The rising prevalence of chronic diseases and increased use of nuclear imaging techniques are the key factors driving the growth of the Europe radioactive tracers market.

A radioactive tracer is a chemical compound in which one or more atoms are replaced by a radioisotope. Radiotracers can be used to study chemical reactions based on the monitoring of their radioactive decay. They are also used to visualize flow in techniques such as single photon emission computed tomography (SPECT), positron emission tomography (PET), and computed radioactive particle tracking (CARPT).

Oncology is one of the significantly developing fields in the healthcare sector as the number of cancer cases is increasing worldwide. According to the Institute for Health Metrics and Evaluation (IHME), cancer is the second leading cause of death after cardiovascular disorders. The use of advanced materials and drugs in the diagnosis and treatment of cancer has surged with noticeable developments in oncology. Radioactive tracer-based imaging is one of the advanced diagnostic methods used for the accurate diagnosis of various cancer types, such as prostate cancer, gynecological cancer, and blood-borne cancer. Once injected into the body, these radioactive tracers attach to the cancer-specific sites, thereby providing an accurate diagnosis of cancer type. Tracers also help determine the development stage of cancer, which enables effective treatment and allow faster recovery in most cases.

Nuclear imaging techniques such as PET and SPECT use gamma emitters for detecting tumors. As the tumor grows, its uptake of the PET and SPECT conjugate increases over time, which improves contrast due to the presence of nuclear imaging agents. This further leads to blood clearance due to which the diagnostic images can be generated properly. For instance, the most commonly used radioactive tracer for detecting cancer is F-18 fluorodeoxyglucose (18F-FDG), a compound similar to glucose or sugar. Cancer cells are highly active, and they need more energy, i.e., extra glucose compared to normal cells. An imaging device such as PET or SPECT is used to detect this energy release with the use of FDG to create an image showing the location of a radioactive tracer in the body. This helps determine the location of cancerous cells in the body of patients so that the treatment can be tailored according to the type and stage of cancer.

Many market players and research institutes operating in the Europe radioactive tracers market are developing advanced technologies to expand their product portfolios and increase their market shares. The rising number of diagnostic procedures, product approvals, and collaborations are among the factors driving the Europe radioactive tracers market size.

In November 2022, Curium resumed Mo-99 Production with a plan of supplying its customers with molybdenum-99 (Mo-99) and technetium-99m (Tc-99m) generators. Mo-99 is critically important for the 40 million patients a year who undergo Tc-99m based SPECT scans to diagnose life-critical diseases.

In June 2022, Telix Pharmaceuticals Limited has advanced a partnership with Invicro LLC to develop an artificial intelligence (AI) platform to accompany Telix’s PSMA-PET imaging agent, Illuccix (kit for the preparation of gallium Ga 68 gozetotide) – known as TelixAI. Through its solutions, conferring advanced analysis capabilities, TelixAI seeks to increase the efficiency and reproducibility of clinicians’ imaging assessments, with an initial focus on prostate cancer diagnosis.

In May 2022, ImaginAb Inc. announced an agreement with Invicro LLC to supply clinical doses of ImaginAb’s investigational CD8 ImmunoPET agent for use in clinical trials as part of Invicro’s global core lab imaging service. The agreement also allows Invicro to produce zirconium Zr 89 crefmirlimab for its preclinical offerings.

In June 2021, IBA launched versatile high-energy new cyclotron—the Cyclone IKON—which offers the largest energy spectrum for PET and SPEC isotopes from 13 MeV to 30 MeV. IBA has redesigned its previous model, Cyclone 30 MeV, and created a next-generation system, the Cyclone IKON. It is more compact and versatile than ever and is capable of working over a large energy span with full current capacity to enable the large-scale and high-purity production of emerging PET isotopes, SPECT isotopes, and parent isotopes.

These developments are responsible for growth of Europe radioactive tracers market.

The World Health Organization (WHO), University of Missouri Research Reactor Center, and Center for Disease Control and Prevention are a few of the major primary and secondary sources referred to while preparing the report on the Europe radioactive tracers market.

Strategic insights for the Europe Radioactive Tracers provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4,175.25 Million |

| Market Size by 2028 | US$ 11,005.25 Million |

| Global CAGR (2023 - 2028) | 17.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Test Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Radioactive Tracers refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

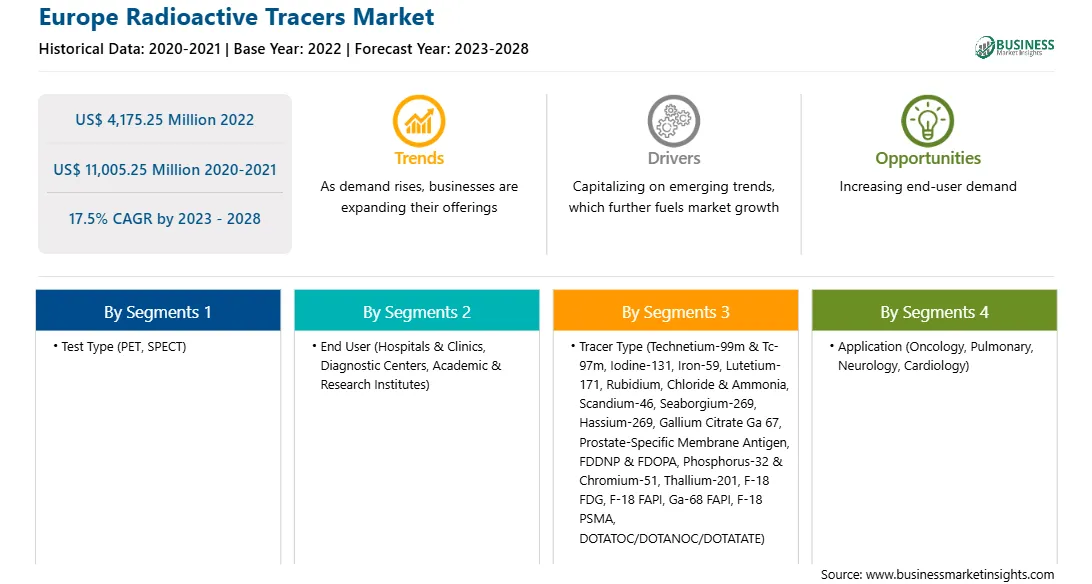

The Europe Radioactive Tracers Market is valued at US$ 4,175.25 Million in 2022, it is projected to reach US$ 11,005.25 Million by 2028.

As per our report Europe Radioactive Tracers Market, the market size is valued at US$ 4,175.25 Million in 2022, projecting it to reach US$ 11,005.25 Million by 2028. This translates to a CAGR of approximately 17.5% during the forecast period.

The Europe Radioactive Tracers Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Radioactive Tracers Market report:

The Europe Radioactive Tracers Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Radioactive Tracers Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Radioactive Tracers Market value chain can benefit from the information contained in a comprehensive market report.