have experienced teams and effective product testing. For instance, in October 2020, Lonza announced an investment of US$ 93.23 million in its Capsules and Health Ingredients (CHI) Division, a delivery/contract partner to the biopharma and health nutrition industry. Such investments will enable the company to expand its overall production capacity of capsules within CHI's Capsugel portfolio by procuring 30 billion capsules annually and maintaining high-quality standards with Lonza's Sigma Series. Also, the company mentioned that this investment of procuring 30 billion capsules will address the high growth across CHI's gelatin, vegetarian, and specialty polymers product portfolio as well as the liquid-filled hard capsules sold under the "Licaps" brand. Therefore, the outsourcing of vegetarian capsules is expected to emerge as a trend in the vegetarian capsules market in the coming years.

According to the Health and Food Supplements Information Service (HSIS) report, in 2019, veganism became more popular in the UK than in any other country. In the UK alone, veganism increased by almost sevenfold between 2014 and 2019. Such a drastic shift of consumers toward veganism is attributed to health conditions, animal welfare concerns, and support for a green environment. Additionally, some consumers started to prefer a vegan diet for weight loss, as animal-derived foods and supplements contain "bad fat."

Further, a primary concern among the UK population regarding plant-based diets was that the complete exclusion of animal-sourced food intake might result in nutritional deficiency. Thus, the UK market witnessed an accelerated consumer demand for dietary supplements to maintain personal health and wellness and tackle nutritional deficiency. The intake of dietary supplements is particularly high among youths aged between 18 and 24 in the UK. As per the PwC 2019 report, 8 out of 10 consumers in the UK consume vitamins and dietary supplements. With the rising consumption of dietary supplements among the UK population, dietary supplement manufacturers are shifting focus toward producing plant-based/vegetarian-based supplements for consumers in the country.

In January 2023, Nutricia (Danone) announced the launch of its first "plant-based, ready-to-drink" oral nutritional supplement, "Fortimel." The new product launch is specifically formulated to meet the nutritional needs of consumers who are malnourished or are at high risk of malnutrition due to illness. The product, initially in 2023, was made available across the Netherlands, Spain, Denmark, Norway, Finland, and the Czech Republic. Later, in 2023, it was made available in other European countries such as the UK, Scotland, and others.

Strategic insights for the Europe Vegetarian Capsules provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 481.73 Million |

| Market Size by 2031 | US$ 875.20 Million |

| Global CAGR (2023 - 2031) | 7.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Vegetarian Capsules refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Strategic insights for the Europe Vegetarian Capsules provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Vegetarian Capsules refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Vegetarian Capsules Strategic Insights

Europe Vegetarian Capsules Report Scope

Report Attribute

Details

Market size in 2023

US$ 481.73 Million

Market Size by 2031

US$ 875.20 Million

Global CAGR (2023 - 2031)

7.7%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Product

By Application

By End User

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Vegetarian Capsules Regional Insights

The Europe vegetarian capsules market is categorized into product, application, functionality, end user, and country.

Based on product, the Europe vegetarian capsules market is segmented hydroxypropyl methylcellulose (HPMC), pullulan, and others. The hydroxypropyl methylcellulose (HPMC) segment held the largest market share in 2023.

In terms of application, the Europe vegetarian capsules market is categorized into antibiotic and antibacterial drug, vitamin and dietary supplement, anti-inflammatory drugs, cardiovascular therapy drugs, antacid and antiflatulent preparation, and others. The antibiotic and antibacterial drug segment held the largest market share in 2023.

By functionality, the Europe vegetarian capsules market is segmented into immediate release capsules, sustained release capsules, and delayed release capsules. The immediate release capsules segment held the largest market share in 2023.

By end user, the Europe vegetarian capsules market is segmented into pharmaceutical companies, nutraceutical companies, contract manufacturing organizations (CMOS), and cosmeceutical companies. The pharmaceutical companies segment held the largest market share in 2023.

By country, the Europe vegetarian capsules market is segmented into the UK, Germany, France, Italy, Spain, and the Rest of Europe. The UK dominated the Europe vegetarian capsules market share in 2023.

ACG; CapsCanada; Capsugel, Inc (A subsidiary of Lonza Group AG); HealthCaps India; Lefancaps; NATURAL CAPSULES LIMITED; QUALICAPS; Shanxi Guangsheng Medicinal Capsules Co (GS Capsules); BrightCaps GmbH; Sunil Healthcare Limited; Yasin; Zhejiang Honghui Capsule Co., Ltd; and Zhejiang Huili Capsules Co., Ltd. are some of the leading companies operating in the Europe vegetarian capsules market.

The Europe Vegetarian Capsules Market is valued at US$ 481.73 Million in 2023, it is projected to reach US$ 875.20 Million by 2031.

As per our report Europe Vegetarian Capsules Market, the market size is valued at US$ 481.73 Million in 2023, projecting it to reach US$ 875.20 Million by 2031. This translates to a CAGR of approximately 7.7% during the forecast period.

The Europe Vegetarian Capsules Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Vegetarian Capsules Market report:

The Europe Vegetarian Capsules Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Vegetarian Capsules Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Vegetarian Capsules Market value chain can benefit from the information contained in a comprehensive market report.