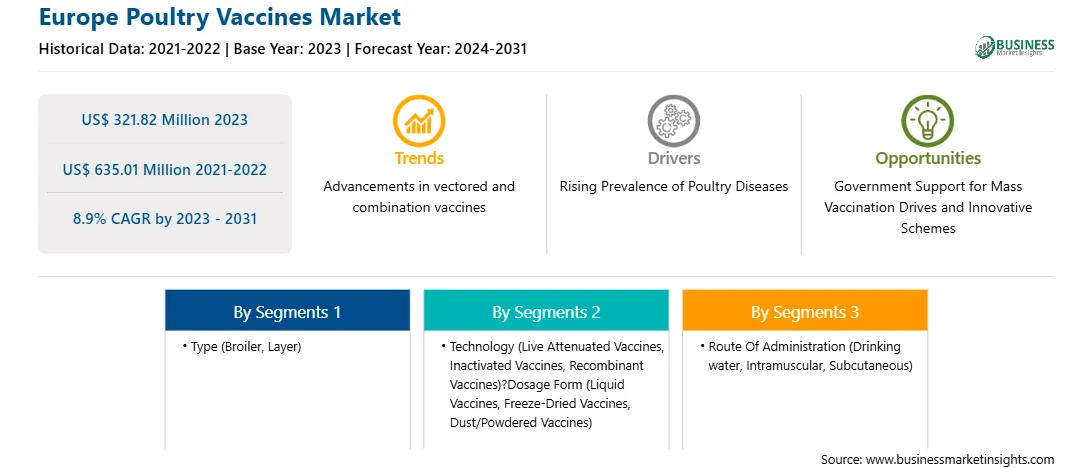

The Europe poultry vaccines market was valued at US$ 321.82 million in 2023 and is expected to reach US$ 635.01 million by 2031; it is estimated to record a CAGR of 8.9% from 2023 to 2031.

According to the US Department of Agriculture (USDA) report, poultry has become the most consumed livestock commodity worldwide in the past two decades, particularly in developing and emerging markets. Also, poultry is expected to remain the world's largest imported livestock commodity by volume in the next 10 years as per the same USDA report. The demand for poultry products and imports is rising worldwide. As rising disposable incomes, consumers shift toward purchasing animal-based poultry products comprising high content of proteins, specifically chicken. With rapid urbanization in many developing economies and emerging markets such as Southeast Asia and Sub-Saharan Africa, poultry products provide consumers with an affordable option for purchase as poultry products comprise high protein content and are more readily available as compared to other meat-based products that are expensive. To match the demand and supply of poultry products, several countries are focusing on domestic poultry production. These countries include the US, Brazil, the European Union (EU), and Thailand, which are also major poultry exporters. According to the Council on Foreign Relations 2024 report, the US, Brazil, the European Union, and Thailand account for 71% of the world's poultry exports in 2021. Further, from 2001 to 2021, global poultry imports rose to an average of 4% year-on-year (y-o-y), reaching 14.2 million metric tons of production in 2021. With poultry products remaining high in demand worldwide and countries focusing on domestic livestock production, the demand for vaccination is also growing. Thus, the growing poultry industry fuels the poultry vaccines market growth.

In Germany, poultry disease outbreaks are rising significantly. For instance, Germany experienced the largest HPAI outbreak on record between November 2020 and May 2021. The outbreak affected 245 poultry; captive bird farms; and over 1,000 wild birds. Additionally, vaccination against Newcastle Disease is a crucial control measure in countries such as Germany, where the virus is common in the free-ranging bird population. The German Standing Veterinary Committee on Immunization (StIKo Vet) recommends revaccinating chickens every six weeks with attenuated live vaccines via drinking water or spray, following the Summary of Product Characteristics (SPCs) of current vaccines. Furthermore, Eimeria vaccination is an important practice in laying hens, both caged and free-range birds, to prevent and manage the possibility of suffering an outbreak of coccidiosis produced by Eimeria spp. during the rearing of “male brother chicks” of the layer breeds and mixed genetics chicks. Therefore, all these factors are contributing to the growth of the poultry vaccines market in Germany.

Strategic insights for the Europe Poultry Vaccines provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 321.82 Million |

| Market Size by 2031 | US$ 635.01 Million |

| Global CAGR (2023 - 2031) | 8.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Poultry Vaccines refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe poultry vaccines market is categorized into type, technology, dosage form, disease, route of administration, end user, and country.

Based on type, the Europe poultry vaccines market is bifurcated into broiler and layer. The broiler segment held a larger market share in 2023.

In terms of technology, the Europe poultry vaccines market is categorized into live attenuated vaccines, inactivated vaccines, and recombinant vaccines. The live attenuated vaccines segment held the largest market share in 2023.

By dosage form, the Europe poultry vaccines market is segmented into liquid vaccines, freeze-dried vaccines, and dust/powdered form vaccines. The liquid vaccines segment held the largest market share in 2023.

Based on disease, the Europe poultry vaccines market is categorized into avian influenza, infectious bronchitis, Marek's disease, avian salmonellosis, infectious bursal disease (IBD), Newcastle disease, and others. The avian influenza segment held the largest market share in 2023.

In terms of route of administration, the Europe poultry vaccines market is segmented into drinking water (D/W), intramuscular (I/M), subcutaneous (I/S), and others. The drinking water (D/W) segment held the largest market share in 2023.

Based on end user, the Europe poultry vaccines market is segmented into poultry farms & hatchery, veterinary hospitals, and poultry vaccination enters & clinics. The poultry farms & hatchery segment held the largest market share in 2023.

By country, the Europe poultry vaccines market is segmented into Germany, Spain, France, the UK, Italy, and the Rest of Europe. Germany dominated the Europe poultry vaccines market share in 2023.

Boehringer Ingelheim International GmbH, Zoetis Inc, BIOVAC, Phibro Animal Health Corp, Dechra Pharmaceuticals PLC, Elanco Animal Health Inc, Merck KGaA, Ceva, and Vaccinova AB. are some of the leading companies operating in the Europe poultry vaccines market.

The Europe Poultry Vaccines Market is valued at US$ 321.82 Million in 2023, it is projected to reach US$ 635.01 Million by 2031.

As per our report Europe Poultry Vaccines Market, the market size is valued at US$ 321.82 Million in 2023, projecting it to reach US$ 635.01 Million by 2031. This translates to a CAGR of approximately 8.9% during the forecast period.

The Europe Poultry Vaccines Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Poultry Vaccines Market report:

The Europe Poultry Vaccines Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Poultry Vaccines Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Poultry Vaccines Market value chain can benefit from the information contained in a comprehensive market report.