Europe Smart Life Sciences Manufacturing Market

No. of Pages: 195 | Report Code: BMIRE00028923 | Category: Technology, Media and Telecommunications

No. of Pages: 195 | Report Code: BMIRE00028923 | Category: Technology, Media and Telecommunications

Technology has been playing a major role in the healthcare sector, wherein the biotechnology industry is the most benefited segment by recent technological advancements in data analytics, compared to other domains such as oncology, neurology, and immunology. Emerging data sciences technologies also assist in the growth of the biotechnology industry. The analysis of living organisms, research for novel drugs, etc., are the major roles played by biotechnology laboratories.

Modern data analytics tools have allowed biotechnology researchers to create predictive analytics models and eventually allow them to understand the most effective ways of achieving their desired goals and objectives. Big data, AI, virtual reality, data visualization, and data security are among the common technologies used in biotech laboratories. Novozymes, a leading biotechnology company headquartered in Bagsværd, just outside of Copenhagen, Denmark, has adopted Tableau, a data visualization tool, which revolutionized its approach to data analysis and collaboration. Tableau helped Novozymes cut the reporting times by more than 90%. It also assists in strategic decision-making within the company’s departments such as sales, raw material purchase, +planning, and finance. In addition, Tableau allows Novozymes’ sales force in sharing key insights with customers, thereby building relationships and enhancing revenue performance.

AstraZeneca, plc, a British–Swedish multinational pharmaceutical and biotechnology company, uses data and technology to minimize the time to discovery and delivery of potential new medicines. The company has data science and AI capabilities embedded in its R&D departments, which allows scientists to push the boundaries of science to deliver life-changing medicines. They apply AI throughout the discovery and development process, from target identification to clinical trials, to uncover new insights guiding the drug discovery and development process.

Atomwise has expertise in using AI in small-molecule drug discovery. In December 2021, the company announced its growing portfolio of emerging joint venture companies, with research programs spanning oncology, immunology, infectious disease, neuroscience, and clotting disorders. In the area of infectious disease, the company announced the addition of vAirus, a newly formed joint venture company with world RNA-virus expert Nito Panganiban. The joint venture will use AI-based screening to find small molecule compounds to act as novel broad-spectrum antivirals against flaviviruses. Integrated big data tools such as electronic health records (eHR) can make it easy for healthcare professionals to obtain a comprehensive patient health record, even if information regarding their health originates from scattered sources. Other advances in genetic research backed by big data could lead to dramatic progress in the fight against single-gene disorders, such as sickle cell disease, cystic fibrosis, and hemophilia. This type of research can also be employed to develop improved treatments and prevention strategies for complex conditions such as mental illness and heart disease.

Europe is one of the developed regions for smart life sciences manufacturing, and Industry 4.0 is the fourth revolution started in 2011 by the German government to describe the digital changes in the manufacturing process. The International Society of Pharmaceutical Engineering (ISPE) introduced Pharma 4.0 in 2017, which takes a holistic approach to the implementation of digital technology in pharmaceutical enterprises. The region has seen significant changes in smart life sciences manufacturing owing to the high implementation of smart manufacturing and collaborations among life sciences manufacturers are likely to propel the market growth in Europe in the coming years. In May 2020, Adamed Group, one of the largest pharmaceutical manufacturers in Europe, partnered with Predica for the deployment of Microsoft Azure cloud platform, including security, data analytics, machine learning, and app development. Predica designed and developed a fully extensible platform based on Azure data services and Power BI that helped Adamed generate automated forecasts and optimize its supply chain and marketing decisions. Additionally, in 2022, Hovione, one the Contract Development and Manufacturing Organization (CDMO) from Portugal, collaborated with GEA to advance continuous tableting. This strategic collaboration combines GEA’s engineering expertise with Hovione’s development and manufacturing experience, and both parties commit to partner to accelerate the adoption of continuous tableting technology.

COVID-19 pandemic has increased the adoption and implementation of smart manufacturing technologies, especially for the production of ventilators, hospital beds, drugs, and vaccines. This led to a significant change in the regulatory policies of the region for the production and approval of medical devices and drugs. The European Parliament has replaced medical device directives with regulations. Owing to the pandemic, the manufacturers have amended provisions for the application of regulations in the region. For low-risk devices, the transition period from directive to regulation is extended until May 2027, and for moderate-risk devices, the period is extended until May 2026. Also, the transition period for high-risk devices is extended until May 2025. Digital automation in medical devices helps comply with the regulation and easily process approval, which reduces the approval time and assists in timely product launches. The changing regulatory scenario, high adoption rate of digital technology in life sciences manufacturing, and rising collaborations among market players are expected to augment the Europe smart life sciences manufacturing market growth in Europe during the forecast period.

