Synthetic oil-based robotics lubricants are widely used in industrial operations and the automotive sector, owing to their advantages. Polyalphaolefin lubricant is the most common synthetic oil utilized in robots in automotive and industrial sectors. It possesses optimum physical and chemical properties, such as high viscosity index, low volatility, low pour point, and thermal stability. Synthetic lubricants are chemically modified and preferred over mineral oil. Robotics lubricant manufacturers prefer synthetic base oil to reduce dependency on nonrenewable resources such as petroleum and crude oil. Several robotics lubricant manufacturers are focused on research and development of synthetic lubricant formulations to provide improved oxidation stability. Further, advanced lubricants have a major role in reducing carbon emissions during the manufacturing process. In the past few years, end-use industries such as automotive and electrical & electronics have launched various initiatives and policies to reduce carbon footprint and carbon emissions, which is leading to the adoption of synthetic lubricants for robotics applications. Therefore, the adoption of synthetic oil-based robotic lubricants is expected to be a major trend in the Europe robotics lubricants market during the forecast period.

According to the report released by the International Federation of Robotics 2022, the installation of robots increased in Europe by 24%, and accounted for 84,302 units in 2021. This rising demand for robot installation was witnessed by the general industry with an upsurge of 51%. The motor vehicle, metal & machinery, and automotive components sectors in Germany accounted for 6,206 units, 3,376 units, and 2,740 units of annual industrial robotic installation, respectively, in 2021. Further, the rubber & plastics and electrical & electronics sectors accounted for 1,490 and 1,154 units of annual industrial robotic installation, respectively, in the same year. According to the World Robotics Report 2022, in Europe, the operational stock of robots in 2021 was registered to be 678,706 units. The robot density has grown by 129 units per 10,000 employees and 8% CAGR in 2021, since 2016. Further, Europe marks the presence of 400 (48%) out of the total global 828 classified professional service robot producers, as of 2021.

The rising automation and constant technological innovation are fueling the demand for robots in the end-use industries such as automotive, food & beverages, metal & machinery, and plastics & chemicals. According to a report released by the International Federation of Robotics 2022, the robotic installation in the Nordic countries upsurged by 31% (3,472 units), whereas the installations in Central & Eastern Europe grew by 47% and reached 12,210 units in 2021. The rise in automation is further fueled by government initiatives and policies in Europe. According to a report by European Commission, in 2023, the EU planned to invest US$ 198 million in 2023projects related to artificial intelligence, robotics, and novel materials. The development of robotics in the region is driving the demand for pertaining businesses such as component manufacturing, robotics lubrication, and electronics. Thus, the development of the robotics industry in Europe is expected to fuel the demand for robotics lubricants during the forecast period.

Strategic insights for the Europe Robotics Lubricants provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Robotics Lubricants refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Europe Robotics Lubricants Strategic Insights

Europe Robotics Lubricants Report Scope

Report Attribute

Details

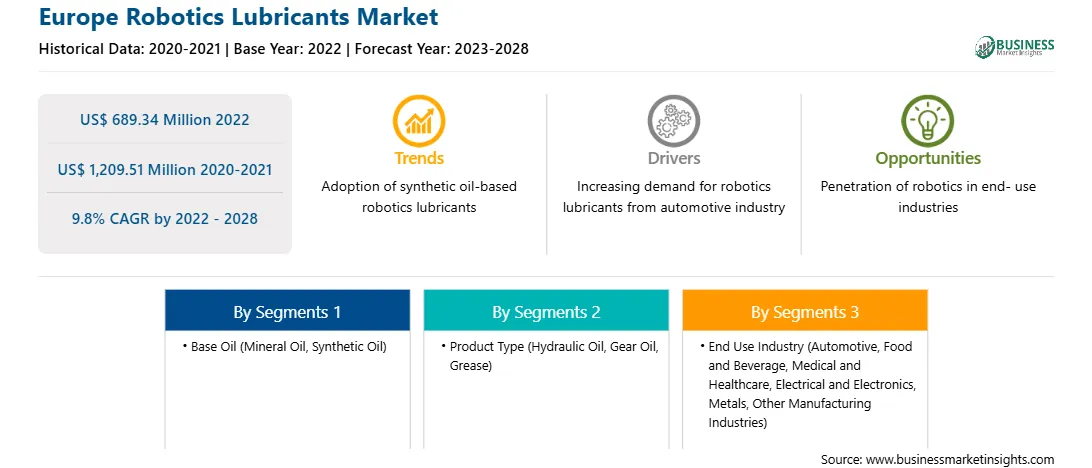

Market size in 2022

US$ 689.34 Million

Market Size by 2028

US$ 1,209.51 Million

Global CAGR (2022 - 2028)

9.8%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Base Oil

By Product Type

By End Use Industry

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Robotics Lubricants Regional Insights

Europe Robotics Lubricants Market Segmentation

The Europe Robotics lubricants market is segmented into base oil, product type, end use industry, and country.

Based on base oil, the Europe robotics lubricants market is segmented into mineral oil, synthetic oil, and others. In 2022, the mineral oil segment registered a largest share in the Europe robotics lubricants market.

Based on product type, the Europe robotics lubricants market is segmented into hydraulic oil, gear oil, and grease. In 2022, the grease segment registered a largest share in the Europe robotics lubricants market.

Based on end use industry, the Europe robotics lubricants market is segmented into automotive, food and beverage, medical and healthcare, electrical and electronics, metals, and other manufacturing industries. In 2022, the automotive segment registered a largest share in the Europe robotics lubricants market.

Based on country, the Europe robotics lubricants market is segmented into Germany, France, the UK, Italy, Russia, and the Rest of Europe. In 2022, the Rest of Europe segment registered a largest share in the Europe robotics lubricants market.

BP Plc, Fuchs Petrolub SE, Idemitsu Kosan Co Ltd, Kluber Lubrication GmbH & Co KG, Schaeffler Austria GmbH, and Shell Plc are the leading companies operating in the Europe robotics lubricants market.

The Europe Robotics Lubricants Market is valued at US$ 689.34 Million in 2022, it is projected to reach US$ 1,209.51 Million by 2028.

As per our report Europe Robotics Lubricants Market, the market size is valued at US$ 689.34 Million in 2022, projecting it to reach US$ 1,209.51 Million by 2028. This translates to a CAGR of approximately 9.8% during the forecast period.

The Europe Robotics Lubricants Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Robotics Lubricants Market report:

The Europe Robotics Lubricants Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Robotics Lubricants Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Robotics Lubricants Market value chain can benefit from the information contained in a comprehensive market report.