According to Oberlo, an e-commerce company, the global count of smartphone users is estimated to reach ~6.8 billion in 2023, recording a 4.2% increase compared to 2022. From 2016 to 2023, the total number of global smartphone users has increased by an average of 9.5% annually. Oberlo also assumes that the global number of smartphone users would continue to rise and reach 7.1 billion by 2024. Such a large scale of smartphone adoption indicates people’s dependency on these devices, which is likely to benefit the Europe smart door lock market, as owners can control these locks by using mobile apps installed on their smartphones. Considering this, various market players provide smart locks that can be specifically operated via smartphones. For example, the YDM 4115-A smart lock by Yale features a fingerprint pin code, key override, Bluetooth connectivity, and remote access through the Yale Access app. Similarly, LAVNA Locks provides LAVNA Smart Digital Lock L-A28 with Bluetooth connectivity, which can be accessed through a mobile app, fingerprint sensor, PIN, OTP, RFID card, and manual key. Further, Denler provides Denler DL04 smart lock, a Wi-Fi-enabled smart lock that can be remotely accessed by owners using a mobile phone app to unlock the door. Other unlocking options offered by this lock include a fingerprint scanner, RFID card, PIN, and manual key. In November 2022, Samsung, with its partner Zigbang, unveiled ultrawideband communication-based (UWB-based) smart door locks. This new smart lock is powered by a UWB chip which can be opened without touching the linked smartphone, as the lock detects a digital house key in the Samsung wallet on the phone. Thus, the rising smartphone adoption worldwide is raising the demand for smart locks, bolstering the growth of the Europe smart door lock market.

The smart door locks market in Europe is sub segmented into France, Germany, Italy, Russia, the UK, and the Rest of Europe. Western Europe is a highly developed region, hosting several types of businesses. Additionally, a rapid digital transformation supports the growth of the Europe smart door lock market in Europe. A well-established manufacturing industry in the region adopts cutting-edge technologies such as the Internet of Things (IoT), the Industrial Internet of Things (IIoT), and Industry 4.0. As a result, globally leading enterprises collaborate with European companies to leverage the well-developed infrastructure in this region. In March 2023, iLOQ, a Finnish company offering smart locking and secure access solutions for buildings and properties, signed a global Master Supply Agreement with Honeywell Building Technologies. Under this agreement, Honeywell agreed to purchase access management solutions from iLOQ.

The demand for smart homes has increased substantially in Europe over the past five years due to the rising penetration of smartphone and other smart devices. Smart home applications comprise advanced security aspects, which include smart locks and cameras along with other smart features. People in the region are adopting systems with innovative security features integrated into their smart homes and considering it as a value-added service for the high quality of living. Such factors are encouraging smart lock providers to introduce innovative locking solutions, which in turn is boosting the growth of the market. The adoption of technologies such as Wi-Fi and Bluetooth, which are integrated within smart locks, are also steeply growing. Bluetooth and Wi-Fi technologies have been establishing new markets and pushing the limits of wireless communication in Europe. Once the smart lock is connected with Bluetooth and Wi-Fi technology, it can be further integrated with smartphone, smart home hub, or with the internet.

Strategic insights for the Europe Smart Door Lock provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

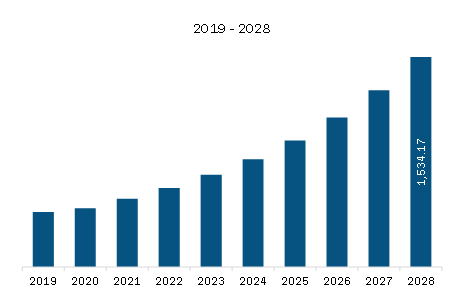

| Market size in 2023 | US$ 670.27 Million |

| Market Size by 2028 | US$ 1,534.17 Million |

| Global CAGR (2023 - 2028) | 18.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Smart Door Lock refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe smart door lock market is segmented into product, technology, end user, and country.

Based on product, the Europe smart door lock market is segmented into fingerprint locks, remote locks, and electronic cipher locks. In 2023, the electronic cipher locks segment registered a largest share in the Europe smart door lock market.

Based on technology, the Europe smart door lock market is segmented into wi-fi, Bluetooth, Z wave, and others. In 2023, Bluetooth segment registered a largest share in the Europe smart door lock market.

Based on end user, the Europe smart door lock market is bifurcated into commercial and residential. In 2023, the commercial segment registered a larger share in the Europe smart door lock market.

Based on country, the Europe smart door lock market is segmented into France, Germany, the UK, Italy, Russia, and the Rest of Europe. In 2023, Germany segment registered a largest share in the Europe smart door lock market.

ADEL Marketing (M) Sdn Bhd; Allegion Plc; Assa Abloy AB; Honeywell International Inc; Master Lock Company LLC; and Spectrum Brands Holdings Inc are the leading companies operating in the Europe smart door lock market.

The Europe Smart Door Lock Market is valued at US$ 670.27 Million in 2023, it is projected to reach US$ 1,534.17 Million by 2028.

As per our report Europe Smart Door Lock Market, the market size is valued at US$ 670.27 Million in 2023, projecting it to reach US$ 1,534.17 Million by 2028. This translates to a CAGR of approximately 18.0% during the forecast period.

The Europe Smart Door Lock Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Smart Door Lock Market report:

The Europe Smart Door Lock Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Smart Door Lock Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Smart Door Lock Market value chain can benefit from the information contained in a comprehensive market report.