Surge in Working Women Population

Breastmilk is the ideal food for infants as it is safe, clean, and contains antibodies that help protect against many common childhood illnesses. Breastmilk provides the child with all the energy and nutrients that are required for the first few months after birth, and it continues to provide up to half or more of a child’s nutritional needs. According to various surveys and reports, breastfeeding is declining for various reasons, including women's participation in the labor force. For instance, according to the Office for National Statistics (ONS) of the UK, the employment statistics of mothers grew from 66.2% in 2000 to 75.1% in 2019. Thus, the increased participation of women in the labor force is reducing breastfeeding and is driving the demand for probiotic infant and child formulas. According to the CDC, 17% of babies are supplemented with formula during the first two days of life, and ~35% of babies older than 6 months are fed breastmilk and formula. Thus, the rise in the number of women participating in the labor force is driving the growth of the Europe probiotic infant and child formula market.

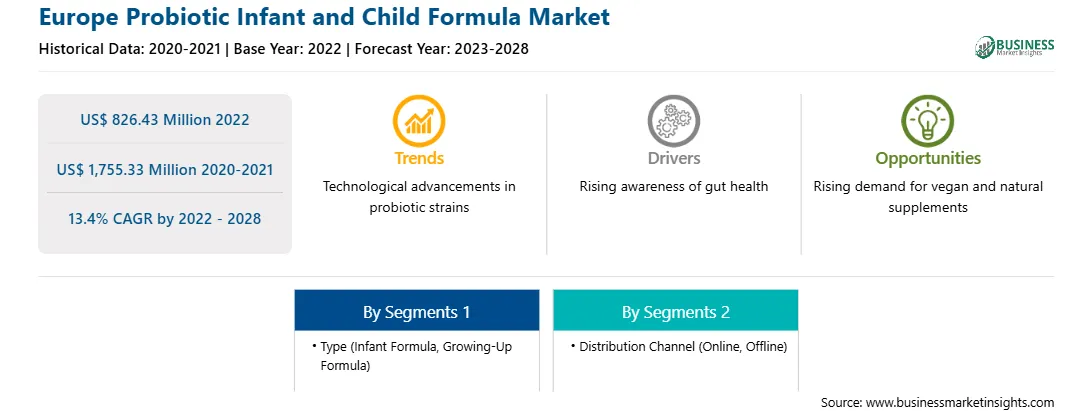

Market Overview

The Europe probiotic infant and child formula market is segmented into Germany, France, Italy, the UK, Russia, and the rest of Europe. The market growth is fuelled by a rising fertility rate. According to the European Commission, the total fertility rate in the European Union increased from 1.43 live births per woman in 2001 to 1.50 live births per woman in 2020. Additionally, infant formula and growing-up formula are majorly used by working mothers to provide healthy and nutritious food for their babies. A growing focus on infant care and nutrition, changing lifestyles, rising middle-class population, and increasing purchasing power and disposable income of people in economies (including the UK, Germany, and France) are expected to propel the probiotic infant and child formula market growth in Europe during the forecast period.

Strategic insights for the Europe Probiotic Infant and Child Formula provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Probiotic Infant and Child Formula refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Probiotic Infant and Child Formula Strategic Insights

Europe Probiotic Infant and Child Formula Report Scope

Report Attribute

Details

Market size in 2022

US$ 826.43 Million

Market Size by 2028

US$ 1,755.33 Million

Global CAGR (2022 - 2028)

13.4%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By Distribution Channel

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Probiotic Infant and Child Formula Regional Insights

Europe Probiotic Infant and Child Formula Market Segmentation

The Europe probiotic infant and child formula Market is segmented into type, distribution channel, and country.

Based on type, the market is segmented into infant formula (0-1 year) and growing-up formula (1-6 years). The growing-up formula (1-6 years) segment registered the larger market share in 2022. Based on distribution channel , the market is segmented into online and offline. The offline segment held the larger market share in 2022. Based on country, the market is segmented into Germany , France ,Italy , UK , Russia and Rest of Europe. Russia dominated the market share in 2022. Nestlé S.A. ; HiPP GmbH & Company Vertrieb KG ; Abbott Laboratories and Mead Johnson & Company, LLC are the leading companies operating in the probiotic infant and child formula in the region.

The Europe Probiotic Infant and Child Formula Market is valued at US$ 826.43 Million in 2022, it is projected to reach US$ 1,755.33 Million by 2028.

As per our report Europe Probiotic Infant and Child Formula Market, the market size is valued at US$ 826.43 Million in 2022, projecting it to reach US$ 1,755.33 Million by 2028. This translates to a CAGR of approximately 13.4% during the forecast period.

The Europe Probiotic Infant and Child Formula Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Probiotic Infant and Child Formula Market report:

The Europe Probiotic Infant and Child Formula Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Probiotic Infant and Child Formula Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Probiotic Infant and Child Formula Market value chain can benefit from the information contained in a comprehensive market report.