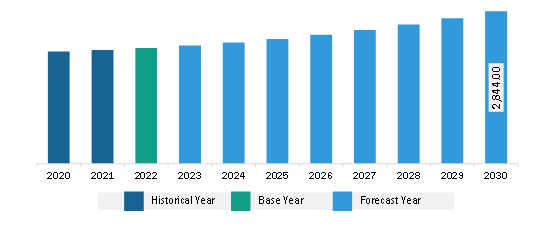

The Europe sealants market was valued at US$ 2,154.90 million in 2023 and is anticipated to reach US$ 2,844.00 million by 2031; it is estimated to register a CAGR of 3.5% from 2023 to 2031.

The automotive industry is experiencing robust growth owing to technological advancements and an upsurge in preference for SUVs, crossovers, and other light trucks. As per the European Automobile Manufacturers’ Association (ACEA) report published in January 2023, car production in North America upsurged by 10.3%, reaching 10.4 million units in 2022 compared to 2021. Similarly, passenger car production in South Korea reached 3.4 million units in 2022, an increase of 7.6% compared to 2021. The report published by the ACEA stated that passenger car production across the world accounted for 68 million units in 2022, recording a rise of 7.9% compared to 2021.

As per the data of the Organisation Internationale des Constructeurs d'Automobiles (OICA), countries in North America, South America, and Central America recorded production of over 16.1 million commercial and passenger cars in 2021; the figure grew by 10%, registering over 17.7 million cars in 2022. Companies operating in the automotive sector invest heavily in automobile manufacturing to increase production and sales. According to the International Energy Agency's annual Global Electric Vehicle Outlook, over 10 million electric cars were sold worldwide in 2022, and the sale is projected to grow by 35% in 2023 to reach 14 million.

Sealants are used in different automobile components and induction systems and aid in sealing moisture, dust, and contaminants. In exterior automotive applications, sealants are used for structural bonding, lamp assembly, and glass bonding. Sealants are utilized in the sealing of vehicle body joints and seams, stationary vehicle glass such as windshields, and quarter glass. The sealant applications across the automotive industry include aluminum vehicle doors, hydrogen cars, vehicle sensors, vehicle lighting systems, and powertrains. Thus, the rising demand from the automotive industry drives the Europe sealants market growth.

Sweden, the Netherlands, Poland, Belgium, and Denmark are among the major countries in the Rest of Europe sealants market. Infrastructure development and other construction activities in these countries generate a high demand for sealants. As these nations invest notably in modernizing and expanding their urban areas, there is a heightened requirement for bonding and soundproofing materials in construction applications. Thus, ongoing urbanization and infrastructure development have increased construction and transportation activities across the Rest of Europe. The automotive industry in the Rest of European countries also generates a significant demand for sealants.

Strategic insights for the Europe Sealants provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2,154.90 Million |

| Market Size by 2031 | US$ 2,844.00 Million |

| Global CAGR (2023 - 2031) | 3.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

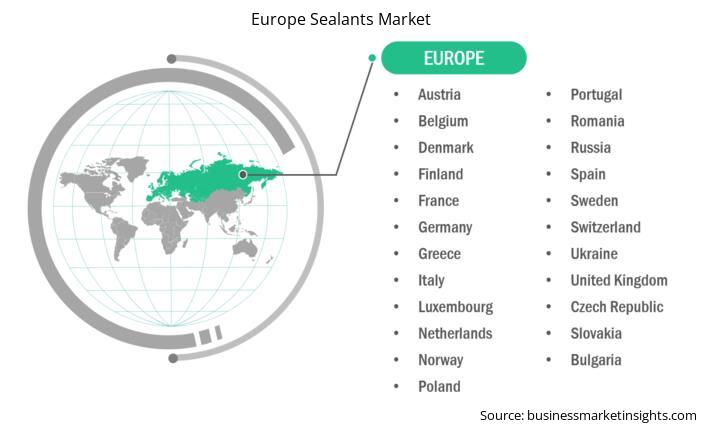

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Sealants refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe sealants market is categorized into type, application, end-use industry, and country.

Based on type, the Europe sealants market is segmented into silicone sealants, polyurethane sealants, acrylic sealants, polysulfide sealants, butyl sealants, hybrid sealant, and others. The silicone sealants segment held the largest market share in 2023. Furthermore, hybrid sealant is divided into silane modified polymer sealants, polyurethane modified acrylic sealants, and others.

In terms of application, the Europe sealants market is categorized into waterproofing, insulation, bonding and sealing, soundproofing, and others.

Based on end-use industry, the Europe sealants market is segmented into building & construction, automotive, electronics, healthcare, aerospace & defense, marine, energy & power, and others.

By country, the Europe sealants market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The Rest of Europe dominated the Europe sealants market share in 2023.

3M Co, ACTEGA DS GmbH, Arkema SA, BASF SE, Dow Inc, HB Fuller Co, Henkel AG & Co KGaA, Momentive Performance Materials Inc, RPM International Inc, and Sika AG are some of the leading companies operating in the Europe sealants market.

The Europe Sealants Market is valued at US$ 2,154.90 Million in 2023, it is projected to reach US$ 2,844.00 Million by 2031.

As per our report Europe Sealants Market, the market size is valued at US$ 2,154.90 Million in 2023, projecting it to reach US$ 2,844.00 Million by 2031. This translates to a CAGR of approximately 3.5% during the forecast period.

The Europe Sealants Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Sealants Market report:

The Europe Sealants Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Sealants Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Sealants Market value chain can benefit from the information contained in a comprehensive market report.