The Europe stevia market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. Stevia is now predominantly used to control calorie, carbohydrate, and sugar intake. Liquid stevia is used as an alternative for cane sugar in sweetening coffee, tea, and smoothies. Stevia is gaining traction in the beverage industry and being preferred by leading beverage manufacturers for strategic approaches such as innovation, artificial sweetener replacement, sugar moderation for kids, and cost savings. In 2017, Coca-Cola introduced a soft drink that included stevia. The coke containing stevia has less sugar and provides a unique taste. Various features of stevia such as zero calories, tooth-friendly, pH stable, non-fermenting, highly soluble, heat stable, and shelf-stable have increased the demand for stevia in the beverage industry. In a few instances, stevia can be applied as a flavor enhancer depending upon the type of beverage. Stevia can also be used for reducing the sugar levels in alcoholic beverages such as beer and cocktails. Thus, an increased application of stevia in the beverage industry is expected to drive the stevia market across the region.

In Europe, Russia reported a huge number of COVID-19 cases, which led to the discontinuation of several business operations, including stevia production activities. Downfall of other food and beverage producing sectors negatively impacted the demand for stevia during the early months of 2020. However, the pandemic has been a reason for major shifts in consumer preferences with an increased awareness about having a healthy lifestyle. Consumers are substituting conventional ingredients with healthier alternatives, which is, in turn, increasing the demand for natural sweeteners such as stevia. With an increase in the diet preference for no added sugars and low carbohydrates among consumers during the pandemic has led to an increase in demand for stevia. During the pandemic, there has been a rapid surge in demand for low sugar and immunity-boosting products owing to people seeking solutions to improve their overall health and wellbeing. Hence, increasing health consciousness and high demand for low sugar alternatives among the Europeans has had a positive impact on the stevia market.

Strategic insights for the Europe Stevia provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 109.88 Million |

