The Europe synthetic gypsum market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. Synthetic gypsum is being used increasingly in the agriculture industry as it contains two essential nutrients—calcium and sulfur; thus, it acts as a fertilizer, especially in the treatment of alkaline soil, and improves the crop yield. It is also used as a soil amendment to improve its water retention capacity, permeability, water infiltration, drainage, aeration, and structure, among other physical properties. The synthetic gypsum is also being used in the treatment of alkaline soils. The type FGD gypsum provides other essential micronutrients to the plants, in addition to calcium and sulfur. It can also be used as a soil conditioner for improving the physical and the chemical properties of the soil by providing better aggregation, minimizing subsoil acidity and aluminum toxicity, and lowering the loss of soil and soluble phosphorus from agricultural fields. Thus, the abovementioned benefits have led to the rise in the use of synthetic gypsum in the agricultural industry.

In case of COVID-19, in Europe, especially France, witnessed an unprecedented rise in number of coronavirus cases, which led to the discontinuation of synthetic gypsum manufacturing activities. Other chemical and materials manufacturing sector has subsequently impacted the demand for synthetic gypsum during the early months of 2020. Moreover, decline in the overall construction and agricultural materials manufacturing activities has led to discontinuation of synthetic gypsum manufacturing projects, thereby reducing the demand for synthetic gypsum. Similar trend was witnessed in other European countries, i.e., Russia, UK, Italy, Germany and Spain. However, the countries are likely to overcome thus drop in demand with the economic activities regaining their pace, especially in the beginning of the 2021.

Strategic insights for the Europe Synthetic Gypsum provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

