Major economies in Europe include Germany, France, Italy, the UK, and Russia, among others. The region holds significant growth opportunities for the recovered carbon black market players, owing to the huge number of waste tire generation annually. ~3 million tons of end-of-life tires (ELT) are collected across the European Union every year. Most of these tires are recycled, and one-third of them are incinerated for energy purposes. Carbon black recovered from the ELTs is a sustainable material with a variety of application lines. In 2018, the total carbon black demand of the European Union was close to 2 million tons, and 45% of this demand was met by the carbon black imported from Russia and Ukraine. A large import of new carbon black is due to the region's stringent environmental and safety regulations, which make new carbon black production more expensive in the region. Additionally, the European tire industry demands increasingly high volumes of carbon black. Rise in application range of recovered carbon black is the major factor driving the growth of the Europe recovered carbon black market.

In Europe, currently France, the UK and Russia are the worst impacted countries by the COVID-19 pandemic. It is estimated to suffer an economic hit due to a lack of revenue from various industries subjected to distortion in supply chain. The massive outbreak of the pandemic has created temporary distortion in operational efficiencies of industrial bases in the European market. Several industrial bases such as automotive, chemical and others have been impacted by the pandemic, which had a direct impact upon the demand for recovered carbon black in the regional market.

Strategic insights for the Europe Recovered Carbon Black provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

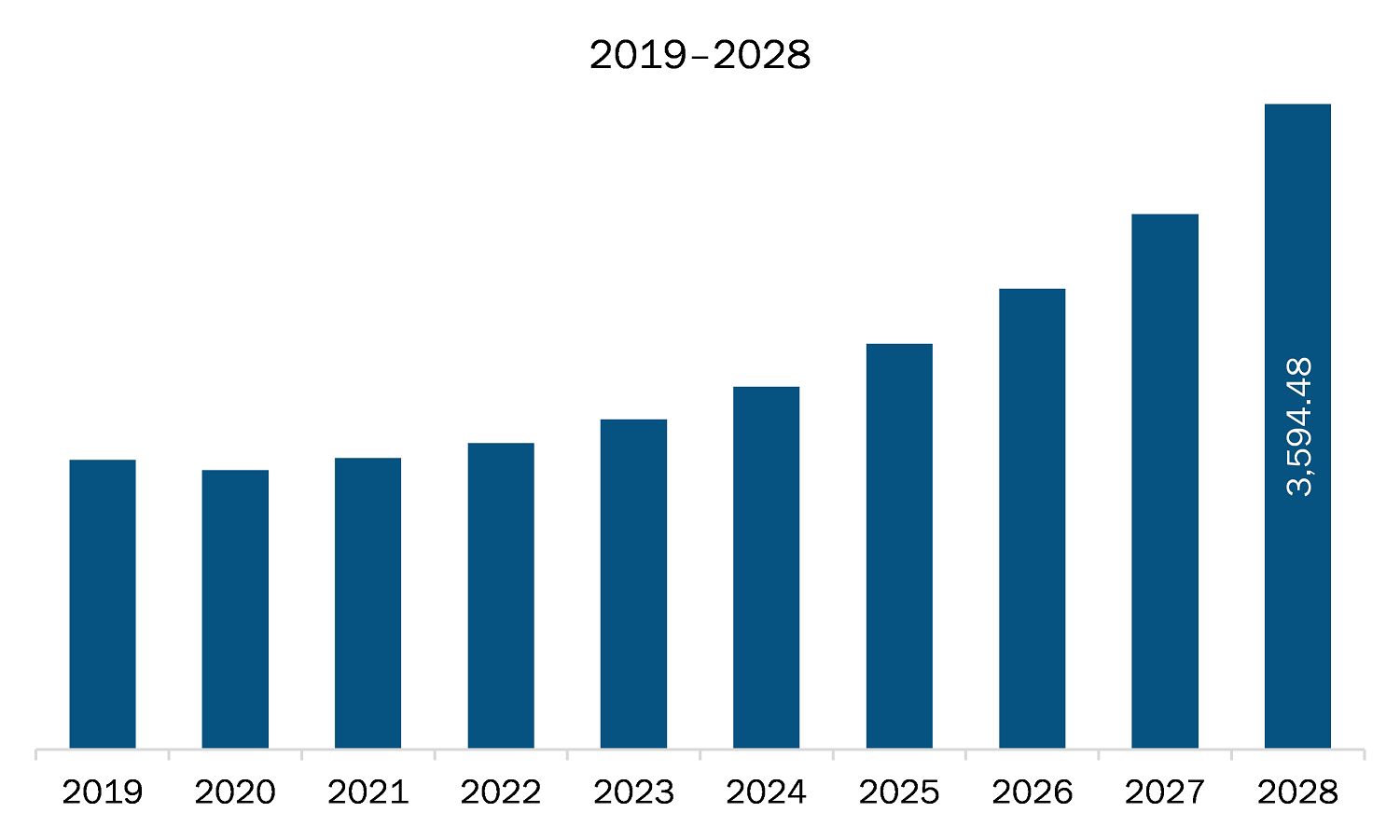

| Market size in 2021 | US$ 1,623.18 Million |

| Market Size by 2028 | US$ 3,594.48 Million |

| Global CAGR (2021 - 2028) | 12.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Recovered Carbon Black refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The recovered carbon black market in Europe is expected to grow from US$ 1,623.18 million in 2021 to US$ 3,594.48 million by 2028; it is estimated to grow at a CAGR of 12.0% from 2021 to 2028. The green economy is another vision of growth and development for many countries; it can promote economic development and improve people's lives while promoting environmental and social well-being. An important part of the green economy strategy is to promote the development and adoption of sustainable technologies. The importance of sustainability is not just based on an ecological perspective, but economic aspects also contribute to it. Recovered carbon black is emerging as an alternative to virgin carbon black that is produced from the combustion of crude oil. The carbon black recovered from recycled tires contributes to a significant decrease in CO2 emissions and emphasizes the concept of reusing products to minimize waste generation. Companies are heading towards the adoption of an eco-friendly and sustainable production approach by investing in better R&D activities to optimize resource consumption. Therefore, such shift towards sustainability, along with rise in need for green alternatives, is emerging as a lucrative opportunity for the recovered carbon black market players.

Based on application, Europe recovered carbon black market is segmented into tire, non-tire rubber, plastics, and others. The tire segment dominated the market in 2020 and non-tire rubber segment is expected to be the fastest growing during the forecast period.

A few major primary and secondary sources referred to for preparing this report on recovered carbon black market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Alpha Carbone; Black Bear Carbon B.V.; Bolder Industries; ENRESTEC; Pyrolyx AG; Scandinavian Enviro Systems AB; and SR2O Holdings, LLC are among others.

The Europe Recovered Carbon Black Market is valued at US$ 1,623.18 Million in 2021, it is projected to reach US$ 3,594.48 Million by 2028.

As per our report Europe Recovered Carbon Black Market, the market size is valued at US$ 1,623.18 Million in 2021, projecting it to reach US$ 3,594.48 Million by 2028. This translates to a CAGR of approximately 12.0% during the forecast period.

The Europe Recovered Carbon Black Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Recovered Carbon Black Market report:

The Europe Recovered Carbon Black Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Recovered Carbon Black Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Recovered Carbon Black Market value chain can benefit from the information contained in a comprehensive market report.