Illicit firearms, small arms and light weapons contribute to instability and violence in Europe and its immediate neighborhood. Consequently, on 13 June, 2018, the High Representative of the Union for Foreign Affairs and Security Policy and European Commission issued a Joint Communication on elements for an EU Strategy against illicit firearms, light weapons and small arms, and their ammunition in order to progress towards a genuine and effective Security Union. Therefore, the EU has adopted a multifaceted modernization program to achieve a higher degree of military capability. This has resulted in commencement of several procurement programs in Europe for advanced weaponry and compatible ammunition. European region recently had to undergo a financial crisis which has prompted major defense spenders in the region to reduce military spending. However, the military spending in both Central and Western Europe increased in 2017 and 2018, which may reflect a need to combat terrorism. Therefore, participation in peacekeeping operations, prevention of terrorism, efforts to secure trade routes and soldier modernization programs, which include small arms and ammunition procurement, are expected to drive the market over the forecast period. The European countries are engaged in procurement of artillery and mortar systems to safeguard their borders against illegal trespassing and several forms of trafficking, thereby creating a significant demand for ammunition. In addition, Europe witnesses a strong presence of several market players such as BAE Systems, Nammo AS, RAUG Group, and Nexter that contribute to the market growth. For instance, in November 2020, UK Ministry of Defense (MoD) announced that munitions worth US$ 3.2 billion will be supplied to by BAE Systems over 15 years in a single-source deal to the British military. Furthermore, growing investments in Europe from private defense companies for the development of advanced caliber is anticipated to drive the market growth.

In case of COVID-19, Europe is highly affected specially Russia. Europe is on the verge of a recession due to the COVID-19 pandemic, which will dwarf the economic downturn that followed the 2008 financial crisis. The consequences for national defense sectors could be disastrous. However, because the crisis and response are still in their early stages, governments can reduce the impact on defense. EU and NATO member states must act jointly and decisively to protect political and defense priorities. Defense spending in European countries will be around US$ 2.88 billion in 2021, according to a defense intelligence firm, janes.com, down by 0.97% from 2020. The United Kingdom, France, and Germany each contribute up to 50% of their total defense spending to the European Union (EU). Due to the impact of COVID 19, these countries were forced to reduce their military spending, resulting in a reduction in the European defense sector.

Strategic insights for the Europe Small Caliber Ammunition provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

