Europe is witnessing massive growth in the retail industry due to rising ecommerce business, which is surging sales of the industry. The region is also highly focused on adopting retail execution software, which brings data and features to the hands of the end-users in real-time. This next-gen software would help businesses in the region accelerate productivity and improve business processes at the business-user level with minimal IT support. As the retail sector has become more automated, the retail execution software has become crucial among businesses since it helps companies gain visibility of merchandise, orders, inventory, and customer demand. In the potential region such as Europe consumer packaged goods (CPG) sector has developed swiftly to meet consumer demands due to the implementation of digital technology, which has enabled several brands to establish markets by selling directly to customers. Numerous retail giants across Europe have launched their CPG marketplaces in order to capitalize on changes in consumer behavior, growing distribution channels, and the arrival of customer-centric digital brands that are taking over the CPG industry. Thus, the CPG industry's growing focus positively impacts the retail execution software market, which helps to manage in-store activities in the CPG industry. Also, Payment gateways getting integrated with retail execution software is a major factor driving the Europe retail execution software market.

Spain, Italy, Germany, the UK, and France are some of the worst affected member states in the European region due to the COVID-19 outbreak. Businesses in the region are facing severe economic difficulties as they had to either suspend their operations or reduce their activities in a substantial manner. Owing to business shutdowns, travel bans, and supply chain disruptions, the region faced an economic slowdown in 2020, which is most likely continue in 2021 as well. Italy, Spain, and Germany have implemented drastic measures and travel restrictions to limit the spread of coronavirus among their citizens. European countries represent a major market for retail execution software adoption, owing to the rising e-commerce industry. In Germany, several fashion retailers, shoe and sports shops, perfumeries, retail, and electronics stores are affected due to this pandemic; online retailers also suffered. All these factors are expected to have a direct impact on retail execution software market growth in European countries. The markets in Italy, Spain, Germany, the UK, and France are anticipated to see the adverse impact in 2020 and likely in 2021 also.

Strategic insights for the Europe Retail Execution Software provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

