Europe comprises economies such as Germany, France, the UK, and Italy. The western part of Europe is characterized for its higher standards of living, with high GDP. The automotive industry contributes 7% to the GDP of the region. The automotive sector supports the growth of the economy by assisting the supply chain that results in the creation of a diversified array of business opportunities and services. The European region comprises several major automotive manufacturing assembly and production plants. There are ~298 vehicle assembly plants across Europe. As per the OICA data, the region had manufactured 16,921,311 units of vehicles of all categories in 2020. The growing automotive sector is creating a lucrative opportunity for the piezoelectric actuators and motors market as the sector is increasingly using piezoelectric actuators in vehicles. Piezoelectric actuators convert an electrical signal into mechanical movement; hence, they can be used for adjusting mirrors, lenses, and other automotive parts. Thus, the growing automotive sector will subsequently foster the piezoelectric actuators and motors market growth in the region.

In Europe, due to the COVID-19 pandemic, several countries witness an economic hit and the decline in business activities across the manufacturing industries due to lowering demand for automotive, consumer electronics goods, and many other products related to manufacturing industries in the first quarter of 2020. Many of the European Union member states have implemented drastic measures on imports and exports, and shipment of goods by partially closing their borders. These measures declined the demand for manufacturing products of various industries, which, in turn, hindered the growth of the piezoelectric actuators and motors market in Europe. The impact of COVID-19 pandemic varied from country to country across Europe as selected countries such as Italy, France, and Russia witnessed a surge in the number of COVID-19 confirmed cases and subsequently imposed stringent and extended lockdown period. However, disrupted supply chains in several European countries and fall in demand have been limiting the performance of the manufacturing sector, including the automotive manufacturing businesses. However, the effect of this slowdown on manufacturing industries has started to recover from 2021 as several countries of the region are slowly resuming their economies and businesses are regaining toward normalcy.

Strategic insights for the Europe Piezoelectric Actuators and Motors provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

