Europe is amongst the largest markets for protective cultures owing to the well-established dairy industry, rising adoption of various food safety trends, and growing innovations across the food & beverages sector in the region. The European Union is a substantial producer of milk and milk products. According to the European Commission, total milk production in the European Union (EU) is estimated at around 155 million tonnes per year. France, Poland, the Netherlands, Italy, and Spain are a few major producers of milk and milk products in the EU. These countries account for about 70% of the total production. The dairy market across the region is witnessing substantial change with the emergence of different consumer trends. Consumers across Europe prefer natural, organic, and sustainable dairy products that are minimally processed and contain simple ingredients. In addition, transparent product labelling helps health-conscious consumers across the region have a better knowledge of the components utilized in dairy products. Moreover, with the advent of hectic modern lifestyles, there is a growing demand for convenient food products that can be consumed on-the-go and don’t need refrigeration while remaining fresh at the same time. Therefore, dairy manufacturers are incorporating protective cultures, which are specialized bacteria, to inhibit the growth of pathogenic organisms or microbiological deterioration agents. Increasing utilization of protective cultures as natural preservatives in processed dairy products is driving the growth of the protective cultures market in Europe. Also, protective cultures are playing a vital role in the region’s evolving dairy landscape. The EU is one of the significant producers of wine. According to the European Commission, the EU accounts for 65% of the global wine production and 60% of global consumption. Wine demand across the region is influenced by the megatrend for natural and pure ingredients. Consumers prefer wines free from exogenous products such as preservatives. Therefore, wine manufacturers are employing bio-ingredients to cater to the emerging trend of wine with clean and natural ingredients. For instance, Chr. Hansen Holding A/S, one of the prominent manufacturers of protective cultures, offers bio-protective cultures to wine manufacturers that lower the sulphite content in wine. Such trends are expected to fuel the demand for protective cultures across the region in the coming years. Furthermore, the presence of a few prominent manufacturers of protective cultures across the region such as DSM, Biochem S.R.L, and Chr. Hansen Holding A/ is expected to boost the market growth in Europe during the forecast period. Over the past few years, the manufacturers of animal feed and pet foods are incorporating natural ingredients in their products to meet consumer changing preferences. Protective cultures have wide applications in formulating clean label pet foods and animal feed. Prominent manufacturers of protective cultures are developing specialty cultures for animal feed. In the recent years, silage manufacturers in Europe are employing microbial strains to inhibit the growth of pathogenic micro-organisms in silage. For instance, DeLaval Inc., a company based in Sweden, offers Feedtech Silage F3000, a bacterial culture that prevents yeast, mold, and clostridia from growing and destroying the silage. The increasing initiatives of manufacturers for developing protective cultures for animal feed preservation are expected to open lucrative growth opportunities for the regional market in the coming years.

In Europe, the UK, France, and Russia are the hardest-hit countries by the COVID-19 outbreak. The UK has recorded the highest-number of COVID-19 cases, followed by France, Spain, Italy, and Germany. Countries in the region have implemented drastic measures and travel restrictions, including partially closing their borders. This is anticipated to impact market growth in Europe. The lockdown restrictions are being slowly lifted in a few of the countries in Europe; for instance, in Denmark, shops and restaurants have reopened. Italy is in the “yellow zone” and is slowly lifting the lockdown restrictions. All these factors are likely to have a positive impact on the food & beverages industry, which will translate into the recovery of the protective cultures market in the coming months.

Strategic insights for the Europe Protective Cultures provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

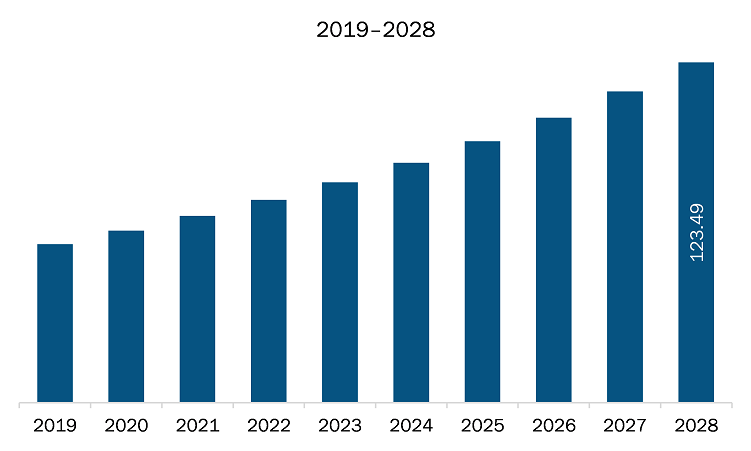

| Market size in 2021 | US$ 67.74 Million |

| Market Size by 2028 | US$ 123.49 Million |

| Global CAGR (2021 - 2028) | 9.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Target Microorganism

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Protective Cultures refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The protective cultures market in Europe is expected to grow from US$ 67.74 million in 2021 to US$ 123.49 million by 2028; it is estimated to grow at a CAGR of 9.0% from 2021 to 2028. Growing demand from untapped region; rapid urbanization, higher disposable incomes, and busy work life are boosting the adoption of western dietary patterns. This factor, in turn, has upsurged the demand for microbial culture in dairy products application. Most of the dairy markets are unorganized. The region remains the growing market for microbial cultures due to strong demand. The manufacturers are eyeing this potential region. Also, they are heavily investing in bringing the latest innovations and increasing production capacity to meet the growing demand in the region. Since the region are utilizing chemical or plant-based preservatives and not microbial, which would create lucrative opportunities for the protective culture market in the future. Hence, all these factors are expected to provide vast opportunities for the growth of the protective culture market in untapped regions during the forecast period. This is bolstering the growth of the protective cultures market.

Based on target microorganism, the Europe protective cultures market is bifurcated into bacteria, and yeasts & molds. In 2020, the yeasts & molds segment held the largest share Europe protective cultures market. Based on application the market is divided into food processing and animal feed. The food processing segment accounts for largest market share in the 2020. Similarly, based on food processing, the market is bifurcated into dairy products

A few major primary and secondary sources referred to for preparing this report on the protective cultures market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Biochem Srl, Bioprox, Chr. Hansen Holding A/S, Dalton Biotecnologie S.r.l., DSM, Lallemand Inc., Meat Cracks Technologie GmbH, International Flavors & Fragrances Inc., Kerry Group and Sacco System among others.

The Europe Protective Cultures Market is valued at US$ 67.74 Million in 2021, it is projected to reach US$ 123.49 Million by 2028.

As per our report Europe Protective Cultures Market, the market size is valued at US$ 67.74 Million in 2021, projecting it to reach US$ 123.49 Million by 2028. This translates to a CAGR of approximately 9.0% during the forecast period.

The Europe Protective Cultures Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Protective Cultures Market report:

The Europe Protective Cultures Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Protective Cultures Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Protective Cultures Market value chain can benefit from the information contained in a comprehensive market report.