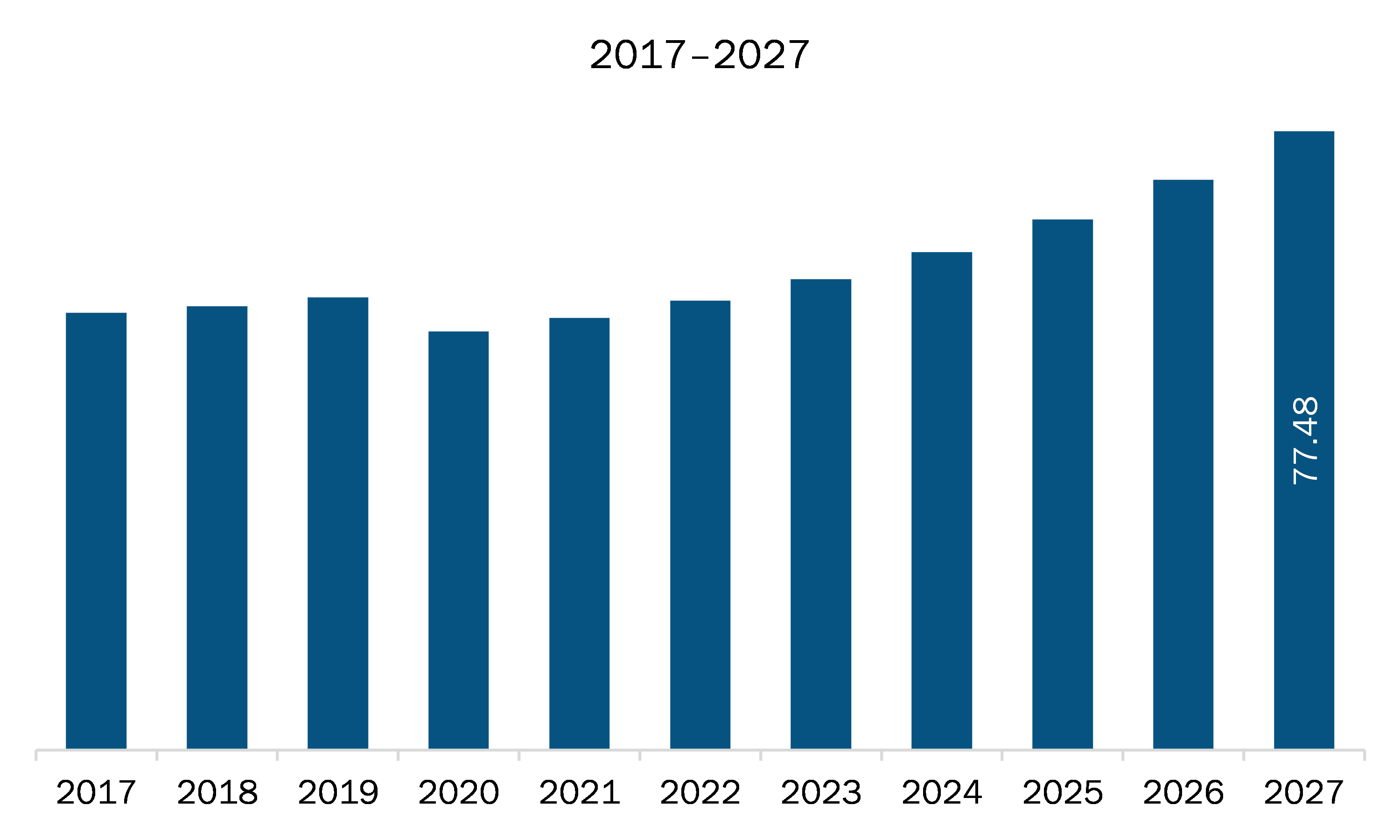

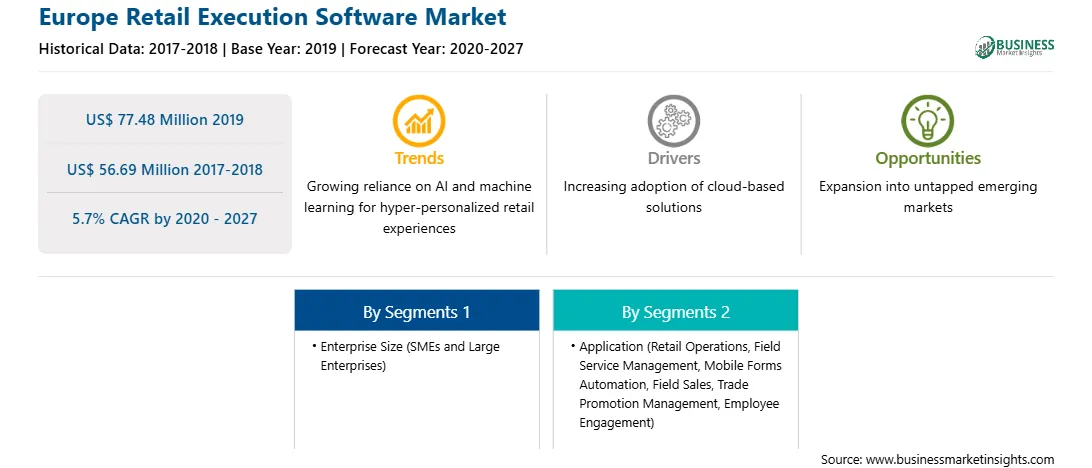

| Market size in 2019 | US$ 77.48 Million |

| Market Size by 2027 | US$ 56.69 Million |

| Global CAGR (2020 - 2027) | 5.7% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Enterprise Size

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Retail Execution Software refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The retail execution software market in Europe is expected to grow from US$ 77.48 million in 2019 to US$ 56.69 million by 2027; it is estimated to grow at a CAGR of 5.7% from 2020 to 2027. In the retail industry, several challenges occur due to imbalance between demand and resource availability, as well as inadequate area mapping. Machine learning, an application of artificial intelligence, is the foundation of the next-gen of technologies. It offers systems the ability to learn from recorded data and experiences with the use of algorithms, patterns, and predictive insights. Moreover, with the capabilities of machine learning, online retailers can swiftly acknowledge and identify customers who have been disconnected from their services. Additionally, retailers can ensure customer retention by reminding customers to reorder perishable products or share exclusive deals.

The Europe retail execution software market has been segmented into enterprise size and application. Based on enterprise size, the Europe retail execution software market is segmented into SMEs and large enterprises. Large enterprises segment held the largest market share in 2019. Based on application, the Europe retail execution software market is segmented into retail operations, field service management, mobile forms automation, field sales, trade promotion management, and employee engagement, and others. Retail operations segment held the largest market share in 2019.

A few major primary and secondary sources referred to for preparing this report on the retail execution software market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Bizom (Mobisy Technologies Private Limited; EdgeCG (StayinFront, Inc.); Intelligence Retail; Trax Technology Solutions Pte Ltd.; Valomnia; WINIT; XTEL (Kantar Group).

The Europe Retail Execution Software Market is valued at US$ 77.48 Million in 2019, it is projected to reach US$ 56.69 Million by 2027.

As per our report Europe Retail Execution Software Market, the market size is valued at US$ 77.48 Million in 2019, projecting it to reach US$ 56.69 Million by 2027. This translates to a CAGR of approximately 5.7% during the forecast period.

The Europe Retail Execution Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Retail Execution Software Market report:

The Europe Retail Execution Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Retail Execution Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Retail Execution Software Market value chain can benefit from the information contained in a comprehensive market report.