Europe comprises economies such as Germany, France, the UK, and Italy. The western part of Europe is characterized for its higher standards of living, with high GDP. The automotive industry directly and indirectly contributed ~7% to the GDP of the region. The automotive sector supports the growth of the economy by assisting the supply chain that results in the creation of a diversified array of business opportunities and services. The European region comprises several major automotive manufacturing assembly and production plants. There are ~298 vehicle assembly plants across Europe. In 2019 and 2020, the production of commercial and passenger vehicles were 4,371,499 and 3,581,851 units, while sales for 2019 and 2020 were 2,498,016 and 2,625,506, respectively. In recent years, the automotive industry has been flourishing in the Central and Eastern European (CEE) region. Rising numbers of car manufacturers established their state-of-the-art and modern production sites in CEE countries, owing to the competitive advantage the CEE region over Western European countries. Owing to increased economic development and political consolidation, the region has enjoyed higher attention from investors, as they consider the region as one joined-up sourcing, manufacturing, and logistics hub. OEM’s and the major automotive suppliers such as Mercedes-Benz, Porsche, Audi, Dacia, Skoda, Jaguar Land Rover (JLR), Kia, Hyundai, VW, and BMW have established their presence in the region. This is pertaining to the presence of innovative and developed supply chain environment, while CEE provides some of the best environments for the automotive industry in the world. Thus, the growing automotive sector in CEE region supports the growth of overhead console market, as the requirement of overhead console is directly associated to the vehicle production.

The impact of COVID-19 differed from country to country across the European region as selected countries witnessed an increase in the number of recorded cases and subsequently attracted strict as well as longer lockdown periods or social isolation. However, Western European countries such as Germany, France, and the UK have seen a comparatively modest growth in industrial activities due of the strong healthcare system. To protect its citizens from the COVID-19 virus, the European government has made tremendous investments in incorporating technologies in its healthcare systems to help identify signs of the COVID-19.

Strategic insights for the Europe Overhead Console provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

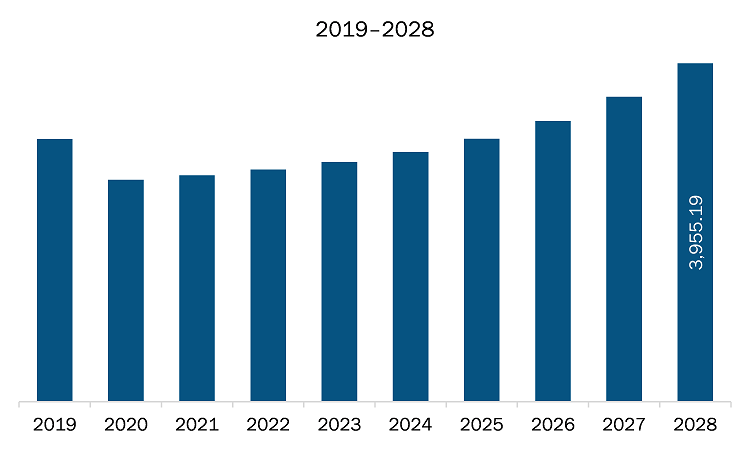

| Market size in 2021 | US$ 2645.94 Million |

| Market Size by 2028 | US$ 3955.19 Million |

| Global CAGR (2021 - 2028) | 5.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Overhead Console refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The overhead console market in Europe is expected to grow from US$ 2645.94 million in 2021 to US$ 3955.19 million by 2028; it is estimated to grow at a CAGR of 5.9% from 2021 to 2028. In the earlier generation, consumers used to purchase premium vehicles to reflect their social status, but the new generation is expressing other reasons for buying premium autos for the need of luxury and clever technologies. According to the studies, women are playing an important role in the premium car market, especially in the developed economies. As per the survey, while selecting a vehicle model, women primarily focus on safety features, comfort, and exterior styling, over the attributes favored by their male counterparts, such as powertrain technology, socially recognized premium brands, and bigger models. The mounting inclination of consumers toward comfortable travel experience is also propelling the demand of car accessories for an entertaining, luxurious driving experience, a surge in vehicle customization among the young population, and increasing trends toward moving car accessories are prominent factors for the Europe overhead console market. Also, the modern customer demands the best range of accessories at a reasonable cost. Several car accessories brands are providing premium quality car accessories at desirable prices. Thus, the above-mentioned factors are driving the demand for overhead consoles in sedans and SUVs.

In terms of application, the others segment accounted for the largest share of the Europe overhead console market in 2020. In terms of vehicle type, the Passenger vehicle segment held the larger market share of the overhead console market in 2020.

A few major primary and secondary sources referred to for preparing this report on the overhead console market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Flex Ltd.; Grupo Antolin; Hella GmbH & Co. KGAA; Magna International Inc.; Yanfeng Automotive Interiors; Gentex Corporation; and Daimay Automotive Interior Co., Ltd. among others.

The Europe Overhead Console Market is valued at US$ 2645.94 Million in 2021, it is projected to reach US$ 3955.19 Million by 2028.

As per our report Europe Overhead Console Market, the market size is valued at US$ 2645.94 Million in 2021, projecting it to reach US$ 3955.19 Million by 2028. This translates to a CAGR of approximately 5.9% during the forecast period.

The Europe Overhead Console Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Overhead Console Market report:

The Europe Overhead Console Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Overhead Console Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Overhead Console Market value chain can benefit from the information contained in a comprehensive market report.