European continent comprises several economies, including Germany, France, Italy, the UK, and Russia. Consumers are becoming increasingly interested in the nutritional qualities of the food they eat. This has prompted further research on the relationship between diet and health. There is a significant increase in the demand for functional food products, specifically in regard to products that contain soluble fibers. Many people from the European countries are focusing on increasing the intake of dietary fibers to improve their health. The grain products are mainly used as a source of fiber in these countries. The soluble dietary fibers are used to create a high-value end product; hence, there is growing demand for soluble dietary fibers in many food & beverages applications in the region.

In Europe, currently Russia, the UK and France are the worst-impacted countries by the COVID-19 pandemic. The region is estimated to suffer an economic hit due to the lack of revenue from various industries subjected to disruption in supply chain. The massive outbreak of the pandemic has created temporary distortion in operation efficiencies of industrial bases in European market. The market for soluble dietary fibers has been negatively impacted due to fluctuations in raw material sourcing and pricing, along with limited operational capabilities due to COVID-19 restrictions. However, shift in consumer lifestyle, rise in preference toward healthy dietary practices, and increase in incorporation of dietary fibers in diets have substantially promoted the demand for soluble dietary fibers in the regional market. For instance, as per an article published by Tate and Lyle in June 2021, the advances and innovation in the food & beverages industry have prompted the consumption of dietary fiber over sugars and fat as a significant replacement. As per an article published in the Journal” Gut Microbes,” the consumption of high fiber diet could significantly lower down the inflammatory responses associated with COVID-19 infection. Additionally, as per an article published by Europe PMC, a study was conducted to understand the microbial patterns with regards to probiotics and dietary fibers. The study projected the consumption of probiotics and dietary fibers could significantly contribute to reduce inflammation and strengthen the overall immune system in response to COVID-19 infection. Hence, the market for soluble dietary fibers is expected to grow in the region. Further, several industrial bases such as food & beverages, pharmaceuticals and nutraceuticals, and animal feed are expected to flourish post pandemic, which has a direct correlation with the demand for soluble dietary fibers in the regional market.

Strategic insights for the Europe Soluble Dietary Fibers provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

