The trade surveillance systems market in Europe comprises France, Germany, Italy, the UK, Russia, and the Rest of Europe. The European market, which includes more than 40 countries, is extremely diversified. Western European countries are most advanced than the NORDIC and other East European countries. As a result, there have been significant advancements in the use of modern technologies in Western Europe. On the other hand, economically strong European countries such as Germany, Italy, and the UK have witnessed significant growth in the implementation of advanced automated solution across all markets, including the financial market. The European stock exchange market is governed by the European Securities and Markets Authority (ESMA), which is an independent European Union Authority located in Paris, France. ESMA works to promote the functioning of Europe's financial markets by increasing investor protection and fostering cooperation among national competent authorities in the field of securities legislation and regulation. The governing body is engaged in constantly setting and updating trading rules and regulations across the region. For instance, for retail clients, the ESMA established modified trading limitations for contracts for difference (CFDs) and spread betting in August 2018. The major change is that binary options will be outlawed, and retail clients' CFD leverage will be limited to 30:1 or 2:1, depending on the volatility of the underlying asset being traded. These limits only applied to traders who were classified as retail investors. Professional clients, who are experienced traders, were not allowed to participate. As a result, professional clients were not afforded the same investor protections as retail consumers. Manual surveillance becomes difficult due to the constantly changing legislature in the trade market, thereby promoting the adoption of automated trade surveillance systems across the region.

In Europe, the COVID-19 pandemic has a different impact on different countries, as only selective countries have witnessed the rise in the number of cases and subsequently attracted strict, as well as prolonged, lockdown periods or social isolation norms. However, Western European countries such as Germany, France, Russia, and the UK have seen a comparatively modest decrease in their growth activities because of the robust healthcare systems. The sudden outbreak of the COVID-19 pandemic across the region has not only led to the standstill of business operations but have also led to the closure of several small and medium enterprises across the region. In the initial three to four months of 2020, the region has experienced a dip in technological investments across the country. The European share prices have experienced sharp dip owing to the sudden outbreak of the COVID-19 pandemic across the region, which impacted investing decision of individual and enterprise investors. Thus, low technological investments by security trading firms coupled with low trading investment has negatively impacted the market. However, since the beginning of 2021, the European stock market have experienced recovery owing to several investor safety initiatives taken by large European companies. Thus, with the rise in trading activities the demand for trade surveillance systems is also expected to rise thereby leaving a moderate impact on the market over the years.

Strategic insights for the Europe Trade Surveillance Systems provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 254.43 Million |

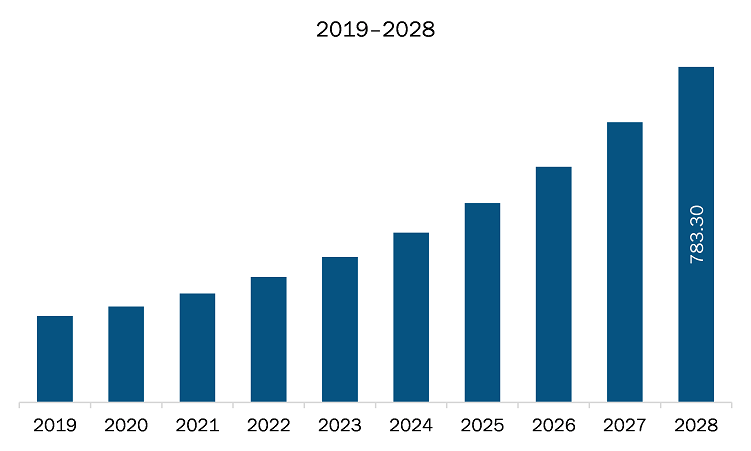

| Market Size by 2028 | US$ 783.30 Million |

| Global CAGR (2021 - 2028) | 17.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Trade Surveillance Systems refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The trade surveillance systems market in Europe is expected to grow from US$ 254.43 million in 2021 to US$ 783.30 million by 2028; it is estimated to grow at a CAGR of 17.4% from 2021 to 2028. Cloud-based trading operations are evolving rapidly because of the convenience of digitalization and quick accessibility. The growing number of cloud-based trading activities increases the requirement for trading surveillance. Cloud-based trade surveillance solutions are gaining more traction than on-premise trade surveillance systems because of its several advantages like scalability. Cloud-based platforms or solutions provide highly scalable performance and a stable environment for the development of trade surveillance solutions. Furthermore, Artificial Technology (AI) technology is used to forecast trends in the acquired data, providing for a standardized and efficient means of monitoring and surveillance of trade activities, as well as ensuring industry compliance. In addition, trade surveillance system providers are introducing new products or updating existing ones to adapt and supply cloud-based solutions. For instance, INTL FCStone, US security and commodities dealer, used Eventus Systems' new trade surveillance technology platform to monitor its global future activity in June 2019. Also, in the same year INTL FCStone announced its expansion operations and replaced its outsourced system with the cloud version of Eventus Systems' Validus market surveillance platform for increased cost efficiency and capabilities as a part of its recently announced expansion ambitions.

In terms of component, the solution segment accounted for the largest share of the Europe trade surveillance systems market in 2020. Further In term of solution, the risk and compliance segment held a larger market share of the trade surveillance systems market in 2020. Similarly in term of services, the professional services segment held a larger market share of the trade surveillance systems market in 2020. In term of deployment on premise segment held a larger market share of the trade surveillance systems market in 2020. In term of organization size, large enterprises segment held a larger market share of the trade surveillance systems market in 2020

A few major primary and secondary sources referred to for preparing this report on the trade surveillance systems market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ACA Group; B-Next; OneMarketData LLC; SIA S.P.A.; Aquis Exchange; Scila AB; CRISIL Limited; FIS Global; Nasdaq Inc; and Software AG among others.

The Europe Trade Surveillance Systems Market is valued at US$ 254.43 Million in 2021, it is projected to reach US$ 783.30 Million by 2028.

As per our report Europe Trade Surveillance Systems Market, the market size is valued at US$ 254.43 Million in 2021, projecting it to reach US$ 783.30 Million by 2028. This translates to a CAGR of approximately 17.4% during the forecast period.

The Europe Trade Surveillance Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Trade Surveillance Systems Market report:

The Europe Trade Surveillance Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Trade Surveillance Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Trade Surveillance Systems Market value chain can benefit from the information contained in a comprehensive market report.