Europe comprises some of strongest military power nations such as Germany, France, Italy, the UK, Spain, and Russia. The Rest of Europe countries with high military expenditure include Spain, Poland, Switzerland, Norway, Sweden, Greece, Netherlands, and Denmark. According to SIPRI, Germany, France, Italy, the UK, and Russia were among the prominent spenders in military expenditure in 2020, spending US$ 52.8 billion, US$ 52.7 billion, US$ 28.9 billion, US$ 59.2 billion, and US$ 61.7 billion, respectively.

Increase in military expenditure and significant steps to support soldiers by adoption of UAV in the field are expected to positively influence the growth of market in various European countries. Also, in Europe, various members of NATO such as France are increasing their defence budgets and planning to reach a defence spending target that will contribute 2% of the GDP. Furthermore, Furthermore, the presence of large number robust aerospace component supplier in countries such as Germany, France, Russia, and the UK, will support the ecosystem of tilt rotor aircraft. Moreover, the Italian Aircraft giant, Leonardo S.p.A has recently introduced AW609, a tilt rotor aircraft which is powered by Pratt & Whitney engine for civilian application. Furthermore, Russian defence contractor, Rostec in September 2018 announced that it is developing its own version on V-22 which will be electrically powered. Also, Russia’s ZALA, unveiled its unmanned tilt rotor aircraft in early 2021. The European air ambulance industry is one of flourishing industries in the current scenario. Numerous air ambulance service providers are operating in the industry and are experiencing rise in demand for their services. Currently, the air ambulance service providers are using either fixed wing aircraft fleet or helicopter fleet or a mix of both. The development and commercialization of civilian/commercial tilt rotor aircraft would be highly beneficial for the air ambulance service providers, as the tilt rotor aircraft fleet has the capability of both, a fixed wing aircraft and helicopter. Thus, the tilt rotor aircraft manufacturers in Europe have the opportunity to attract the European air ambulance service providers to gain customer base and annual revenues.

The European tilt rotor aircraft market also had minimal impact on the market growth throughout 2020 as the majority of the products are in development stage or in prototype phase. Countries such as the UK, Italy, and Russia have a notable number of players with prominent product developments. Several manufacturers have postponed their product launch initiatives or product deliveries, which had a negative impact on the tilt rotor market. Russia launched it unmanned tilt rotor aircraft in April 2021, that was scheduled to be launched in mid-2020. The component suppliers and OEMs of tilt rotor aircraft faced challenges in supplying parts and components to the OEMs due to disruption in the supply chain. This hampered the growth of the tilt rotor market.

Strategic insights for the Europe Tilt Rotor Aircraft provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

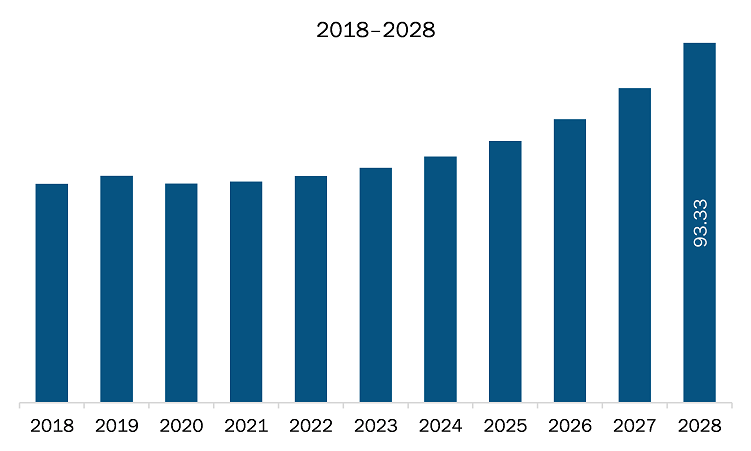

| Market size in 2021 | US$ 57.37 Million |

| Market Size by 2028 | US$ 93.33 Million |

| Global CAGR (2021 - 2028) | 7.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Tilt Rotor Aircraft refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The tilt rotor aircraft market in Europe is expected to grow from US$ 57.37million in 2021 to US$ 93.33 million by 2028; it is estimated to grow at a CAGR of 7.2% from 2021 to 2028.Advancement of Tilt Rotor Aircraft for Civil Application; Owing to the growing number of high net individual and ultra-high net individuals across the globe, especially in emerging economies, the adoption of tilt rotor aircraft is anticipated to witness a steady growth. Until now the tilt rotor aircraft was majorly used for military application; however, recently, Leonardo S.p.A launched AW609, a tilt rotor aircraft. The tilt rotor aircraft can play a vital role in search and rescue (SAR) as well as emergency medical services (EMS) operations owing to aircraft’s long range and VTOL capabilities, with which it can potentially replace helicopters. Also, the tilt rotor aircraft can be utilized in the forthcoming urban ariel mobility industry as these aircraft have longer range compared to rotor wing aircraft, thus allowing to save significant amount of operational cost. Thus, all these factors are projected to drive the market growth in the coming years. This is bolstering the growth of the tilt rotor aircraft market.

In terms of type, the Manned Aerial Vehicle segment accounted for the largest share of the Europe tilt rotor aircraft market in 2020. In terms of end user type, the Military segment held a larger market share of the tilt rotor aircraft market in 2020.

A few major primary and secondary sources referred to for preparing this report on the Europe tilt rotor aircraft market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BAE Systems plc

The Europe Tilt Rotor Aircraft Market is valued at US$ 57.37 Million in 2021, it is projected to reach US$ 93.33 Million by 2028.

As per our report Europe Tilt Rotor Aircraft Market, the market size is valued at US$ 57.37 Million in 2021, projecting it to reach US$ 93.33 Million by 2028. This translates to a CAGR of approximately 7.2% during the forecast period.

The Europe Tilt Rotor Aircraft Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Tilt Rotor Aircraft Market report:

The Europe Tilt Rotor Aircraft Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Tilt Rotor Aircraft Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Tilt Rotor Aircraft Market value chain can benefit from the information contained in a comprehensive market report.