Europe region includes France, Germany, Italy, Spain, United Kingdom, and rest of Europe. Germany led the market during forecast period. According to the International Trade Administration (ITA), in 2017, the pharmaceutical market in Germany accounted for US$ 60.5 billion. It will remain one of the most attractive destinations for the pharmaceutical industry across the globe over the coming years. The demand for pharmaceuticals in Germany is growing significantly, owing to the rising geriatric population, the increasing prevalence of chronic diseases, and increasing order for the production of new molecules for various therapeutic areas to fulfill the unmet condition. The significant research advancements are providing a spur to the growth of the pharmaceutical isolators market in Germany. There are numerous international and domestic pharmaceutical players present in Germany. Some of the local critical players established in Germany include BASF, Bayer, and Hoechst who are using isolators in sterilized manufacturing process. German CMOs provide their production services to large pharmaceutical companies and to small-scale biotech companies that make them the leader in Europe but globally. In 2014, there were more than 640 pharmaceutical companies present in Germany. These pharmaceutical companies are majorly focusing on R&D to develop new drugs for various therapeutic applications. The expenditures for R&D have increased by pharmaceutical companies in Germany. For instance, according to a report published by the European Federation of Pharmaceutical Industries and Associations (EFPIA) in 2018, the pharmaceutical R&D expenditure in Germany has increased from US$ 7,100.6 million (6216 € million) in 2015 to US$ 7,113.2 million in 2016 (6,227€ million). It is expected to increase the demand for outsourcing activities to CROs and hence to drive the market.

In case of COVID-19, Europe is highly affected specially France and Russia. Europe has strengthened its efforts to serve through its pharmaceutical industry. For instance, On January 4, 2021, Moderna and Recipharm Announce COVID-19 vaccine supply agreement. The companies have entered into an agreement to support the formulation and fill/finish of Moderna’s COVID-19 vaccine supply outside of the United States. According to a Recipharm press release, the manufacturing will take place at Recipharm’s drug product manufacturing facility in France and, subject to regulatory approval in countries outside of the US, the supply will begin in early 2021. On December 9, 2020, CureVac N.V, a global clinical-stage biopharmaceutical company developing a new class of transformative medicines based on messenger ribonucleic acid (mRNA), and Fareva announced an agreement regarding the fill & finish manufacturing of CureVac´s COVID-19 vaccine candidate, CVnCoV, at Fareva’s Pau and Val-de-Reuil-sites in France. Wockhardt Ltd has entered into an agreement with the UK government to fill and finish covid-19 vaccine vials at its subsidiary CP Pharmaceuticals’ facility based in Wrexham, North Wales. As per the agreement, Wockhardt will fill finish the vaccines in vials after it receives the bulk products from the company manufacturing successful vaccines. All these developments will support the market growth for pharmaceutical isolators during the pandemic.

Strategic insights for the Europe Pharmaceutical Isolator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

