The European protein binding assay market is divided into Germany, UK, France, Italy, Spain, and the rest of Europe. The region holds a significant market share in the global protein binding assay market. The market growth is attributed due to the developments in the pharmaceutical and biotechnological industries, increase in adoption of protein-based drugs, and rise in the availability of numerous advanced technologies utilized for protein binding. Also, the substantial number of CROs operating in the space are further contributing to the growth of the market. The pharmaceutical industry in Germany, hold the fourth largest position with small and mid-sized companies. According to the Federal Ministry for Economic affairs and Energy, in 2016, pharmaceutical sales in Germany was increased to US$64.88 billion. The demand of pharmaceuticals in Germany is growing significantly, owing to the rising geriatric population, the increasing prevalence of chronic diseases, and increasing demand for the production of new molecules for various therapeutic areas to fulfill the unmet condition. The significant research advancement is providing a spur to the growth of the protein binding assay market in Germany. There are various international and domestic pharmaceutical players present in Germany. In 2014, there were more than 640 pharmaceutical companies present in Germany. These pharmaceutical companies are majorly focusing on R&D to develop new drugs for various therapeutic applications. The expenditures for R&D have increased by the pharmaceutical companies in Germany. For instance, according to a report published by European Federation of pharmaceutical Industries and Associations (EFPIA) in 2018, the pharmaceutical R&D expenditure in Germany has increased from US$ 7100.6 million (6216 € million) in 2015 to US$ 7113.2 million in 2015 (6,227€ million). This is expected to increase the demand of outsourcing R&D activities to the CROs and hence is going to drive the market. Germany offers excellent conditions for clinical trial activities. The clinical development pipeline has shown a significant growth in this country. Moreover, increase in adoption of protein binding assays in drug discovery & development also expected to increase the growth of the protein binding assay market in this country. Market players are adopting organic and inorganic growth strategies for the market development in the country. For instance, In March 2017, 3B Pharmaceuticals GmbH (3B Pharmaceuticals), a German peptide drug discovery company, and Sovicell GmbH (Sovicell), a manufacturer of research kits for ADMET applications launched a novel service to reliably quantify the plasma protein binding capacity of experimental drug candidates. The companies have developed Escalate; a mass spectrometry assay based on Sovicell’s proprietary equilibrium shift technology. 3B Pharmaceuticals will be the exclusive global service provider under a license from Sovicell which will supply 3B Pharmaceuticals with EScalate reagents

The European economy is seriously hit due to the exponential growth of COVID-19 cases in the region. Many countries are declaring more cases each day now than during the first wave earlier this year. Lockdowns are being reintroduced in UK, Spain, and Italy, and Ireland, as per the European Centre for Disease Prevention and Control (ECDC). Due to the second wave of COVID-19 crises, the government of many nations is managing towards mounting up testing capacity. Countries in the European regions were profoundly affected due to the COVID-19 pandemic. For instance, countries such as Italy, Spain, and France have reported the highest number of positive cases and have registered the maximum number of deaths. The rising occurrence rate of coronavirus results in increased stress on the region's healthcare system, which is also rising the demand for diagnostic tests in its healthcare system, supporting the expansion of the sector in this region. As of July 29, 2021, as per Worldometer, Spain, Italy, Germany, France, and the UK are among the most affected European countries. As per the data provided by Worldometer, till July 29, 2021, the UK, France, Spain, Italy, and Germany recorded 5,770,928; 6,054,049; 4,395,602; 4,330,739; and 3,769,541; respectively, COVID-19 cases and the death counts are also huge in these nations. Most of the region's sectors are massively hit by the pandemic's spread, with most nations being locked down. Number of clinical trials for the development of vaccination for the COVID-19 infection is increased thus the demand for demand for protein binding assay is also increased in this drug discovery activities.

