The telecom sector in Europe is booming, and it has delivered a host of significant economic and societal enablers throughout the years. In Europe, a wide range of goods is available to meet the needs of both retail and business customers. The varied service portfolios, which include cloud, security, and Internet of Things (IoT), reflect the industry's continual growth. In addition, the number of mobile users has also increased as a result of these technical developments, necessitating a more effective subscriber data management system. Furthermore, the number of subscribers is expected to increase in the next years. According to studies, Europe had 372 million 4G customers at the end of 2017, an increase from 286 million a year earlier, accounting for more than 35% of all mobile subscribers. Moreover, TeleGeography's GlobalComms Forecast Service expects the number of 4G users to reach 709 million by December 2022, presenting a lucrative opportunity for SDM vendors. Furthermore, fixed-mobile convergence is extremely strong in Europe, with a growing demand for convergent services, as customers strive to simplify their lives and receive greater value. Despite fierce competition from OTT video packages, the operators' video offering is anticipated to expand in the future years, surpassing US$ 1.19 billion for the first time in 2019. In addition, the region's IT services offering has grown substantially in recent years, with a diversified portfolio that includes cloud, security, unified communications, enterprise services, and other services. IoT sales are anticipated to reach US$ 6.16 billion by 2025, indicating that the trend is continuing. Hence, the aforementioned aspect indicates that the region's telecom sector is likely to grow, which would primarily generate attractive opportunities for subscriber data management vendors.

In case of COVID-19, Europe is highly affected especially France and Russia. In Europe, the COVID-19 pandemic has a different impact on different countries, as only selective countries have witnessed the rise in the number of cases and subsequently attracted strict, as well as prolonged, lockdown periods or social isolation norms. However, Western European countries such as Germany, France, Russia, and the UK have seen a comparatively modest decrease in their growth activities because of the robust healthcare systems. The sudden outbreak of the COVID-19 pandemic across the region has not only led to the standstill of business operations but have also led to the closure of several small and medium enterprises across the region. In the initial three to four months of 2020, the region has experienced a dip in technological investments across the country. It has also led to the standstill of manufacturing units thereby adversely impacting the production of subscription management hardware and servers across the region. However, the restrictions imposed across the region, increased the internet traffic to 70% in a week’s time. The major sections that experienced rise in subscription was the OTT platforms for movies and TV shows. Additionally, Disney+ which was launched in the UK and other European countries in March 2020, recorded over 50 million subscribers in five months. Thus, the rising subscriptions of OTT platforms among the region’s population led to a positive impact on the growth of the market.

Strategic insights for the Europe Subscriber Data Management provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

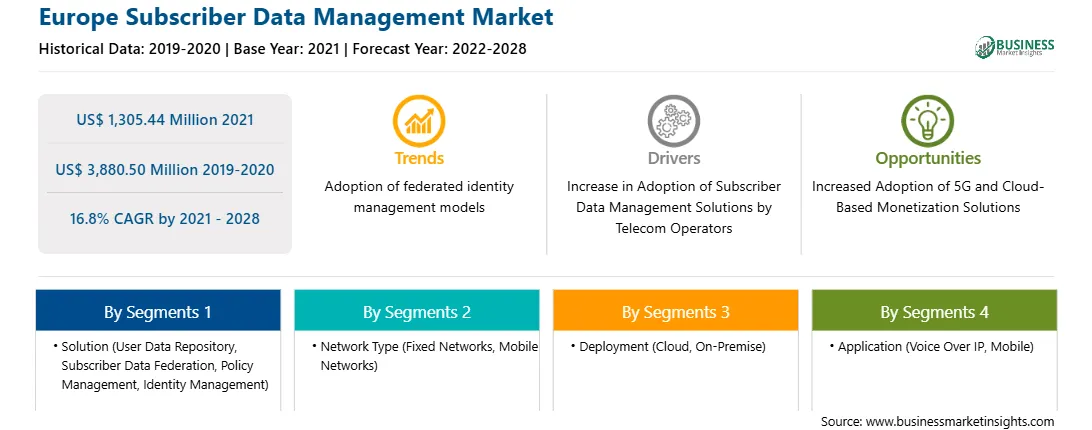

| Market size in 2021 | US$ 1,305.44 Million |

| Market Size by 2028 | US$ 3,880.50 Million |

| Global CAGR (2021 - 2028) | 16.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Solution

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Subscriber Data Management refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe subscriber data management market is expected to grow from US$ 1,305.44 million in 2021 to US$ 3,880.50 million by 2028; it is estimated to grow at a CAGR of 16.8% from 2021 to 2028. Surging investments for product innovation and growth is expected to surge the market growth. The major players in the Europe subscriber data management market are constantly investing in both organic and inorganic strategies to make innovations in their product offerings and grow their country presence across the region. For instance, The Enea AB Unified Data Manager, a hardware-agnostic, cloud-native network function for 4G and 5G data management, was launched by Enea's Openwave Mobility Inc. in February 2020. The software implements 3GPP unified data management (UDM) features in 5G networks and interoperates with multiple home subscriber servers (HSS) in 4G networks. Similarly, eir, Ireland's communications service provider, has deployed its 5G network across the country in November 2019. Customers in Ireland will now be able to connect to 5G and benefit from increased mobile broadband and fixed wireless access owing to Ericsson's 5G Core offering and subscriber data management solutions. These advancements made by the major players across the region are expected to contribute to the growth of the Europe market over the years.

In terms of solution, the user data repository segment accounted for the largest share of the Europe subscriber data management market in 2020. In terms of network type, the fixed networks segment held a larger market share of the Europe subscriber data management market in 2020. In terms of deployment, the cloud segment held a larger market share of the Europe subscriber data management market in 2020. Further, the voice over IP segment held a larger share of the Europe subscriber data management market based on application in 2020.

A few major primary and secondary sources referred to for preparing this report on the Europe subscriber data management market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Cisco Systems, Inc.; Enea AB; Hewlett Packard Enterprise Development LP (HPE); Huawei Technologies Co., Ltd.; Nokia Corporation; Oracle Corporation; R Systems International Limited; Sandvine; Telefonaktiebolaget LM Ericsson; and ZTE Corporation.

The Europe Subscriber Data Management Market is valued at US$ 1,305.44 Million in 2021, it is projected to reach US$ 3,880.50 Million by 2028.

As per our report Europe Subscriber Data Management Market, the market size is valued at US$ 1,305.44 Million in 2021, projecting it to reach US$ 3,880.50 Million by 2028. This translates to a CAGR of approximately 16.8% during the forecast period.

The Europe Subscriber Data Management Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Subscriber Data Management Market report:

The Europe Subscriber Data Management Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Subscriber Data Management Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Subscriber Data Management Market value chain can benefit from the information contained in a comprehensive market report.