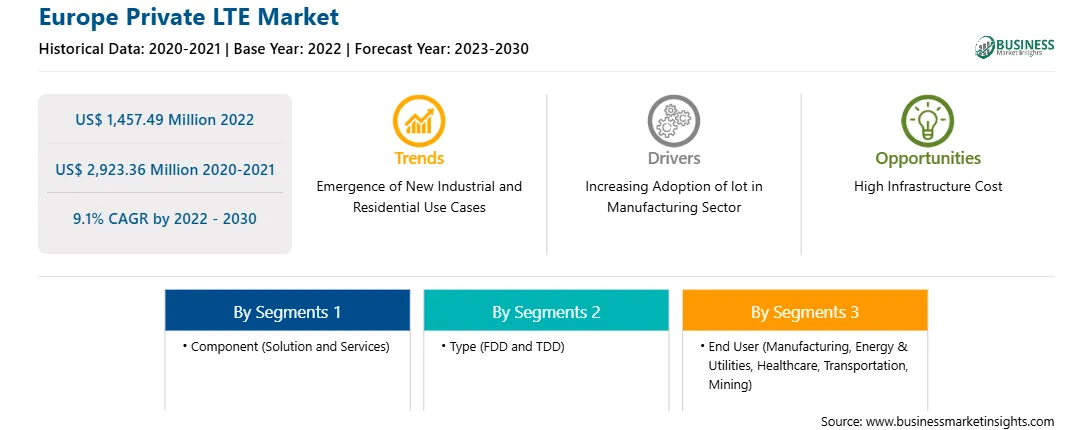

The Europe private LTE market was valued at US$ 1,457.49 million in 2022 and is expected to reach US$ 2,923.36 million by 2030; it is estimated to grow at a CAGR of 9.1% from 2022 to 2030.

Growing Demand for Reliable and Efficient Communications Network Infrastructure Drives Europe Private LTE Market.

The continuous growth of communication infrastructure has led to an exponential increase in the energy consumption of data centers, telecommunication networks, and other related technologies. With the rising demand for digital services and emerging technologies such as the Internet of Things (IoT), there is an urgent need for more energy-efficient solutions in the communication sector.

The emergence of IoT has enabled each device to be connected over the internet, and the increasing global adoption would result in billions of devices connected over the internet. These devices are bound to create vast amounts of data. Furthermore, with the growth in mobile broadband data, new use cases such as Fixed Wireless Access, Critical IoT, and Massive IoT will evolve. These evolutions will increase data traffic in the future. The capabilities of existing network infrastructures have benefited telecommunication service providers and carrier operators with various telecommunication bodies globally to develop a standard infrastructure for private LTE. As private LTE operates with a high-frequency spectrum, it enables the connection of many devices over the network. Thus, the rising demand for reliable and efficient communication network infrastructure drives the private LTE market globally.

Countries in the European Union (EU) have several key manufacturing industries, such as automotive, aerospace, machinery & equipment, military vehicles, and shipbuilding. The automotive industry in these countries is contributing to their GDP. Europe is a prominent producer of motor vehicles and is home to several premium automotive manufacturers. LTE wireless networks are on the horizon, and IoT is gaining importance as devices are predicted to form a foremost portion of this network concept. The Europe market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. Megacities in Germany, the UK, and France are observed to be the nodes of the growth of IoT, boosting the implementation of these technologies in other developing cities across Europe, including several cities in Russia.

The telecom infrastructure in Europe requires modification in the investment framework to safeguard the deployment of ultra-fast network services across Europe. One of the primary reasons for developing telecom infrastructure is to have better access networks across Europe with the exponential demands for higher bandwidth internet applications and value-added services. The significant features of new access networks such as private LTE consist of the convergence of wired and wireless transmission, development, and the adoption of advanced technology smartphones that connect efficiently with these networks. Therefore, European regulatory bodies and telecom authorities actively focus on developing these networks. Implementing LTE technology can greatly impact the design of IoT ecosystems, especially in scalability, reliability, latency, and security. IoT and advanced networks support a wide range of manufacturing use cases, making it possible to boost manufacturing processes through a single communication system. The private LTE network is also gaining pace as it captures real-time data and permits remote machinery control. The growing adoption of IoT is also boosting efficiency and optimizing the value manufacturers can provide to their customers.

Strategic insights for the Europe Private LTE provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Private LTE refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Europe Private LTE Strategic Insights

Europe Private LTE Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,457.49 Million

Market Size by 2030

US$ 2,923.36 Million

Global CAGR (2022 - 2030)

9.1%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Component

By Type

By End User

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Private LTE Regional Insights

The Europe private LTE market is segmented based on component, type, end user, and country. Based on component, the Europe private is segmented into solution and services.

The solution segment held a larger market share in 2022. The services segment is further bifurcated into professional and managed services.

Based on type, the Europe private LTE market is bifurcated into FDD and TDD. The FDD held a larger market share in 2022.

Based on end user, the Europe private LTE market is segmented into manufacturing, energy & utilities, healthcare, transportation, mining, and others. The manufacturing held the largest market share in 2022.

Based on country, the Europe private LTE market is segmented into Germany, the UK, France, Italy, Russia, and the Rest of Europe. Germany dominated the Europe private LTE market share in 2022.

Cisco Systems Inc, Telefonaktiebolaget LM Ericsson, Huawei Investment & Holding Co Ltd, Samsung Group, Verizon Communications Inc, CommScope Holding Co Inc, Star Solutions, Sierra Wireless Inc, and Kyndryl Holdings Inc are some of the leading companies operating in the Europe private LTE market.

The Europe Private LTE Market is valued at US$ 1,457.49 Million in 2022, it is projected to reach US$ 2,923.36 Million by 2030.

As per our report Europe Private LTE Market, the market size is valued at US$ 1,457.49 Million in 2022, projecting it to reach US$ 2,923.36 Million by 2030. This translates to a CAGR of approximately 9.1% during the forecast period.

The Europe Private LTE Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Private LTE Market report:

The Europe Private LTE Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Private LTE Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Private LTE Market value chain can benefit from the information contained in a comprehensive market report.