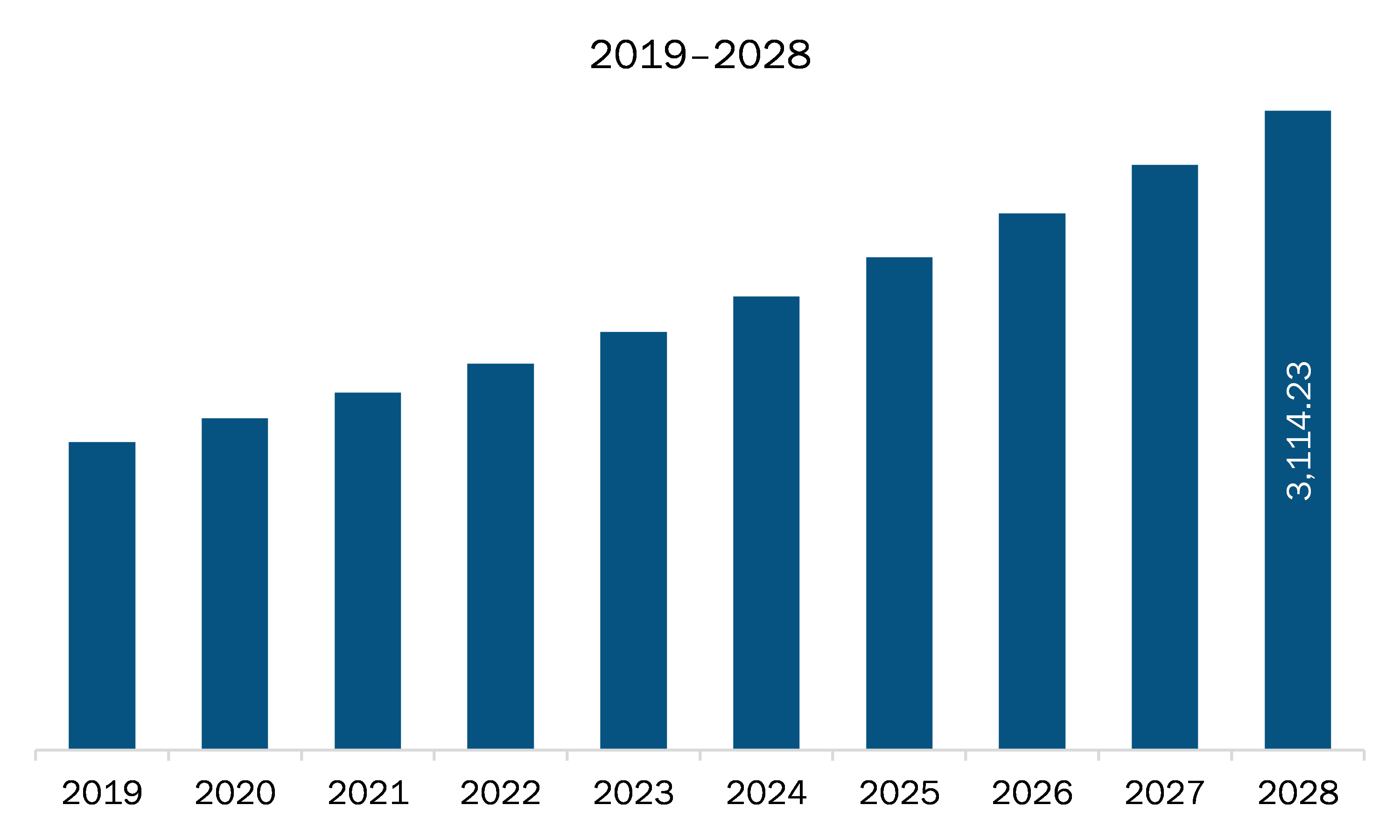

| Market size in 2021 | US$ 1,741.57 Million |

| Market Size by 2028 | US$ 3,114.23 Million |

| Global CAGR (2021 - 2028) | 8.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Pharmaceutical Isolator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe pharmaceutical isolator market is expected to grow from US$ 1,741.57 million in 2021 to US$ 3,114.23 million by 2028; it is estimated to grow at a CAGR of 8.7% from 2021 to 2028. In the pharmaceutical industry. automation of aseptic procedures, with the help of dedicated workstations and system software, has lowered manual interference in manufacturing processes, increased efficiency, and enabled researchers to concentrate on important tasks and avoid human errors. The increased adoption of automated pharmaceutical isolators can also be attributed to factors such as maintaining stringent regulatory compliance, increasing efficiency and productivity, and driving the safety and integrity of pharmaceutical products. The advancement of automation, including robotics, is one area of progress for aseptic fill-finish processes. Recent emerging technologies in aseptic processing, such as advanced isolators, robotics, and increased automation, are expected to change the industry and markedly reduced contamination risks for sterile products. Conventional isolator systems routinely require many operators at a time when regulators have long stated the need for aseptic filling systems to use robotics and reduce human interaction in drug manufacturing. Gloveless isolator technology for biopharmaceutical processes is getting traction in the industry. Future trends in technology are making isolators increasingly attractive for aseptic operations. Automated isolators are a perfect fit for parenteral solution products that can ensure the highest level of aseptic conditions. Therefore, growing use of automation is expected to fuel the Europe market growth.

In terms of type, the open isolator segment accounted for the largest share of the Europe pharmaceutical isolator market in 2020. In terms of pressure, the positive pressure segment held a larger market share of the Europe pharmaceutical isolator market in 2020. In terms of configuration, the floor standing segment held a larger market share of the Europe pharmaceutical isolator market in 2020. In terms of application, the aseptic isolators segment held a larger market share of the Europe pharmaceutical isolator market in 2020. Further, the pharmaceutical and biotechnology companies segment held a larger share of the Europe pharmaceutical isolator market based on end user in 2020.

A few major primary and secondary sources referred to for preparing this report on the Europe pharmaceutical isolator market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Azbil Telstar, Bioquell (Ecolab Solution), Comecer, Fedegari Autoclavi S.p.A., Getinge AB, Hosokawa Micron Group, ITECO S.R.L., Nuaire Inc., and Schematic Engineering Industries.

The Europe Pharmaceutical Isolator Market is valued at US$ 1,741.57 Million in 2021, it is projected to reach US$ 3,114.23 Million by 2028.

As per our report Europe Pharmaceutical Isolator Market, the market size is valued at US$ 1,741.57 Million in 2021, projecting it to reach US$ 3,114.23 Million by 2028. This translates to a CAGR of approximately 8.7% during the forecast period.

The Europe Pharmaceutical Isolator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Pharmaceutical Isolator Market report:

The Europe Pharmaceutical Isolator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Pharmaceutical Isolator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Pharmaceutical Isolator Market value chain can benefit from the information contained in a comprehensive market report.