Silicon carbide is also known as carborundum is a semiconductor material widely used in electronics and semiconductor industries. The different physical and chemical properties of silicon carbide ensure its use in varied application industries. The physical hardness of silicon carbide makes it fit for use as an abrasive in different processes such as honing, water jet cutting, grinding, and sand blasting. Silicon carbide is also used in oilfield applications such as components of pumps used to drill and extract the oil. Rising demand for silicon carbide in various application industries has led to an increase in the investments by manufacturers, governments, and research institutes in the production of silicon carbide. Economically strong countries like Germany, the UK, and Russia have witnessed significant growth in the implementation of technologically advanced solutions. Other than the chemical industry, the other industries flourishing in the region are automotive, aerospace and aviation, military and defense, electronics and semiconductors, medical and healthcare, others, which are bolstering the growth of silicon carbide in the region. For instance, Europe’s electronics and electrical engineering sector is a large and attractive sales market. In 2016 it had a world market share of 14.6%. The energy sector, covering extraction, production, and distribution, directly employs the EU about 1.6 million people and generates an added €250 billion to the economy in the year 2019, corresponding to 4% of value-added of the non-financial EU business economy.

In case of COVID-19 outbreak, countries in Europe, especially France, reported an unprecedented rise in the number of confirmed cases, which led to the discontinuation of silicon carbide manufacturing activities, Other chemical and materials manufacturing sector has negatively impacted the demand for silicon carbide during the early months of 2020. Moreover, decline in the overall manufacturing activities has led to the discontinuation of silicon carbide components manufacturing projects, thereby reducing the demand for silicon carbide. Similar trend was witnessed in other European countries, such as Russia, the UK, Italy, Spain and Germany. However, the countries are likely to overcome this drop in demand with the economic activities regaining their pace, especially in the beginning of the 2021.

Strategic insights for the Europe Silicon Carbide provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 85.11 Million |