Strategic insights for the Europe Protein Binding Assay provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

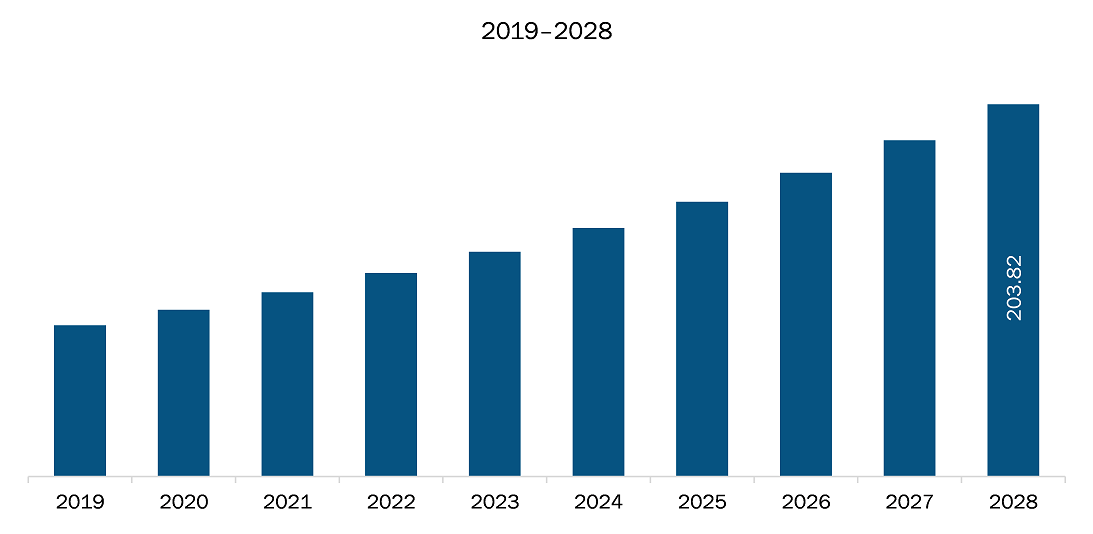

| Market size in 2021 | US$ 100.90 Million |

| Market Size by 2028 | US$ 203.82 Million |

| Global CAGR (2021 - 2028) | 10.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Protein Binding Assay refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The protein binding assay market in Europe is expected to grow from US$ 100.90 million in 2021 to US$ 203.82 million by 2028; it is estimated to grow at a CAGR of 10.6% from 2021 to 2028. Growing Label-Free receptor assays to emerge as powerful assay platform in coming years; development of pharmacological assays has resulted in the discovery of a wide range of receptor and drug molecule cellular behavior. Label-free receptor assays are growing rapidly as a powerful assay platform for studying receptor signaling and identifying critical nodes in receptor signaling networks. Drug molecules can now be categorized and characterized in novel ways due to label-free receptors. With substantial advances in biosensor instrumentation, such as the Epic system, high throughput screening of drug molecules operating on native cells, including primary cells, has become a reality. Traditional label-based techniques, such as fluorescence, are being replaced by label-free detection of molecular interactions. The label-free technique is preferred to avoid molecular labels when functional information is required. This is especially true for protein targets where labels can compromise the function of a protein. Label-free methods are compatible with real-time detection, allowing for the assessment of the rates of interacting molecules' association and dissociation. Several label-free approaches are currently available for the detection of biomolecular interactions, based on technologies—such as interferometry, diffraction, surface plasmon resonance (SPR), and quartz crystal microbalance. SPR detection is the most extensively used of them. Thus, label-free assays, which evaluate the interaction of molecules (antibodies-antigens, ligands-receptors, proteins-proteins) without the use of tags such as fluorescent dyes or radioisotopes, are expected to become a powerful assay platform in the future years.

Based on technology is segmented into ultracentrifugation ultrafiltration, equilibrium dialysis, surface plasmon and others. In 2020, the equilibrium dialysis segment is likely to hold the largest share of the market, by technology. Based on the end user was segmented into contract research organization, pharmaceutical & biotechnology companies, and research & diagnostic laboratories. In 202

A few major primary and secondary sources referred to for preparing this report on the protein binding assay market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Biotium, Inc, Eurofins Scientific, General Electric Company, MERCK KGaA, MicroConstants, Inc, Pharmaron Beijing Co., Ltd, Sartorius AG, SOVICELL GMBH, and THERMO FISHER SCIENTIFIC INC. among others.

The Europe Protein Binding Assay Market is valued at US$ 100.90 Million in 2021, it is projected to reach US$ 203.82 Million by 2028.

As per our report Europe Protein Binding Assay Market, the market size is valued at US$ 100.90 Million in 2021, projecting it to reach US$ 203.82 Million by 2028. This translates to a CAGR of approximately 10.6% during the forecast period.

The Europe Protein Binding Assay Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Protein Binding Assay Market report:

The Europe Protein Binding Assay Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Protein Binding Assay Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Protein Binding Assay Market value chain can benefit from the information contained in a comprehensive market report.