Several industrialized and emerging economies, such as Germany, France, Italy, the UK and Russia, make up Europe. In Europe, the security inspection sector is much more fragmented other regions. The growing adoption of digitization across the European region, specifically more than 77% is not only affecting the various industries to optimize their capabilities such as manufacturing, automotive, information technology and telecommunications amongst others, but have also experienced high adoption in the national security dimension. Border authorities and customs, ports, airports, and railway operators across the region collect massive security related data on daily basis, which are required to be shared between the European and Schengen government bodies for easy accessibility among police and other judicial authorities. Thus, high demand of security data among the region is influencing the adoption of technologically advanced security inspection systems. The Full-body X-ray screening systems at high Demand across important facilities is expected to create a significant demand for security inspection in the coming years, which is further anticipated to drive the Europe security inspection market.

Furthermore, COVID-19 is having a bad impact over the Europe region. As selected countries observed a rise in the number of reported COVID-19 cases and subsequently experienced strict as well as longer lockdown periods or social isolation, the effect of COVID-19 varied from country to country across the European region. However, owing to a strong healthcare system, Western European countries such as Germany, France, Russia, and the UK have seen a comparatively modest decrease in their development activities across the security sector. With a negative economic growth rate in the first half of 2020, the European economy is projected to contract. It is expected that countries such as the UK, Italy, and Germany would have a greater effect on the economy compared to other European countries. The imbalance in the demand and supply side of security screening solutions, and the lockdown phase in several European countries will have the significant negative impact on the security inspection market in the first half of year 2020. However, the upliftment of lockdowns have led to start of trade and travel; thereby, expected to influence the growth of the market with the adoption of new technologies to ensure safety and security of its population.

Strategic insights for the Europe Security Inspection provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

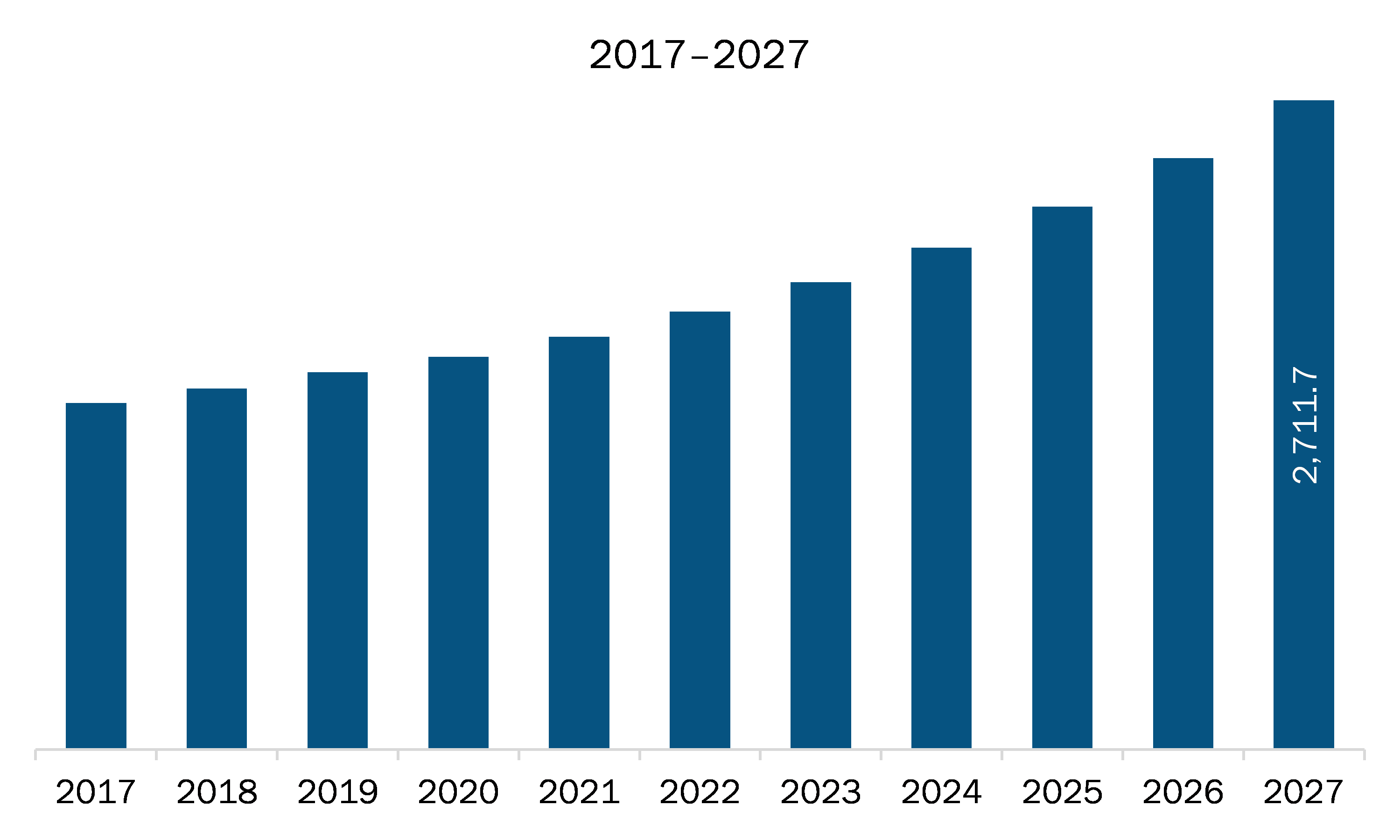

| Market size in 2019 | US$ 1,575.6 Million |

| Market Size by 2027 | US$ 2,711.7 Million |

| Global CAGR (2020 - 2027) | 7.5% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Security Inspection refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The security inspection market in Europe is expected to grow from US$ 1,575.6 million in 2019 to US$ 2,711.7 million by 2027; it is estimated to grow at a CAGR of 7.5% from 2020 to 2027. Increasing demand for real-time treat detection to offer much safer environment in airports, railway stations, country borders, and other crowed places is influencing the investment in technologies such as artificial intelligence by major market players. For instance, Gatekeeper Security, Inc. has developed artificial intelligence powered vehicle inspection security for screening vehicles across various industries such as energy, and transportation amongst others to detect threat in real-time and take action accordingly. The solutions enable under vehicle inspection, automatic number plate reader, and 360-degree vehicle scanning capabilities to ensure no threat across the facilities and the vehicles. Therefore, rise in investment in technology is expected to fuel the growth of the Europe security inspection market.

In terms of product type, the personnel screening systems segment accounted for the largest share of the Europe security inspection market in 2019. In terms of application, the aviation segment held a larger market share of the Europe security inspection market in 2019.

A few major primary and secondary sources referred to for preparing this report on the security inspection market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ADANI; Analogic Corporation; C.E.I.A. SpA; EAS Envimet Analytical Systems Ges.m.b.H.; Gilardoni S.p.A.; Leidos; Nuctech Company Limited; OSI Systems, Inc.; Smiths Group plc; unival group GmbH.

Some of the leading companies are:

The Europe Security Inspection Market is valued at US$ 1,575.6 Million in 2019, it is projected to reach US$ 2,711.7 Million by 2027.

As per our report Europe Security Inspection Market, the market size is valued at US$ 1,575.6 Million in 2019, projecting it to reach US$ 2,711.7 Million by 2027. This translates to a CAGR of approximately 7.5% during the forecast period.

The Europe Security Inspection Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Security Inspection Market report:

The Europe Security Inspection Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Security Inspection Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Security Inspection Market value chain can benefit from the information contained in a comprehensive market report.