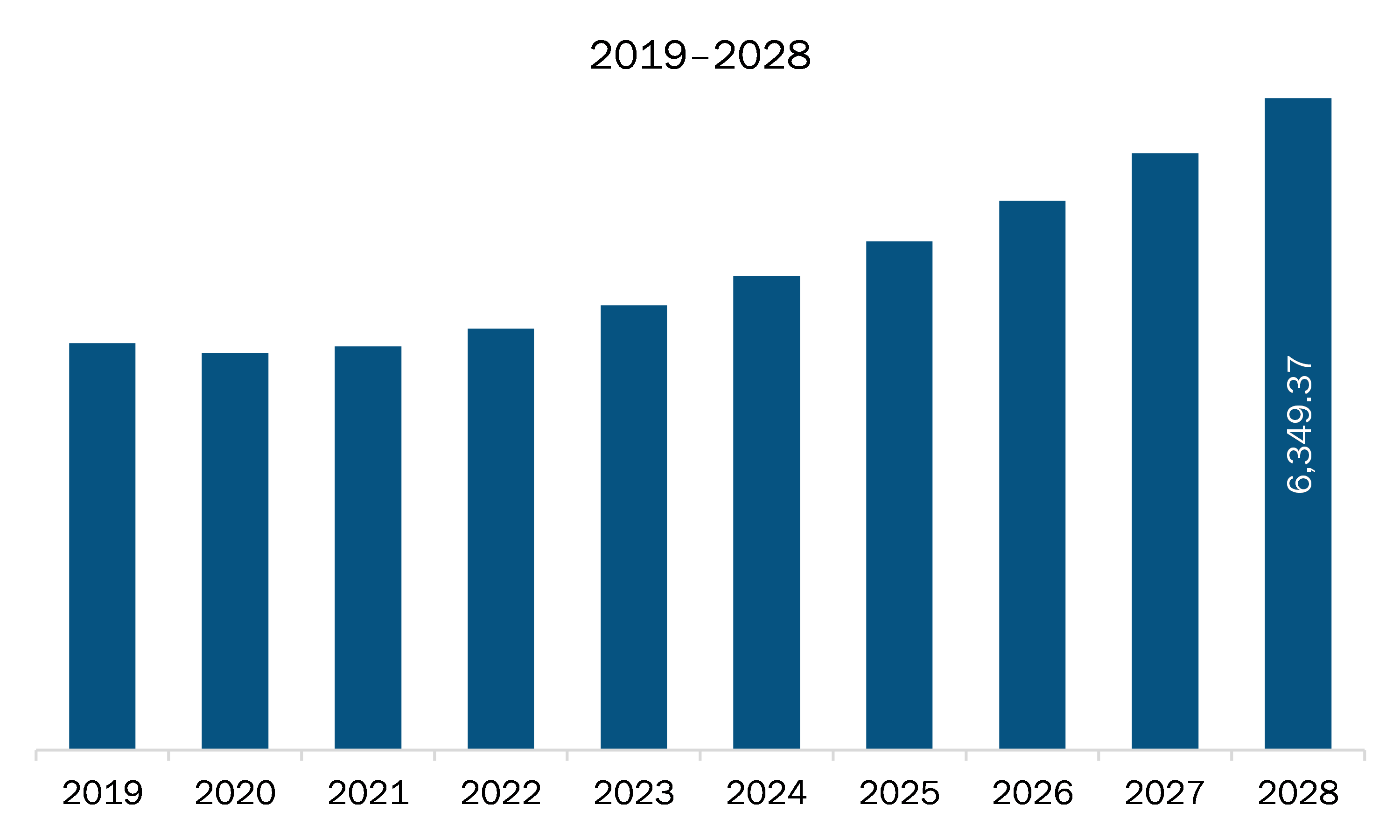

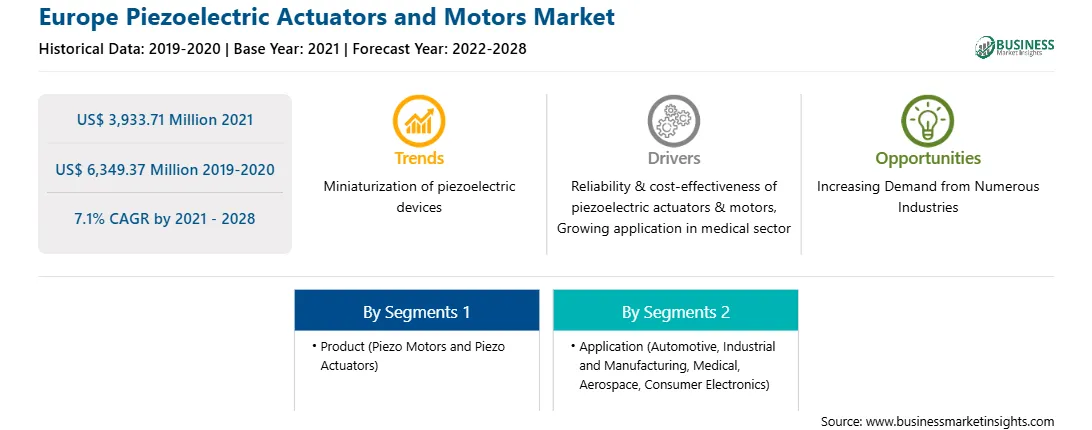

| Market size in 2021 | US$ 3,933.71 Million |

| Market Size by 2028 | US$ 6,349.37 Million |

| Global CAGR (2021 - 2028) | 7.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Piezoelectric Actuators and Motors refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The piezoelectric actuators and motors market in Europe is expected to grow from US$ 3,933.71 million in 2021 to US$ 6,349.37 million by 2028; it is estimated to grow at a CAGR of 7.1% from 2021 to 2028. The aerospace sector is the most high-tech sector in Europe. The European aeronautic industry is a multifaceted industry that is involved in the development and manufacturing of a wide range of products such as aero engines, unmanned aerial vehicles, helicopters, military and civil aircraft, systems, and equipment. Hence, the rising aerospace sector in the region is expected to proliferate the market share. The sector has emerged as one of the biggest beneficiaries of piezoelectric actuators as they are used in aircraft for improving fuel efficiency and reducing carbon emissions and control system failures. Thus, the growing aerospace sector is expected to propel the growth of the piezoelectric actuators and motors market.

Europe piezoelectric actuators and motors market is segmented into product, application, and country. Based on product, the market is segmented into piezo motors and piezo actuators. The piezo motors segment is further bifurcated into piezo linear motors and piezo rotary motors. Similarly, the piezo actuators segment is classified into stack actuators, strip actuators, and others. Piezoelectric actuators segment held the largest market share in 2020. In terms of application, the market is segmented into automotive, industrial & manufacturing, medical, aerospace, consumer electronics, and others. Industrial and Manufacturing segment held the largest market share in 2020. Based on country, the Europe piezoelectric actuators and motors market is segmented into France, Germany, Italy, UK, Russia, and rest of Europe. Germany held the largest market share in 2020.

A few major primary and secondary sources referred to for preparing this report on the piezoelectric actuators and motors market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are APC International, Ltd.; CEDRAT TECHNOLOGIES; FAULHABER Group; Johnson Electric Holdings Limited; Microfine Materials Technologies Pte Ltd; Physik Instrumente (PI) GmbH & Co. KG.; PiezoMotor Uppsala AB; piezosystem jena GmbH; and TDK Corporation.

The Europe Piezoelectric Actuators and Motors Market is valued at US$ 3,933.71 Million in 2021, it is projected to reach US$ 6,349.37 Million by 2028.

As per our report Europe Piezoelectric Actuators and Motors Market, the market size is valued at US$ 3,933.71 Million in 2021, projecting it to reach US$ 6,349.37 Million by 2028. This translates to a CAGR of approximately 7.1% during the forecast period.

The Europe Piezoelectric Actuators and Motors Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Piezoelectric Actuators and Motors Market report:

The Europe Piezoelectric Actuators and Motors Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Piezoelectric Actuators and Motors Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Piezoelectric Actuators and Motors Market value chain can benefit from the information contained in a comprehensive market report.