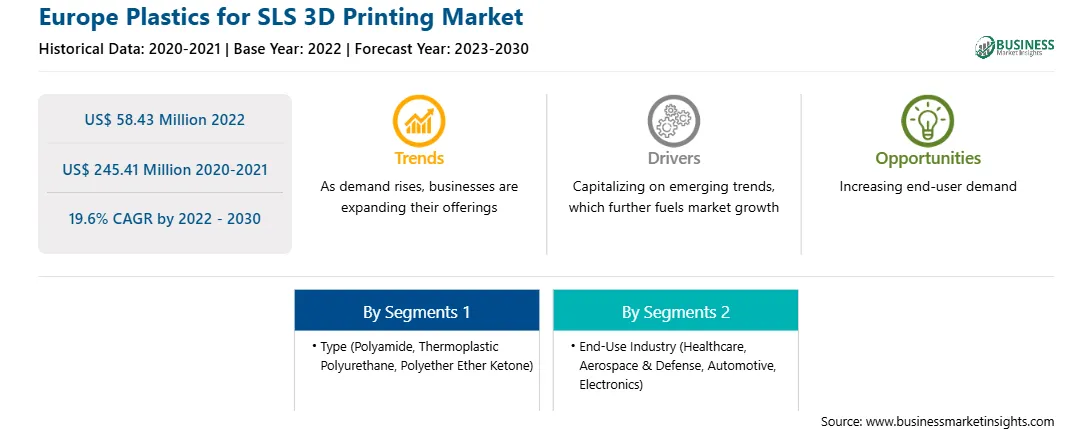

The Europe plastics for SLS 3D printing market was valued at US$ 58.43 million in 2022 and is expected to reach US$ 245.41 million by 2030; it is estimated to record a CAGR of 19.6% from 2022 to 2030.

Plastic parts manufactured using SLS technology offer a compelling combination of lightweight design and exceptional durability, and this versatility has recently found notable applications across various industries. In aerospace, where reducing weight is a paramount concern for improving fuel efficiency, SLS-produced plastic components have gained traction. For instance, Airbus has integrated SLS 3D-printed plastic parts into their A350 XWB aircraft, including brackets and ducting components, which contribute to weight reduction without compromising strength or safety. The automotive industry has also embraced SLS plastic parts. Automakers such as BMW have used SLS technology to create lightweight and durable plastic components for their vehicles, including customized parts for the BMW i8 Roadster. These parts help reduce the overall weight of the car, enhancing its performance and fuel efficiency. Furthermore, in consumer goods, SLS plastic parts have made a significant impact. Companies such as Adidas have employed SLS 3D printing to produce customized midsoles for athletic shoes. These midsoles are not only lightweight but also designed to provide superior cushioning and support tailored to an individual's foot, enhancing comfort and performance. Hence, the strong growth in the demand for lightweight plastic parts from various industries is driving the need for plastic for SLS 3D printing, thereby fueling the market growth.

SLS 3D printing is used to produce molds and fixtures for manufacturing processes. SLS 3D printing is utilized in producing complex and intricate geometries, as well as automotive interior components such as dashboard panels and center console parts. The automotive industry in Europe is constantly seeking ways to reduce vehicle weight to improve fuel efficiency and performance. Further, the growing automotive industry in the region is expected to drive the demand for plastics for SLS 3D printing. A 2022 report by the International Energy Agency stated that 2.3 million electric vehicles were sold in Europe in 2021 (a rise from 1.4 million in 2020). According to the International Trade Administration report published in 2022, increased investment in the automotive industry creates lucrative opportunities for automotive components and materials manufacturers. Turkey marked the presence of 48,000 hybrid and 2,000 electric vehicles on the roads and ~800 vehicle charging stations as of 2022. Several SLS 3D printing companies in the region launched product portfolios suitable for automotive interior components, gimbal bellows, air cleaner covers, hoses, grips, connectors, and joints. For instance, in October 2023, CRP Technology Srl announced the launch of Windform TPU for the SLS 3D printing process. In September 2022, Wematter partnered with OKM3D to establish a sales and service network for the Gravity SLS 3D printer in Germany. The partnership aimed at the business expansion of Wematter, providing the European market access to the Gravity 2022 SLS 3D printing. In May 2023, 3D Systems agreed on a deal for the acquisition of SLS 3D printing firm Wematter. Thus, advancements in the automotive industry and strategic initiatives by the market players in the region are projected to drive the demand for plastics for SLS 3D printing.

Strategic insights for the Europe Plastics for SLS 3D Printing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 58.43 Million |

| Market Size by 2030 | US$ 245.41 Million |

| Global CAGR (2022 - 2030) | 19.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Plastics for SLS 3D Printing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe plastics for SLS 3D printing market is segmented based on type, end-use industry, and country.

Based on type, the Europe plastics for SLS 3D printing market is categorized into polyamide, thermoplastic polyurethane (TPU), polyether ether ketone (PEEK), and others. The polyamide segment held the largest Europe plastics for SLS 3D printing market share in 2022.

In terms of end-use industry, the Europe plastics for SLS 3D printing market is segmented into healthcare, aerospace & defense, automotive, electronics, and others. The others segment held the largest Europe plastics for SLS 3D printing market share in 2022.

Based on country, the Europe plastics for SLS 3D printing market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The Rest of Europe dominated the Europe plastics for SLS 3D printing market in 2022.

3D Systems Corp, BASF SE, Evonik Industries AG, Arkema SA, Ensinger GmbH, Fiberlab SA, Stratasys Ltd, Sinterit Sp Zoo, EOS GmbH, and CRP Service SRL are some of the leading companies operating in the Europe plastics for SLS 3D printing market.

1. 3D Systems Corp

2. Arkema SA

3. BASF SE

4. CRP Service SRL

5. Ensinger GmbH

6. EOS GmbH

7. Evonik Industries AG s

8. Fiberlab SA

9. Sinterit Sp Zoo

10. Stratasys Ltd

The Europe Plastics for SLS 3D Printing Market is valued at US$ 58.43 Million in 2022, it is projected to reach US$ 245.41 Million by 2030.

As per our report Europe Plastics for SLS 3D Printing Market, the market size is valued at US$ 58.43 Million in 2022, projecting it to reach US$ 245.41 Million by 2030. This translates to a CAGR of approximately 19.6% during the forecast period.

The Europe Plastics for SLS 3D Printing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Plastics for SLS 3D Printing Market report:

The Europe Plastics for SLS 3D Printing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Plastics for SLS 3D Printing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Plastics for SLS 3D Printing Market value chain can benefit from the information contained in a comprehensive market report.