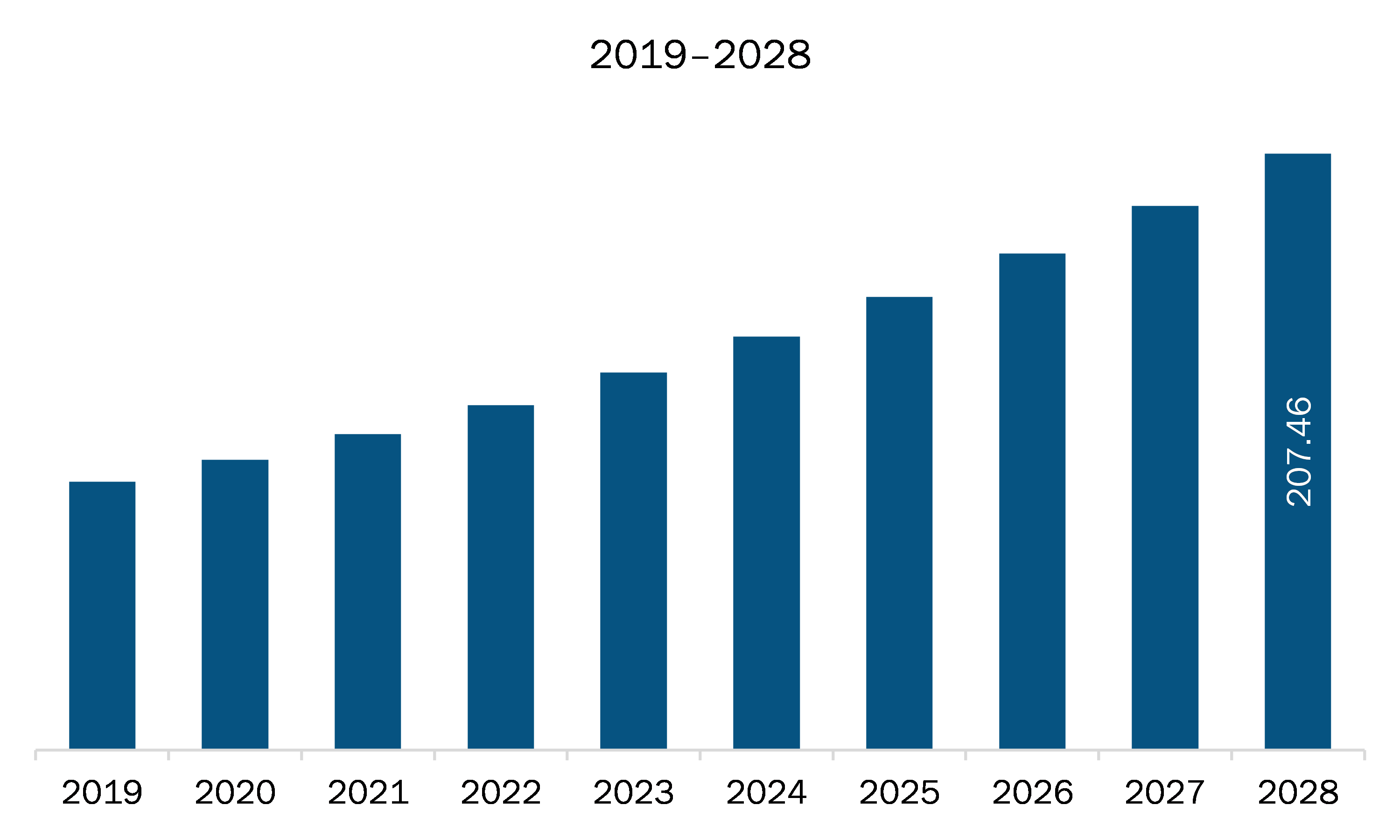

| Market Size by 2028 | US$ 207.46 Million |

| Global CAGR (2021 - 2028) | 9.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Stevia refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The stevia market in Europe is expected to grow from US$ 109.88 million in 2021 to US$ 207.46 million by 2028; it is estimated to grow at a CAGR of 9.5% from 2021 to 2028. The market for stevia in Europe is witnessing growth owing to the presence of well-established players such as Cargill, Incorporated; Ingredion Incorporated; Tate & Lyle PLC; ADM; and others in this region. The major players operating in the European stevia market are focused on new and improved product offerings so that they could meet the demand of the end-use industries in the market, which is further expected to boost the market growth. Also, the companies are focusing on merger & acquisition, partnerships, and expansions to expand their footprint across Europe and to fulfill the growing demand of the stevia. For instance, in 2021, Tate & Lyle and Codexis announced the extension of their partnership to increase the production of two of Tate & Lyle’s newest sweeteners, including DOLCIA PRIMA Allulose and TASTEVA M Stevia Sweetener. Codexis latest novel enzyme products, produced in collaboration with Tate & Lyle’s experts, will enable additional production efficiencies and improve Tate & Lyle’s ability to accelerate sugar and calorie reduction with the best tasting, cost-effective sweeteners.

Based on type, the powder segment accounted for the largest share of the Europe stevia market in 2020. Based on application, the beverages segment accounted for the largest share of the Europe stevia market in 2020.

A few major primary and secondary sources referred to for preparing this report on the Europe stevia market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include Cargill, Incorporated; Ingredion Incorporated; Tate & Lyle PLC; the Archer-Daniels-Midland Company; S&W Seed Company; Morita Kagaku Kogyo Co., Ltd.; and PureCircle.

The Europe Stevia Market is valued at US$ 109.88 Million in 2021, it is projected to reach US$ 207.46 Million by 2028.

As per our report Europe Stevia Market, the market size is valued at US$ 109.88 Million in 2021, projecting it to reach US$ 207.46 Million by 2028. This translates to a CAGR of approximately 9.5% during the forecast period.

The Europe Stevia Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Stevia Market report:

The Europe Stevia Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Stevia Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Stevia Market value chain can benefit from the information contained in a comprehensive market report.