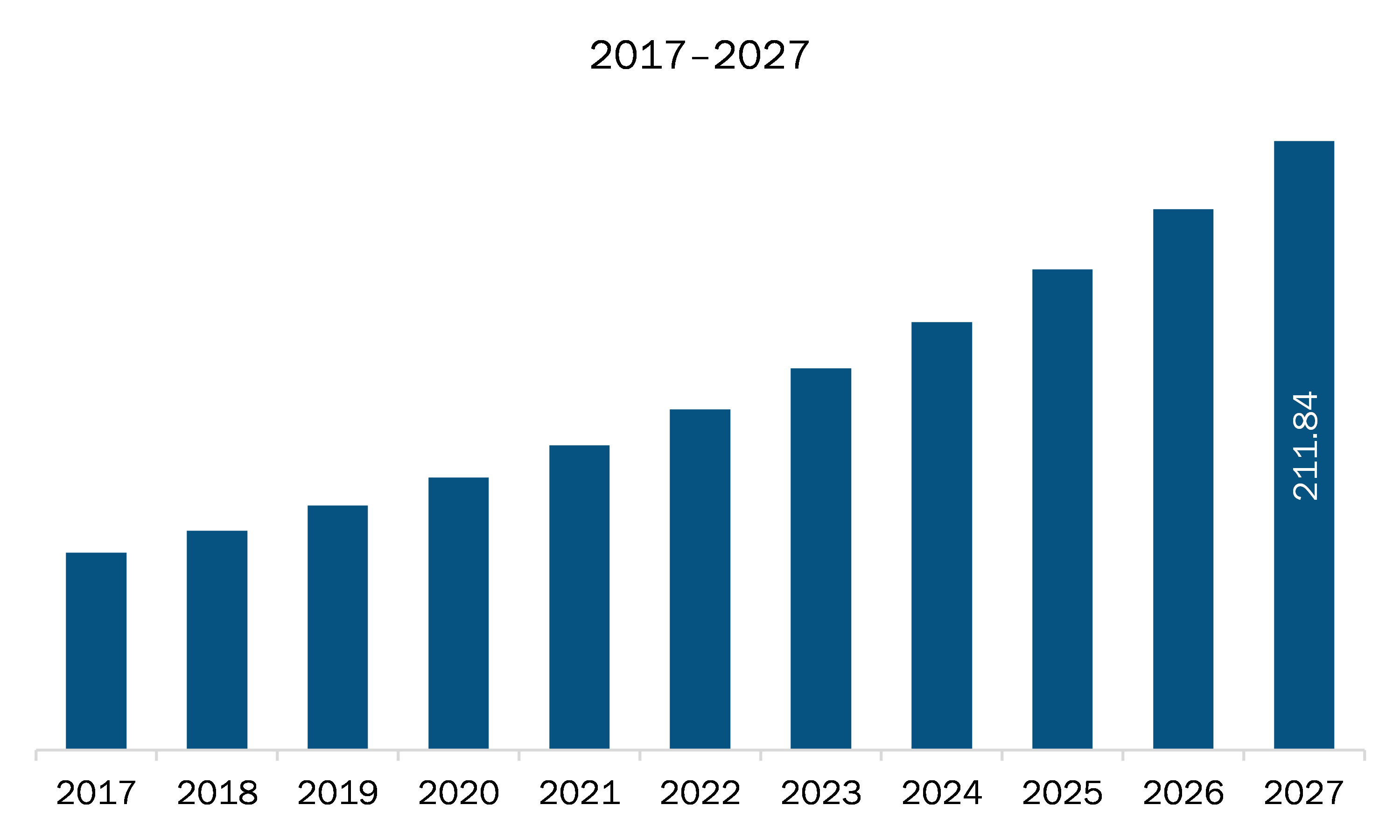

| Market Size by 2027 | US$ 211.84 Million |

| Global CAGR (2020 - 2027) | 12.2 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Silicon Carbide refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The silicon carbide market in Europe is expected to grow from US$ 85.11 million in 2019 to US$ 211.84 million by 2027; it is estimated to grow at a CAGR of 12.2 % from 2020 to 2027. Rising demand for silicon carbide in various industrial applications has compelled manufacturers, governments, and research institutes to invest more in the expansion of their silicon carbide production capabilities and geographic presence. Investment opportunities are being witnessed in both upstream and downstream sectors of the silicon carbide market. For instance, in 2018, Mersen Corporate Services SAS, a manufacturer of electrical power and advanced materials, acquired 49% of CALY Technologies with an aim to promote the development, expansion, and consolidation of the latter’s product portfolio of silicon carbide, current limiting devices, and diodes. Thus, increasing focus on growth strategies such as product innovation, expansion, partnerships, acquisitions, in both upstream and downstream markets, are offering profitable opportunities for the future growth of the silicon carbide market players.

In terms of type, the black silicon carbide segment accounted for the largest share of the Europe silicon carbide market in 2019. In terms of end-user industry, the electronics and semiconductor segment held a larger market share of the silicon carbide market in 2019.

A few major primary and secondary sources referred to for preparing this report on the silicon carbide market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Fiven ASA, Carborundum Universal Limited, Esd-Sic bv, Esk-Sic GmbH, Futong Industry Co. Limited, Electro Abrasives, LLC, Washington Mills, Tifor B.V., and Grindwell Norton Ltd.

The Europe Silicon Carbide Market is valued at US$ 85.11 Million in 2019, it is projected to reach US$ 211.84 Million by 2027.

As per our report Europe Silicon Carbide Market, the market size is valued at US$ 85.11 Million in 2019, projecting it to reach US$ 211.84 Million by 2027. This translates to a CAGR of approximately 12.2 % during the forecast period.

The Europe Silicon Carbide Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Silicon Carbide Market report:

The Europe Silicon Carbide Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Silicon Carbide Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Silicon Carbide Market value chain can benefit from the information contained in a comprehensive market report.