Exercising at home during the COVID-19 lockdown has become mandatory for fitness enthusiasts, due to which the demand for smart bikes in the market has also increased. To provide comfort to people, smart bike manufacturers have upgraded their products. For instance, in November 2021, Muoverti launched a TiltBike, enabling riders to balance and steer, accelerate and brake, and fully engage their body to simulate the riding experience. Similarly, other manufacturers have developed smart bikes to provide riders with a significant outdoor riding experience while actually being indoors. Some of these bikes are Wattbike, Flexbike, PowerMax BS -130, Joroto Indoor Cycle, and others. Wattbike provides accurate data, polar view, real ride feel technology, Handlebar Height, etc., thus giving the sensation of riding on the road. Flexbike is a Bluetooth-enabled smart bike. The Flexnest's app provides 3 types of bike workouts: Quick, virtual, and class ride.

The PowerMax BS -130 has adjustable handlebars and high-density padded seats, which offers users a customizable experience. Also, Joroto Indoor Cycle is a fully adjustable bike with a 2-way adjustable handlebar and 4-way adjustable seat. It also has an easy-read digital monitor to track workout data, such as workout time, RPM, distance, speed, and calories burned.

In addition, market players have launched various new software applications to enhance the user experience. For instance, Zwift allows indoor cyclists to join group rides where they can measure themselves against others worldwide. Also, it has the feature of messaging others, thus helping interact with other users. Moreover, Bowflex offers Netflix, Disney Plus, and HBOMax, among other things, thus keeping the rider engaged while doing the workout. Thus, the rising demand for technologically advanced smart bikes is boosting the market.

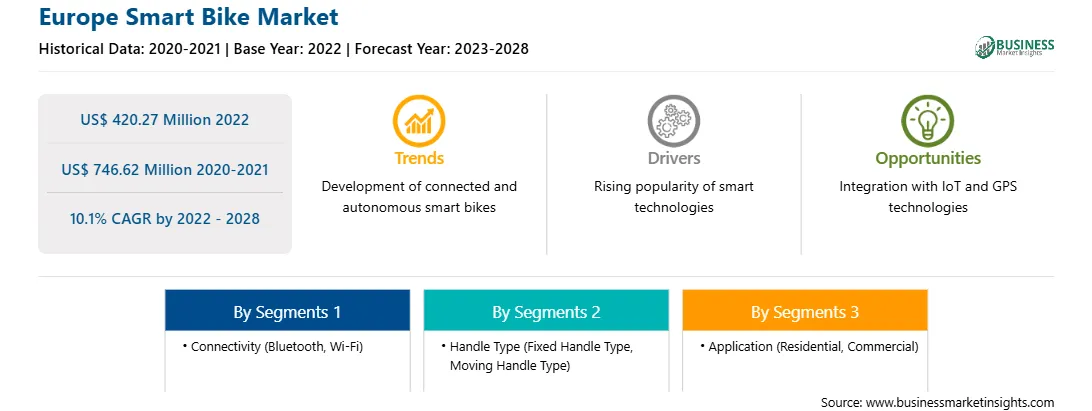

Market Overview

Europe smart bike market is spread across Germany, France, the UK, Italy, Russia, and the Rest of Europe. Europe is the second largest shareholder in the smart bike market and is expected to hold its position till 2028. The region is known to adopt technology at a fast pace and also is a leading innovator. Additionally, inhabitants of the region are known to adopt new technologies quickly. The demand for smart bikes has rapidly grown due to such features in Europe.

With the heightened demand, the number of smart bike start-ups has also been rising in the region, aiming to acquire market share from leading companies while providing their hardware at competitive prices. The pandemic also promoted such trends. As people spent more time indoors, owing to pandemic-related temporary movement restrictions, the need to maintain fitness and health led to a huge spike in demand for smart bikes. Apex Rides Ltd., a UK-based smart bike start-up, seized this opportunity and sold 2,500 bikes in 2020, their first year in business. However, they could not cater to most of the demand due to pandemic-related supply chain disruptions. Such trends indicate how fast the smart bike market is expanding in this region.

Furthermore, due to the increasing demand for smart bikes in Europe, manufacturers such as Peloton have added European scenic rides into their subscription-based apps. Scenic rides allow the users to visualize the specific scenes on the inbuilt screen of the bike or connected smartphones or tablets while using the bike. Such integrations aim to increase the attractiveness of smart bikes among European customers. These trends can further boost the demand for smart bikes in Europe in the coming years. However, growth rates in 2022 and 2023 are expected to be on the lower side, owing to higher inflation, leading to lower consumer spending, and easing pandemic-related restrictions.

Strategic insights for the Europe Smart Bike provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 420.27 Million |

| Market Size by 2028 | US$ 746.62 Million |

| Global CAGR (2022 - 2028) | 10.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Connectivity

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Smart Bike refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe smart bike market is segmented into connectivity, handle type, and application, and country.

Based on connectivity, the market is sub segmented into Bluetooth and wi-fi. The Bluetooth segment held a larger market share in 2022.

Based on handle type, the market is segmented into fixed handle type and moving handle type. The fixed handle type segment held a larger market share in 2022.

Based on application, the market is segmented into residential and commercial. The residential segment held a larger market share in 2022.

Based on country, the market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. Germany dominated the market share in 2022.

Echelon Fitness Multimedia, LLC.; Garmin Ltd.; Johnson Health Tech; Keiser Corporation; Life Fitness; MAD DOGG ATHLETICS; Nautilus, Inc.; Peloton Interactive, Inc.; and Wahoo Fitness are the leading companies operating in the smart bike market in the region.

The Europe Smart Bike Market is valued at US$ 420.27 Million in 2022, it is projected to reach US$ 746.62 Million by 2028.

As per our report Europe Smart Bike Market, the market size is valued at US$ 420.27 Million in 2022, projecting it to reach US$ 746.62 Million by 2028. This translates to a CAGR of approximately 10.1% during the forecast period.

The Europe Smart Bike Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Smart Bike Market report:

The Europe Smart Bike Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Smart Bike Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Smart Bike Market value chain can benefit from the information contained in a comprehensive market report.