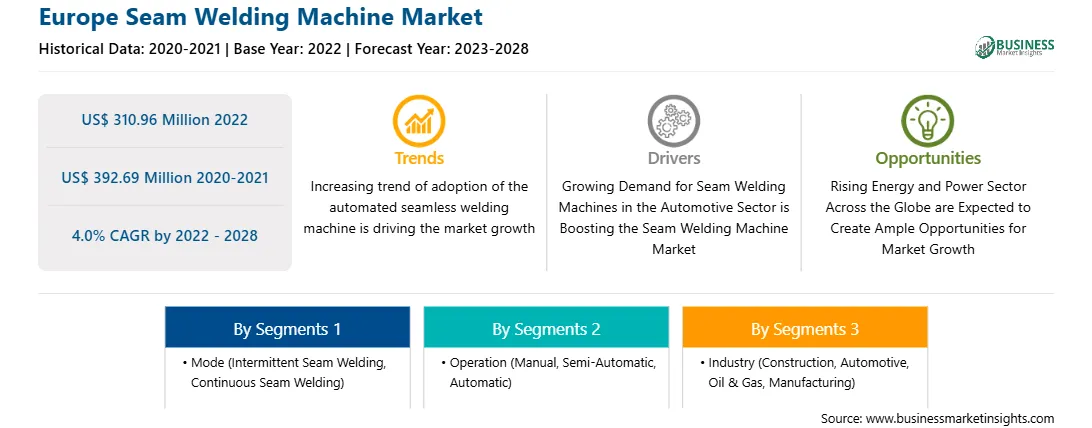

The seam welding machine market in Europe is expected to grow from US$ 310.96 million in 2022 to US$ 392.69 million by 2028. It is estimated to grow at a CAGR of 4.0% from 2022 to 2028.

Increasing Adoption in Energy, Shipbuilding, and Construction Industries

Robust expansion of the global energy (the wind power sector in particular), shipbuilding, and construction industries will provide robust growth for the seam welding machine market in the long term. Further, the growing demand for steel and other metal products in shipbuilding and construction sectors is boosting the use of innovative seam welded steel, which is anticipated to fuel the market growth. Moreover, the rising growth in aerospace, automotive, transportation, and shipbuilding industries is boosting the high growth in the seam welding machine market. The seam welding machine has high growth prospects in the shipbuilding construction business.

Market Overview

The European seam welding machine market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The economically strong countries, including Germany, Italy, the UK, and Spain, have witnessed significant growth in demand for seam welding machines owing to a rise in construction projects in the commercial, residential, and industrial sectors. The residential construction market in Germany is expected to grow owing to increasing urbanization at a faster pace, further leveraging the demand for welded products that helps drive the market growth. According to the reported news in Germany, 3.6 billion migrants are expected to arrive in Germany by 2024; thus, Germany needs at least 350,000 additional homes annually. Therefore, the German government has established the Housing Construction Campaign, a comprehensive package of policies targeting housing shortages and rising house prices, to alleviate pressure on the housing market. Per the Euroconstruct, the number of permits for new nonresidential buildings has skyrocketed, and double-digit growth is expected across European countries. The European Commission’s Renovation Wave

aims to renovate thirty-five million buildings during the forecast period. The Crown Round III Offshore Wind Farm Development, Madrid Metro Expansion, Corridor 11 Pozega to Boljare Motorway, Krampnitz Housing Development, and Nantes New CHU Hospital Development are among the major construction projects lined-up in Europe with an approximate investment worth US$ 12.66 billion in 2022. According to the European Climate, Infrastructure and Environment Executive Agency, ~135 transport infrastructure projects have been selected for EU grants, totaling US$ 5.26 billion. These projects will likely boost the EU’s railway network, including cross-border links and connections to ports and airports. Under the CEF Transport program (2021–2027), US$ 25.17 billion are available for the transition of the preceding projects in the EU Member States. Since 2014, CEF has supported over 1030 projects in the transport sector for a total amount of US$ 22.44 billion. Thus, such a rise in the number of industrial, transportation, and other construction projects is augmenting the demand for seam welding machines in Europe.

Europe Seam Welding Machine Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the Europe Seam Welding Machine provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Seam Welding Machine refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Europe Seam Welding Machine Strategic Insights

Europe Seam Welding Machine Report Scope

Report Attribute

Details

Market size in 2022

US$ 310.96 Million

Market Size by 2028

US$ 392.69 Million

Global CAGR (2022 - 2028)

4.0%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Mode

By Operation

By Industry

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Seam Welding Machine Regional Insights

Europe Seam Welding Machine Market Segmentation

The Europe seam welding machine market is segmented into mode, operation, industry, and country. Based on mode, the Europe seam welding machine market is segmented into intermittent seam welding and continuous seam welding segment. The continuous seam welding segment accounted for the larger share of the seam welding machine market in 2022.

Based on operation, the Europe seam welding machine market is segmented into manual, semi-automatic and automatic segment. The automatic segment accounted for the largest share of the seam welding machine market in 2022.

Based on industry, the Europe seam welding machine market is categorized into construction, automotive, oil and gas, manufacturing, and others. The construction segment accounted for the largest share of the seam welding machine market in 2022.

Based on country, the market is segmented into France, Germany, Italy, the UK, Russia, and the Rest of Europe. Germany dominated the market in 2022.

A.C.T Otomotiv Müh. Dan. San. Tic. Ltd. Şti.; Emerson Electric Co; LEISTER TECHNOLOGIES; Schnelldorfer Maschinenbau GmbH; and SPIRO INTERNATIONAL Inc are the leading companies operating in the seam welding machine market in the region.

The Europe Seam Welding Machine Market is valued at US$ 310.96 Million in 2022, it is projected to reach US$ 392.69 Million by 2028.

As per our report Europe Seam Welding Machine Market, the market size is valued at US$ 310.96 Million in 2022, projecting it to reach US$ 392.69 Million by 2028. This translates to a CAGR of approximately 4.0% during the forecast period.

The Europe Seam Welding Machine Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Seam Welding Machine Market report:

The Europe Seam Welding Machine Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Seam Welding Machine Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Seam Welding Machine Market value chain can benefit from the information contained in a comprehensive market report.