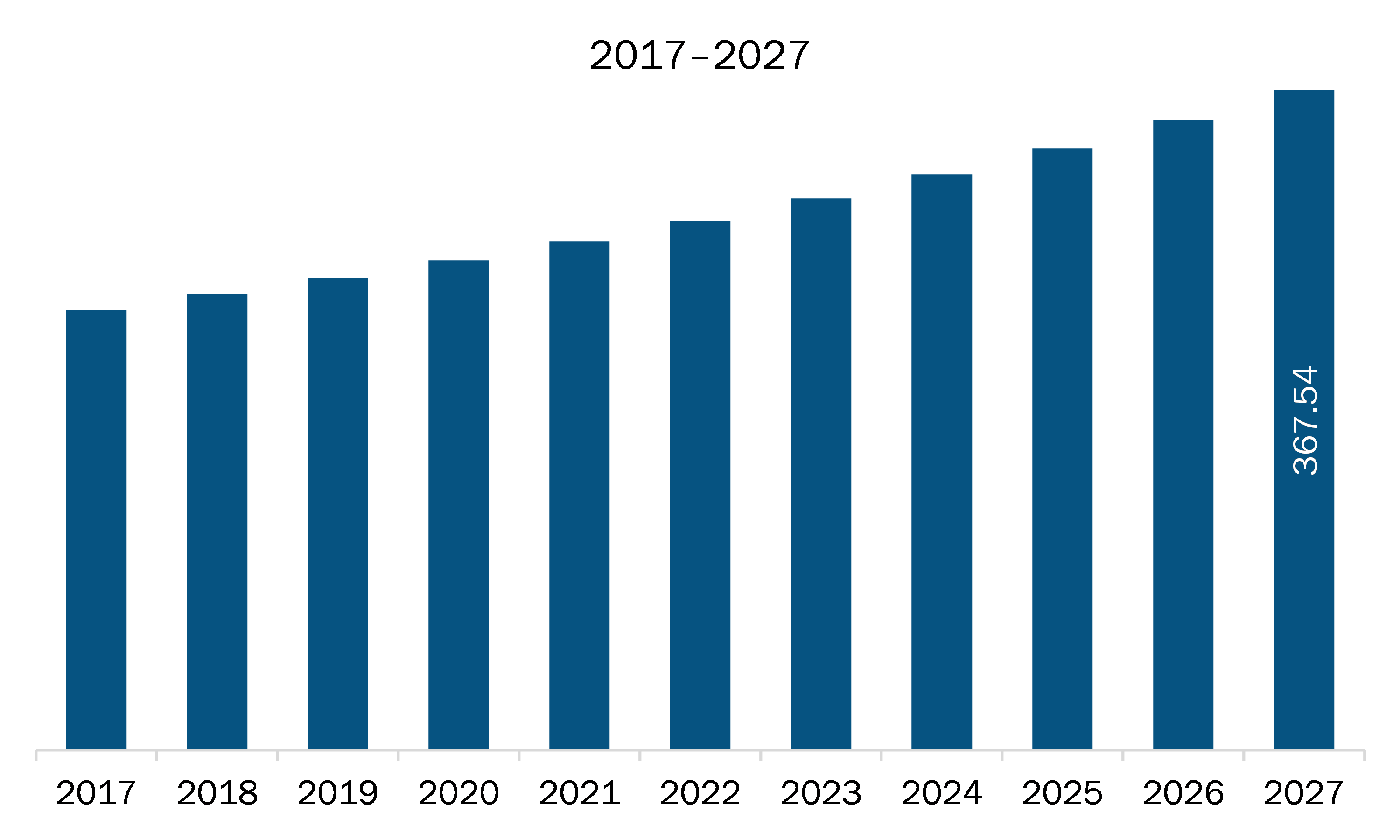

| Market size in 2020 | US$ 272.45 Million |

| Market Size by 2027 | US$ 367.54 Million |

| Global CAGR (2020 - 2027) | 4.4% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Synthetic Gypsum refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The companies which are manufacturing synthetic gypsums are always looking to innovate the products provided by them. The increase in the environmental awareness, concerns and the cost of raw materials has increased the efficient usage of natural reserves. Synthetic gypsum is one of the by-products wastes which is produced from the flue gas desulphurization (FGD) process in order to avoid industrial stack emission of SO2. The adsorption of SO2 through caustic lime produces a final product which is known as synthetic gypsum. Polyethylene is one of the most post-consumer plastics in the world and could be used instead of virgin polyethylene. Nowadays, recycled post-consumer plastics are used as binder and FGD waste was used as filler material for the aluminum composite panels in order to be environmentally friendly. The combination of recycled polyethylene and FGD gypsum are used as filler material for sandwich polymer-metal panels is due to economically and environmental concerns.

Based on type, the FGD gypsum segment accounted for the largest share of the Europe synthetic gypsum market in 2019. Based on application, the drywall segment held a larger market share of the Europe synthetic gypsum market in 2019. Drywall is one of the most common form of finish wall sheathing. The drywall is basically made up of gypsum plaster which has been stuck between two thick layers of paper and provides a smooth finish to the wall. Synthetic gypsum was used by the manufacturing companies in order to save the cost, as well as because of the environmental benefits of the by-product. Natural gypsum is mostly obtained from the gypsum mines, whereas the synthetic gypsum will help the companies to save the limited resource as well as help them save energy by constructing a production plant beside a synthetic gypsum producing power plant. The different types of synthetic gypsum that are suitable for the manufacturing of the drywall includes flue gas desulfurization gypsum, citrogypsum, flurorgypsum and titanogypsum.

A few major primary and secondary sources referred to for preparing this report on the Europe synthetic gypsum market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include Drax Group Plc, USG Corporation, Larargeholcim Ltd., Knauf Gips KG, BauMineral GmbH, and Steag GmbH.

The Europe Synthetic Gypsum Market is valued at US$ 272.45 Million in 2020, it is projected to reach US$ 367.54 Million by 2027.

As per our report Europe Synthetic Gypsum Market, the market size is valued at US$ 272.45 Million in 2020, projecting it to reach US$ 367.54 Million by 2027. This translates to a CAGR of approximately 4.4% during the forecast period.

The Europe Synthetic Gypsum Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Synthetic Gypsum Market report:

The Europe Synthetic Gypsum Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Synthetic Gypsum Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Synthetic Gypsum Market value chain can benefit from the information contained in a comprehensive market report.