Strategic insights for the Europe Smart Life Sciences Manufacturing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Smart Life Sciences Manufacturing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Smart Life Sciences Manufacturing Strategic Insights

Europe Smart Life Sciences Manufacturing Report Scope

Report Attribute

Details

Market size in 2023

US$ 5,679.19 Million

Market Size by 2033

US$ 22052.87 Million

Global CAGR (2023 - 2033)

14.5%

Historical Data

2021-2022

Forecast period

2024-2033

Segments Covered

By Component

By Technology

By Application

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Smart Life Sciences Manufacturing Regional Insights

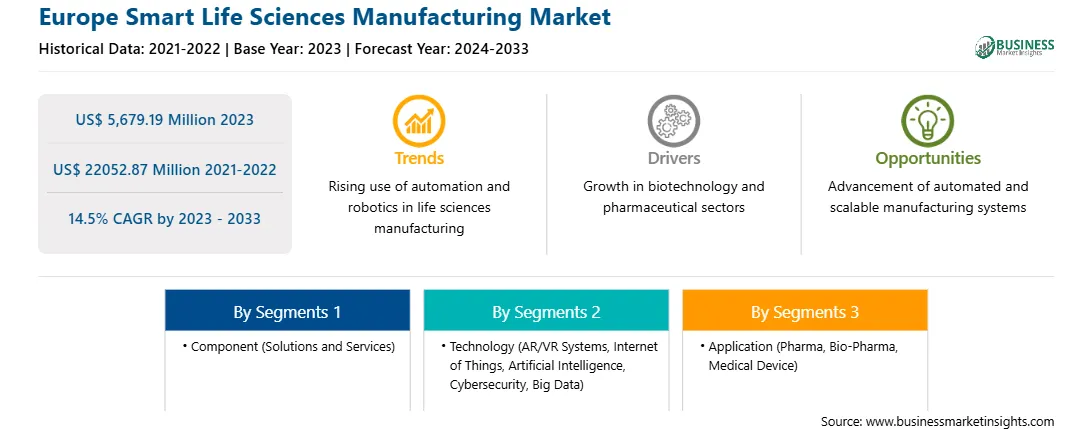

The Europe smart life sciences manufacturing market is segmented into technology, component, application, and country.

Based on component, the Europe smart life sciences manufacturing market is segmented into solutions and services. The solution segment held a larger share of the Europe smart life sciences manufacturing Market in 2023.

Based on technology, the Europe smart life sciences manufacturing market segment is categorized into AR/VR Systems, Internet of things (IoT), Artificial Intelligence (AI), Cybersecurity, Big Data, and others. The Internet of Things segment held the largest share of the Europe smart life sciences manufacturing market in 2023.

Based on application, the Europe smart life sciences manufacturing market is segmented into pharma, bio-pharma, and medical devices. The medical devices segment held the largest share of the Europe smart life sciences manufacturing market in 2023.

Based on country, the Europe smart life sciences manufacturing market is segmented into Germany, France, Italy, Spain, the UK, and the Rest of Europe. Germany dominated the Europe smart life sciences manufacturing market in 2023.

ABB Ltd, Bosch Rexroth AG, Emerson Electric Co, Fortinet Inc, General Electric Co, Honeywell International Inc, International Business Machines Corp, Rockwell Automation Inc, Siemens AG, and Sophos Ltd are some of the leading companies operating in the Europe smart life sciences manufacturing market.

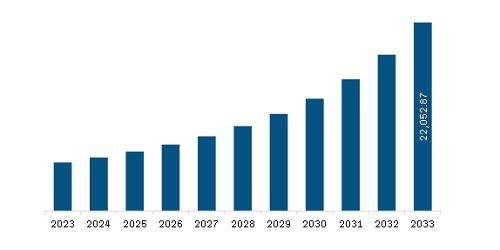

The Europe Smart Life Sciences Manufacturing Market is valued at US$ 5,679.19 Million in 2023, it is projected to reach US$ 22052.87 Million by 2033.

As per our report Europe Smart Life Sciences Manufacturing Market, the market size is valued at US$ 5,679.19 Million in 2023, projecting it to reach US$ 22052.87 Million by 2033. This translates to a CAGR of approximately 14.5% during the forecast period.

The Europe Smart Life Sciences Manufacturing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Smart Life Sciences Manufacturing Market report:

The Europe Smart Life Sciences Manufacturing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Smart Life Sciences Manufacturing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Smart Life Sciences Manufacturing Market value chain can benefit from the information contained in a comprehensive market report.