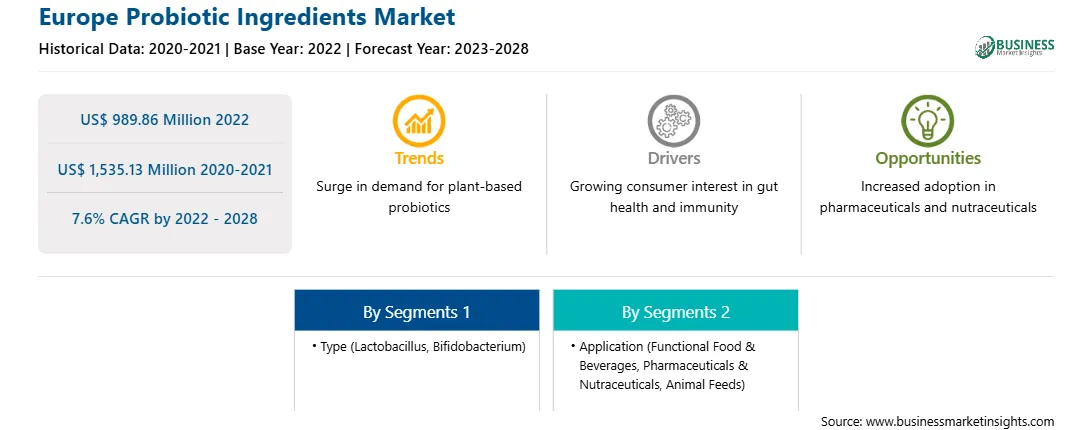

The Europe probiotic ingredients market is expected to grow from US$ 989.86 million in 2022 to US$ 1,535.13 million by 2028; it is estimated to grow at a CAGR of 7.6% from 2022 to 2028.

Antibiotics, a feed additive, have been widely used in livestock diets for several decades due to their therapeutic effects. However, a few countries have limited the use of certain antibiotics due to concerns that using antibiotics as feed additives contribute to increased bacterial antibiotic resistance. Furthermore, from 2006 onward, the European Union (EU) prohibited the use of antibiotics as feed additives. As a result of the shift in customer demand for safe food production and regulatory concerns regarding antibiotics, growth-promoting additives have ensured a search for natural strategies to modulate gut development and health. Moreover, probiotics, prebiotics, and essential oils have been suggested as antibiotic alternatives, as probiotics are live microbial feed supplements that beneficially affect the host by improving intestinal microbial balance. The use of probiotics as a possible alternative to antibiotics has received renewed interest due to the legislation prohibiting the use of sub-therapeutic amounts of antibiotics. Probiotic is a generic term, and products can contain yeast cells, bacterial cultures, or both that stimulate microorganisms capable of modifying the gastrointestinal environment to improve health and feed efficiency.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Europe probiotic ingredients market. The Europe probiotic ingredients market is expected to grow at a good CAGR during the forecast period.

Strategic insights for the Europe Probiotic Ingredients provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 989.86 Million |

| Market Size by 2028 | US$ 1,535.13 Million |

| Global CAGR (2022 - 2028) | 7.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Probiotic Ingredients refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Probiotic Ingredients Market Segmentation

The Europe probiotic ingredients market is segmented based on type, application, and country. Based on type, the Europe probiotic ingredients market is divided into lactobacillus, bifidobacterium, and others. The lactobacillus would dominate the Europe probiotic ingredients market in 2022. Based on application, the market is categorized into functional food & beverages, pharmaceuticals & nutraceuticals, animal feed, and others. The functional food & beverages would dominate the Europe probiotic ingredients market in 2022. Based on country, the Europe probiotic ingredients market is segmented into Germany, the UK, France, Italy, Russia, and the Rest of Europe. The Rest of Europe would dominate the Europe probiotic ingredients market in 2022.

Key players operating in the Europe probiotic ingredients market include ADM; Novozymes A/S; Chr. Hansen Holding A/S; Kerry Group plc; Lallemand Inc; IFF Nutrition & Biosciences; AngelYeast Co., Ltd; Probiotical S.p.A; Adisseo; and Probi by Altair.

The Europe Probiotic Ingredients Market is valued at US$ 989.86 Million in 2022, it is projected to reach US$ 1,535.13 Million by 2028.

As per our report Europe Probiotic Ingredients Market, the market size is valued at US$ 989.86 Million in 2022, projecting it to reach US$ 1,535.13 Million by 2028. This translates to a CAGR of approximately 7.6% during the forecast period.

The Europe Probiotic Ingredients Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Probiotic Ingredients Market report:

The Europe Probiotic Ingredients Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Probiotic Ingredients Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Probiotic Ingredients Market value chain can benefit from the information contained in a comprehensive market report.