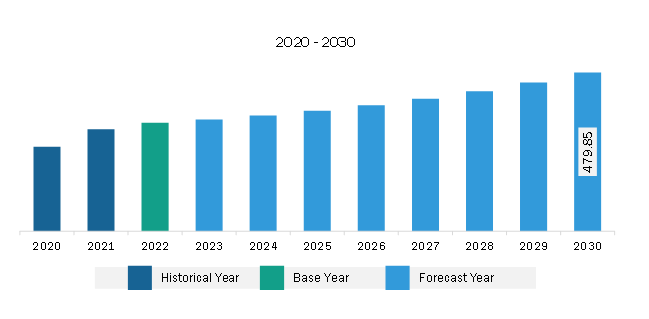

The Europe third party logistics market was valued at US$ 327.76 billion in 2022 and is expected to reach US$ 479.85 billion by 2030; it is estimated to register a CAGR of 4.9% from 2022 to 2030.

Over the last decade, the progress of hardware and the Internet has been directly linked with the adoption of e-commerce. E-commerce has replaced mortar and brick retail in almost all aspects, becoming the preferred medium for marketing, promoting, and purchasing products, goods, and services. As a result, many popular retail stores and brands have launched online shopping platforms. As a result, the volume of overall shipments has increased, ultimately creating demand for shipping services. In the 13 markets evaluated, almost 159 billion packages were transported in 2021, compared to 131 billion packages in 2020, representing a 21% increase.

Third-party logistics is acting as a significant component of e-commerce to manage the issues of inventory, warehousing, packing, tracking, and shipping. In the e-commerce business, third-party logistics providers deliver flexibility and scalability, upgraded technology, and efficiency and specialization. The logistics requirements and services provided by the third-party logistics firms to e-commerce businesses are supply chain management, warehousing, and consolidation services, which help shipping companies in successful order fulfillment. Thus, the growing number of shipments and quality services provided by the provider are driving the third-party logistics market.

Europe is home to some of the largest automotive, medical device, and machine manufacturing companies. Developed infrastructure and government investments are supporting the 3PL market growth. The federal government invested approximately US$ 14.5 billion throughout the 2020 to modernize and renew Germany's rail infrastructure, a US$ 960 million increase over last year. In addition, Spain has developed Trans-European Transport that connects the country to the Rest of Europe. Further, the growing technological adoption in the European logistics industry is another factor supporting the market growth. Germany is the largest market in Europe in terms of third-party logistic services. The presence of major logistic service providers, such as DHL Deutsche Bahn, in the country is one of the factors driving the market. Moreover, the country is located at the center of Europe, which makes it the center of the logistics industry. Germany has a strong hold on automotive, engineering, chemical, and electrical sectors.

The country is ranked third among the top exporters in the world, accounting for the nation's half economic output. Thus, owing to the factors mentioned above, the annual revenue generated in the 3PL market is higher in the country.

Strategic insights for the Europe Third Party Logistics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 327.76 Billion |

| Market Size by 2030 | US$ 479.85 Billion |

| Global CAGR (2022 - 2030) | 4.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Mode of Transports

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Third Party Logistics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe third party logistics market is categorized into mode of transports, services, end user, and country.

Based on mode of transports, the Europe third party logistics market is segmented into roadways, railways, waterways, and airways. The roadways segment held the largest market share in 2022.

In terms of services, the Europe third party logistics market is segmented into international transportation, warehousing, domestic transportation, inventory management, and others. The domestic transportation segment held the largest market share in 2022.

Based on end user, the Europe third party logistics market is segmented into automotive, healthcare, retail, consumer goods, and others. The others segment held the largest market share in 2022.

By country, the Europe third party logistics market is segmented into Germany, France, Italy, Spain, the UK, and the Rest of Europe. The Rest of Europe dominated the Europe third party logistics market share in 2022.

C H Robinson Worldwide Inc, DB Schenker, DSV AS, GEODIS SA, Kuehne + Nagel International AG, Nippon Express Co Ltd, Sinotrans Ltd, Torello Trasporti Srl, United Parcel Service Inc, and XPO Inc are among the leading companies operating in the Europe third party logistics market.

The Europe Third Party Logistics Market is valued at US$ 327.76 Billion in 2022, it is projected to reach US$ 479.85 Billion by 2030.

As per our report Europe Third Party Logistics Market, the market size is valued at US$ 327.76 Billion in 2022, projecting it to reach US$ 479.85 Billion by 2030. This translates to a CAGR of approximately 4.9% during the forecast period.

The Europe Third Party Logistics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Third Party Logistics Market report:

The Europe Third Party Logistics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Third Party Logistics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Third Party Logistics Market value chain can benefit from the information contained in a comprehensive market report.