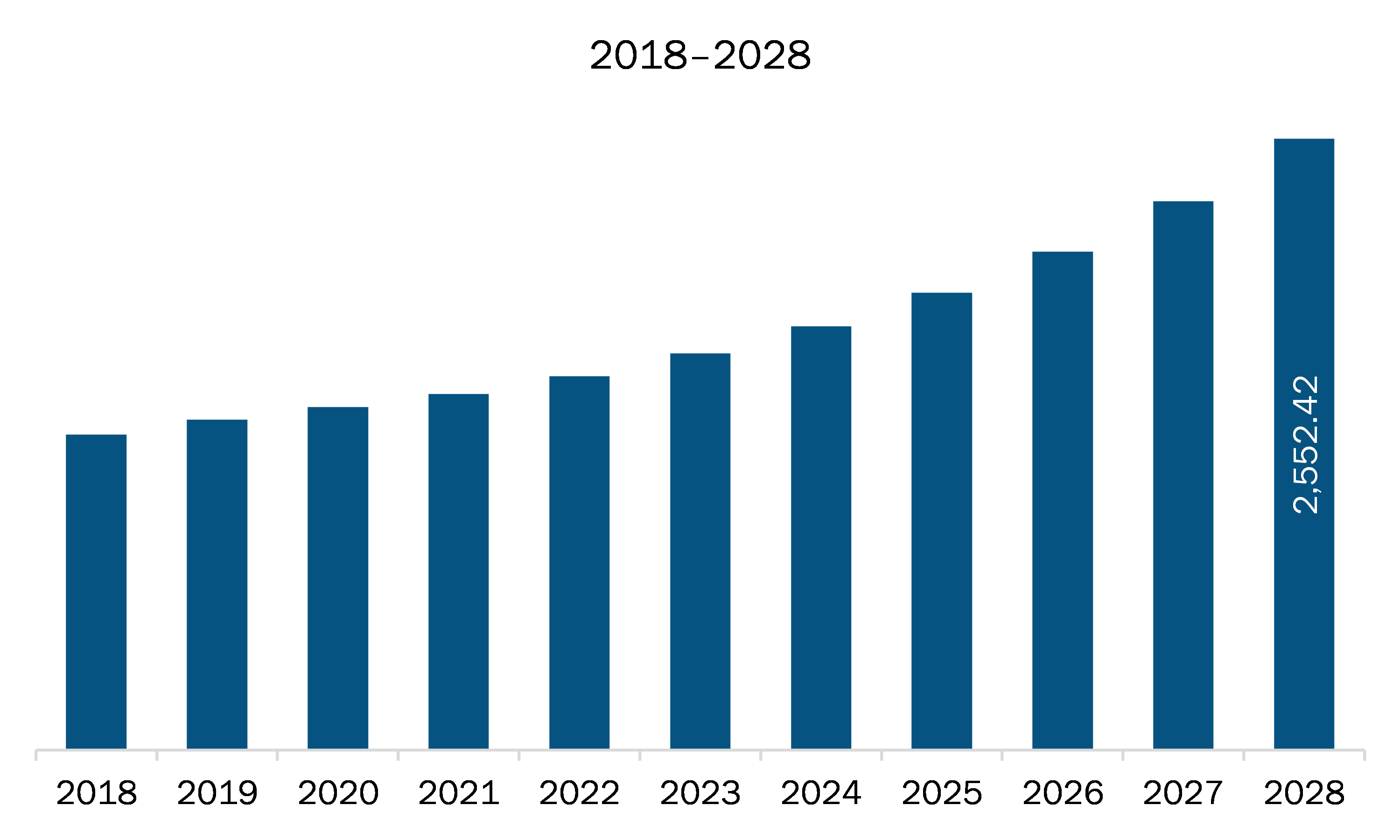

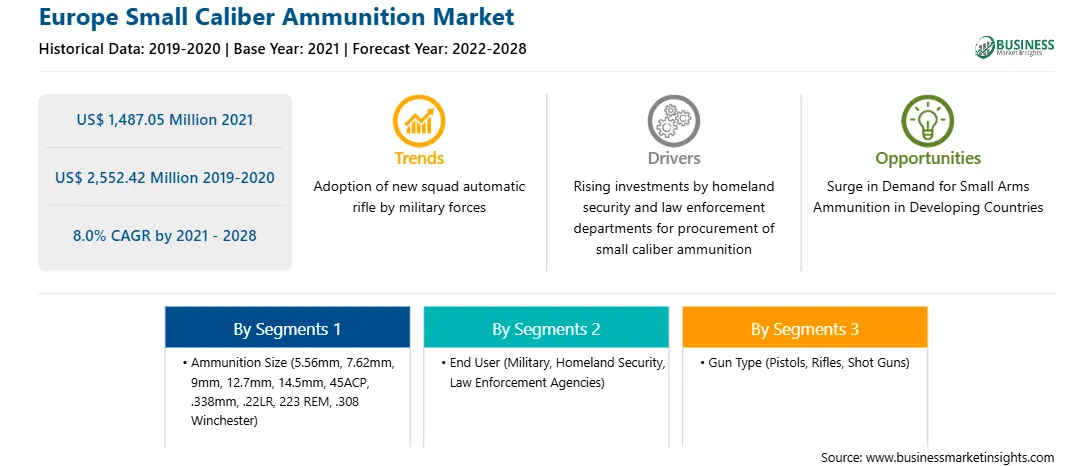

| Market size in 2021 | US$ 1,487.05 Million |

| Market Size by 2028 | US$ 2,552.42 Million |

| Global CAGR (2021 - 2028) | 8.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Ammunition Size

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Small Caliber Ammunition refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe small caliber ammunition market is expected to grow from US$ 1,487.05 million in 2021 to US$ 2,552.42 million by 2028; it is estimated to grow at a CAGR of 8.0% from 2021 to 2028. Growing adoption of new squad automatic rifle by military forces will fuel the market growth. The military forces across Europe region are focusing on adopting revolutionary new bullet designs like the cased-telescoped offering increased lethality but also weight savings for overburdened infantry soldiers. In addition, rapid prototyping has led to the development of new automatic rifles that could replace existing M249. Further, the armies across Europe region are planning to move to field a new squad automatic rifle. The new automatic rifle would fire a 6.8 mm round which the service and representatives from industry who are competing for the contract to build it are embracing. The 6.8mm caliber is developed to address the shortcomings of 5.6mm caliber. This is anticipated to fuel the growth of Europe small caliber ammunition market in the near future. In addition, as per a poll conducted in 2020, by the Verdict Media Limited, the NATO members across Europe region will adopt the 6.8mm weapons in the next decade, thereby contributing to the Europe small caliber ammunition market growth.

In terms of ammunition size, the 9mm segment accounted for the largest share of the Europe small caliber ammunition market in 2020. In terms of end user, the military segment held a larger market share of the Europe small caliber ammunition market in 2020. Further, the pistols segment held a larger share of the Europe small caliber ammunition market based on gun type in 2020.

A few major primary and secondary sources referred to for preparing this report on the Europe small caliber ammunition market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BAE Systems Plc, CBC Global Ammunition, Denel PMP, Elbit Systems Ltd., FN HERSTAL, NAMMO AS, and Northrop Grumman Corporation.

The Europe Small Caliber Ammunition Market is valued at US$ 1,487.05 Million in 2021, it is projected to reach US$ 2,552.42 Million by 2028.

As per our report Europe Small Caliber Ammunition Market, the market size is valued at US$ 1,487.05 Million in 2021, projecting it to reach US$ 2,552.42 Million by 2028. This translates to a CAGR of approximately 8.0% during the forecast period.

The Europe Small Caliber Ammunition Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Small Caliber Ammunition Market report:

The Europe Small Caliber Ammunition Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Small Caliber Ammunition Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Small Caliber Ammunition Market value chain can benefit from the information contained in a comprehensive market report.