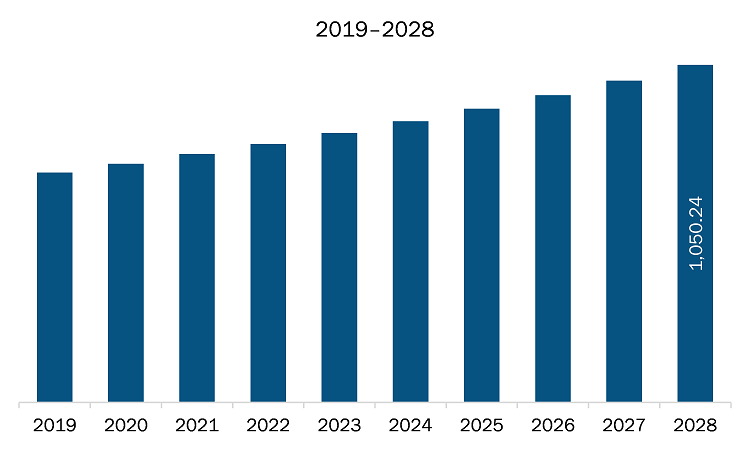

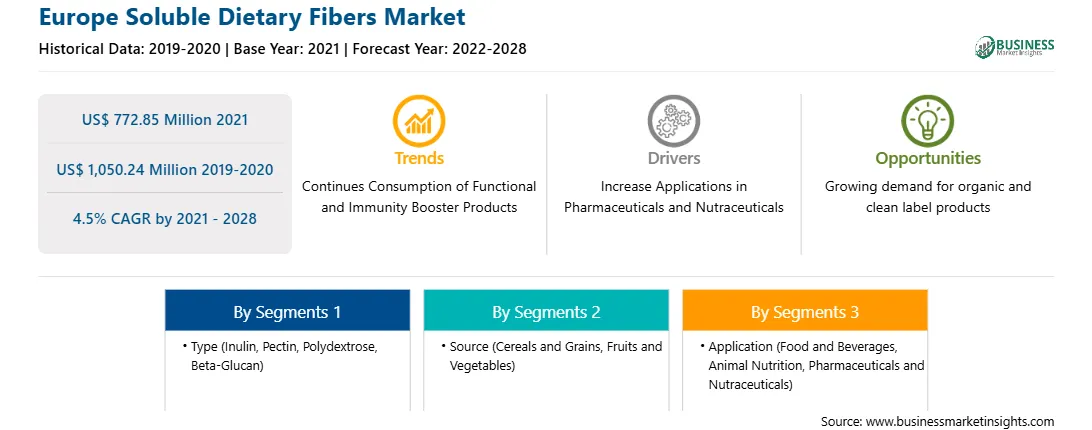

| Market size in 2021 | US$ 772.85 Million |

| Market Size by 2028 | US$ 1,050.24 Million |

| Global CAGR (2021 - 2028) | 4.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Soluble Dietary Fibers refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The soluble dietary fibers market in Europe is expected to grow from US$ 772.85 million in 2021 to US$ 1,050.24 million by 2028; it is estimated to grow at a CAGR of 4.5% from 2021 to 2028. The use of soluble dietary fiber is rising fairly in beverages and drinks as it shows better dispersibility in water in comparison to insoluble fiber. Additionally, the incorporation of soluble dietary fiber in beverage formulations helps improve the overall physical and chemical properties as the beverage particles get uniformly distributed; enhance the stability; and prevent precipitation and stratification. Such functional beverages promote satiety, help in weight management, and minimize the need to the intake other high calorific foods. Different types of soluble fibers such as grains and multi-fruits, pectins, β-glucans, and cellulose beet-root fiber, can be used in preparation of beverages. For instance, as per an article published by the National Center for Biotechnology Information (NCBI), oat fiber can be effectively used in preparation of milk shakes, instant type-breakfast drinks, fruit and vegetable juices, iced tea, sports drinks, cappuccino, and wine. An article published by PreScouter” Natural Replacements for Sugar in Beverages” in April 2018, stated that the soluble fiber, inulin, is considered as a perfect ingredient which can be used in instant beverages, soy drinks, and flavored waters, especially “functional” beverages. Inulin possesses high solubility in water along with providing extra strength to body. Inulin is considered as an ideal sugar replacer in low-calorie beverages. Similarly, an article published by FoodIngredientsFirst in April 2020, represented that soluble fibers and natural flavors have grown indispensably in the sweeteners market, attributable to significant shift toward sugar-reduced foods as well as enhanced mouthfeel, texture, and sweetness. The rising inclination toward replacing sugar with artificial sweeteners to improve texture, taste, and nutrition has driven the demand for soluble dietary fibers such as chicory inulin. Chicory inulin possesses a sweetness of approximately 10% in comparison with that of sucrose and has the capability to replace sugars in 1:1 ratio in many applications. Similarly, Litesse Ultra polydextrose is another soluble fiber, which can effectively substitute the lost texture and mouthfeel by reduction of sugar. Similarly, prebiotic dietary fibers, possessing high solubility in water, are significantly used in beverage formulations to promote the digestive health. For instance, barley, which is composed of –20 grams of beta-glucan per 100 grams, is significantly used as a popular cereal grain to produce beer. It contains 2. Beta glucan (β-glucan) is a type of soluble fiber which is known for several functional and bioactive properties and helps to minimizes the risk of dyslipidemia, hypertension, and obesity. Companies such as Ingredion is involved in offering NUTRAFLORA soluble prebiotic fiber, which enhances the flavor of beverages along with acting as an effective sugar substitute. Similarly, Fibersol—a joint venture between Archer Daniels Midland Company; Matsutani Chemical Industry Co., Ltd.; and Matsutani America—is involved in providing low-viscosity soluble prebiotic dietary fiber, which helps increase the fiber content and enhance the nutritional profile of different types of beverages such as juices & fortified waters, shakes & smoothies, protein & nutritional, yogurt & dairy-based, coffee & tea, sports & energy, and carbonated & alcoholic. Hence, the soluble dietary fiber acts as an effective sugar replacement and can also be used as a prebiotic fiber in beverage formulations.

In terms of type, the inulin segment accounted for the largest share of the Europe soluble dietary fibers market in 2020. In terms of source, the cereals and grains segment accounted for the largest share. Further In term of application, the food and beverages held a larger market share of the soluble dietary fibers market in 2020.

A few major primary and secondary sources referred to for preparing this report on the soluble dietary fibers market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Cargill, Incorporated, Kerry Group, Ingredion Incorporated, Nexira, Roquette Frères, Tate & Lyle PLC, ADM, IFF Nutrition & Biosciences, COSUCRA, and BENEO GmbH among others.

The Europe Soluble Dietary Fibers Market is valued at US$ 772.85 Million in 2021, it is projected to reach US$ 1,050.24 Million by 2028.

As per our report Europe Soluble Dietary Fibers Market, the market size is valued at US$ 772.85 Million in 2021, projecting it to reach US$ 1,050.24 Million by 2028. This translates to a CAGR of approximately 4.5% during the forecast period.

The Europe Soluble Dietary Fibers Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Soluble Dietary Fibers Market report:

The Europe Soluble Dietary Fibers Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Soluble Dietary Fibers Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Soluble Dietary Fibers Market value chain can benefit from the information contained in a comprehensive market report.